Tesco 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

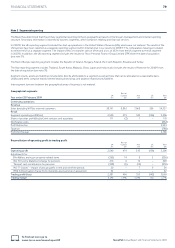

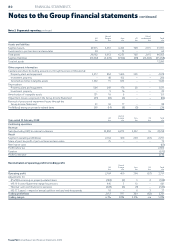

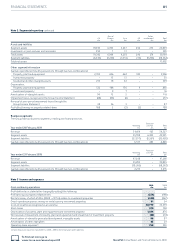

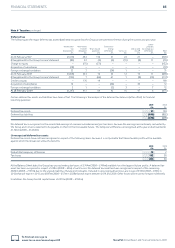

Note 2 Segmental reporting continued

Rest of Other/

UK Europe Asia US unallocated Total

£m £m £m £m £m £m

Assets and liabilities

Segment assets 29,913 6,953 6,242 768 2,115 45,991

Investments in joint ventures and associates 49 – 13 – – 62

Total assets 29,962 6,953 6,255 768 2,115 46,053

Segment liabilities (13,032) (1,270) (1,966) (98) (16,692) (33,058)

Total net assets 12,995

Other segment information

Capital expenditure (including acquisitions through business combinations):

Property, plant and equipment 2,417 852 1,404 305 – 4,978

Investment property – 48 152 – – 200

Goodwill and other intangible assets 1,242 15 385 – – 1,642

Depreciation:

Property, plant and equipment 566 249 176 20 – 1,011

Investment property – 9 16 – – 25

Amortisation of intangible assets 131 16 6 – – 153

Impairment losses recognised in the Group Income Statement (21) (41) (4) – – (66)

Reversal of prior period impairment losses through the

Group Income Statement 21 50 17 – – 88

Profit/(loss) arising on property-related items 263 (14) (8) (5) – 236

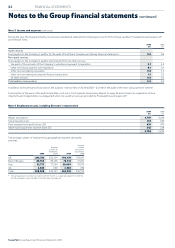

Rest of

UK Europe Asia US Total

Year ended 23 February 2008 £m £m £m £m £m

Continuing operations

Revenue

Sales (excluding VAT) to external customers 34,858 6,872 5,552 16 47,298

Result

Segment operating profit/(loss) 2,164 400 294 (67) 2,791

Share of post-tax profit of joint ventures and associates 75 – – – 75

Net finance costs (63)

Profit before tax 2,803

Taxation (673)

Profit for the year 2,130

Reconciliation of operating profit to trading profit

Rest of

UK Europe Asia US Total

£m £m £m £m £m

Operating profit 2,164 400 294 (67) 2,791

Adjustments for:

(Profit)/loss arising on property-related items (188) (5) 3 2 (188)

IAS 19 Income Statement charge for pensions 446 5 10 – 461

‘Normal’ cash contributions for pensions (328) (3) (9) – (340)

IAS 17 ‘Leases’ – impact of annual uplifts in rent and rent-free periods 18 – 6 3 27

Trading profit/(loss) 2,112 397 304 (62) 2,751

Trading margin 6.1% 5.8% 5.5% n/a 5.8%

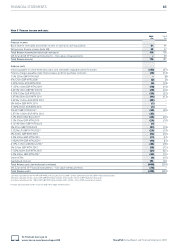

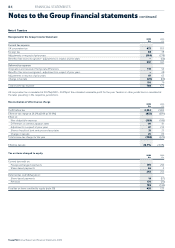

Notes to the Group financial statements continued