Tesco 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

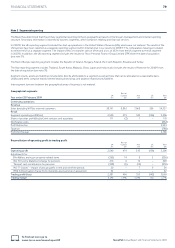

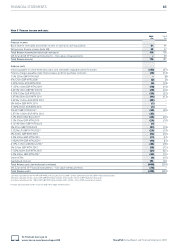

Note 10 Goodwill and other intangible assets continued

Impairment of goodwill

Goodwill arising on business combinations is not amortised but is reviewed for impairment on an annual basis or more frequently if there are indications

that goodwill may be impaired. Goodwill acquired in a business combination is allocated to groups of cash-generating units according to the level at

which management monitor that goodwill.

Recoverable amounts for cash-generating units are based on the higher of value in use and fair value less costs to sell. In 2008/9, recoverable amounts

are based on value in use. Value in use is calculated from cash flow projections for five years using data from the Group’s latest internal forecasts, the

results of which are reviewed by the Board. The key assumptions for the value in use calculations are those regarding discount rates, growth rates and

expected changes in margins. Management estimate discount rates using pre-tax rates that reflect the current market assessment of the time value

of money and the risks specific to the cash-generating units. Changes in selling prices and direct costs are based on past experience and expectations

of future changes in the market. Given the current economic climate, a sensitivity analysis has been performed in assessing the recoverable amounts

of goodwill. In the case of Japan, it is reasonably possible that a change in key assumptions would cause the goodwill to exceed its value in use. At

28 February 2009, there was headroom of £8m, incorporating a long-term growth rate of 1.5% and a pre-tax discount rate of 7.3% as key assumptions.

A 0.2% reduction in the long-term growth rate or a 0.2% increase in the discount rate would cause goodwill to exceed its value in use. EBITDA margin

is also assumed to increase in 2009/10 from 2008/9, where a 2.9% decrease in the forecast margin for 2009/10 would also cause goodwill to exceed its

value in use. For Poland, with headroom of £84m and assuming an 11.3% pre-tax discount rate, a 0.4% increase in the discount rate would cause

goodwill to exceed its value in use.

The forecasts are extrapolated beyond five years based on estimated long-term average growth rates of generally 2%-10% (2008: 3%-4%).

The pre-tax discount rates used to calculate value in use range from 7%-24% (2008: 8%-24%). On a post-tax basis, the discount rates ranged from

5%-19% (2008: 5%-20%). These discount rates are derived from the Group’s post-tax weighted average cost of capital as adjusted for the specific

risks relating to each geographical region.

In February 2009 and 2008 impairment reviews were performed by comparing the carrying value of goodwill with the recoverable amount of the

cash-generating units to which goodwill has been allocated. Management determined that there has been no impairment.

The components of goodwill are as follows:

2009 2008

£m £m

UK 616 571

Tesco Personal Finance Group Limited 767 –

Thailand 153 124

South Korea 378 48

Japan 196 129

China 540 376

Malaysia 76 65

Poland 354 394

Czech Republic 47 44

Turkey 53 54

Other 5 24

3,185 1,829

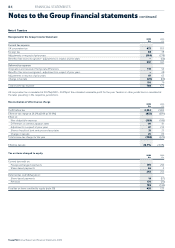

Notes to the Group financial statements continued