Tesco 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 DIRECTORS’ REMUNERATION REPORT

Tesco PLC Annual Report and Financial Statements 2009

Directors’ remuneration report continued

If the Remuneration Committee exercises its judgement to allow some,

or all, of the remaining 25% of the PSP awards to vest, we will describe

in the Directors’ Remuneration Report in the relevant year those factors

taken into account in determining the level of the award which would vest.

There is no re-testing of performance in respect of any targets.

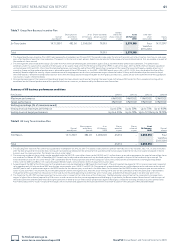

Return on capital employed – US

The Group is seeking to build a substantial presence in the US which in time

has the potential to become a significant source of value for our shareholders.

The Tesco PLC US Long Term Incentive Plan 2007 (the US LTIP) has been

designed to deliver reward only if the US business realises this potential.

The US CEO was made an award of two million shares under the US LTIP

in 2007. Awards were also made to other senior members of the

US management team. No other Executive Directors will participate

in the Plan. Awards under the plan vest based on the ROCE and EBIT

performance of the US business as set out on page 61.

A key part of the Group’s long-term strategy is to consider new business

ventures which have the potential for significant long-term value creation

for our shareholders. The Group New Business Incentive Plan (Group Plan)

supports this initiative. Initially only the Group CEO will participate in the

Group Plan. However, awards may be made to other employees at the

discretion of the Remuneration Committee in the future where this is

appropriate to do so in order to support the Group’s new business ventures.

An award of 2.5 million shares was made to the Group CEO in November

2007. This award will vest based on the ROCE and EBIT performance of the

US business as set out on page 61, however the plan also requires Group

and International ROCE targets to be met and any payouts under this plan

will be scaled back on a pro rata basis to the extent they are not met.

As the Company’s US venture is currently the most developed new business

initiative, the award made to the Group CEO under the Group Plan is

focused on the performance of the US venture, although the Remuneration

Committee has the flexibility to consider and include other new business

development opportunities within the proposed award. In addition, the

Remuneration Committee will consider the findings of the Governance

Oversight Committee (described below) and opinions of the Audit

Committee as to whether the level of reported results achieved reflects

the underlying financial performance of the Company when considering

if, and the extent to which, the award made to the Group CEO will vest.

Service agreements

The Executive Directors all have rolling service agreements with no fixed

expiry date. These contracts are terminated on notice of 12 months by

the Company and six months’ notice by the Executive. If an Executive

Director’s employment is terminated (other than pursuant to the notice

provisions in the service agreement or by reason of resignation or

unacceptable performance or conduct) the Company will pay a sum

calculated on the basis of basic salary and the average annual bonus paid

for the last two years. No account will be taken of pension. Termination

payments will be subject to mitigation. This means that amounts will be

paid in instalments to permit mitigation. If the termination occurs within one

year of retirement, the termination payment will be reduced accordingly. To

reflect his length of service with Tesco and the early age of his appointment

as CEO, Sir Terry Leahy’s service agreement provides for his full pension

entitlement to become available on retirement on or after his 57th birthday.

The Remuneration Committee has agreed that new appointments of

Executive Directors will normally be on a notice period of 12 months.

The Committee reserves the right to vary this period to 24 months for the

initial period of appointment and for the notice period to then revert to

12 months. The service agreements are available to shareholders to view

on request from the Company Secretary.

Outside appointments

Tesco recognises that its Executive Directors may be invited to become

Non-executive Directors of other companies. Such non-executive

duties can broaden experience and knowledge which can benefit Tesco.

Subject to approval by the Board, Executive Directors are allowed to

accept non-executive appointments and retain the fees received, provided

that these appointments are not likely to lead to conflicts of interest.

Executive Directors’ biographies can be found on page 43 of this Report.

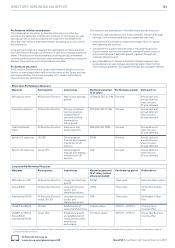

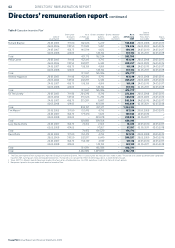

Fees retained for any non-executive directorships are set out below.

Company in which Fee retained

non-executive in 2008/9

directorship held (£000)

Philip Clarke Whitbread PLC 55

Andrew Higginson BskyB PLC 60

Lucy Neville-Rolfe The Carbon Trust 19

Non-executive Directors

Non-executive Directors have letters of appointment setting out their

duties and the time commitment expected. The letters are available

to shareholders to view from the Company Secretary upon request.

The Chairman meets with each Non-executive Director separately to

review individual performance. All Non-executive Directors are subject

to re-election by shareholders every three years at the Annual General

Meeting and their appointment can be terminated by either party without

notice. Charles Allen and Harald Einsmann, each having served over ten

years, will submit themselves for re-election every year subject to the

Chairman having reviewed their performance and concluded that they

remain independent and continue to add value.

The remuneration of the Non-executive Directors is determined by the

Chairman and the Executive Committee after considering external market

research and individual contribution. Non-executive Directors’ fees were

reviewed during the year and the basic fee was increased to £65,000 per

annum. The Chairs of the Audit and Remuneration Committees receive

£30,000 (in addition to their basic non-executive fee) and Non-executive

Directors who are members of these Committees receive an additional

£12,000 for each Committee. The Senior Independent Non-executive

Director, Rodney Chase, who is also the Deputy Chairman, receives a total

fee of £135,000 per annum. The Remuneration Committee determines

the Chairman’s remuneration, having regard to time commitment and

packages awarded to Chairmen of other companies of a similar size and

complexity. David Reid, Non-executive Chairman, receives an annual fee

of £610,000 this year and has the benefit of a company car and chauffeur.

The Remuneration Committee

The Remuneration Committee (the Committee) is governed by formal

Terms of Reference. They are reviewed annually and this year they were

updated to reflect an increased level of oversight of senior management

packages. The Terms of Reference are available from the Company

Secretary upon request or can be viewed at www.tesco.com/boardprocess.

Composition of the Committee

The Committee consists entirely of independent Non-executive Directors.

The members of the Committee during the year were Charles Allen

(Chairman of the Committee), Patrick Cescau, Rodney Chase, Karen Cook,

E Mervyn Davies and Harald Einsmann. Patrick Cescau was appointed a

member of the Remuneration Committee effective from 1 February 2009.

E Mervyn Davies resigned from the Company during the year due to a

conflict of interest. Ken Hanna joined the Committee on 1 April 2009.

The directors’ biographies can be found on page 43 of this Report.

No member of the Committee has any personal financial interest in the

matters being decided, other than as a shareholder, nor any day-to-day

involvement in running the business of Tesco. Jonathan Lloyd, the

Company Secretary, is Secretary to the Committee. David Reid, Non-

executive Chairman, and Sir Terry Leahy, Chief Executive of the Group,

both attend meetings at the invitation of the Committee. They are not

present when their own remuneration is being discussed.

The Committee is supported by the Group Personnel and Finance

functions and has continued to use the services of Deloitte LLP whom it

appointed as an external, independent advisor. Deloitte LLP also provided

advisory services in respect of corporate tax planning, share schemes,

international taxation, corporate finance and treasury to the Group during

the year. Members’ attendance at Committee meetings is listed in the

Corporate Governance section on page 45 of this Report.