Tesco 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Tesco PLC Annual Report and Financial Statements 2009

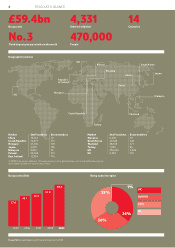

FINANCIAL HIGHLIGHTS

15.1%

Group sales

(including VAT)*

2009

2009 52 weeks

53 weeks pro-forma 2008

Group sales (£m) (including value added tax) 59,426 58,588 51,773

Group revenue (£m) (excluding value added tax) 54,327 53,552 47, 298

Underlying Group profit before tax (£m)*† 3,128 3,093 2,846

Group profit before tax (£m) 2,954 2,920 2,803

Underlying diluted earnings per share (p)** 28.92 – 27.02

Dividend per share (p) 11.96 – 10.90

Group enterprise value (£m) (market capitalisation plus net debt) 35,907 – 37,656

Return on capital employed 13.0%‡ – 12.9%§

* Sales & profit growth reported on a consistent basis (12 months versus 12 months) for China.

** Growth in underlying diluted EPS has been adjusted to reflect a constant tax rate year on year. Growth was 7.0% on a statutory basis.

† Adjusted for IAS 32, IAS 39, the net difference between the IAS 19 Income Statement charge and ‘normal’ cash contributions for pensions, IAS 17 ‘Leases’ (impact of annual uplifts

in rent and rent-free periods, and the IFRS 3 amortisation charge on intangible assets arising on the acquisition of Tesco Personal Finance (TPF).

‡ Excluding acquisitions of TPF and Homever, India start-up costs, and after adjusting for assets held for sale.

§ Using a ‘normalised’ tax rate before start-up costs in the US and Tesco Direct, and excludes the impact of foreign exchange in equity and our acquisition of a majority share of Dobbies.

10.0%

Underlying Group profit

before tax*†

5.5%

Group profit before tax*

11.0%

Underlying diluted earnings

per share**

2.6%

Diluted earnings per share

9.7%

Dividend per share

Good financial management and leading market

positions have served us well this year in the

face of a challenging consumer environment.

We will continue to pursue our long-term

strategy which will put us in an even stronger

position once our markets emerge from the

economic downturn.

All growth figures reported on a 53-week basis.