Tesco 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

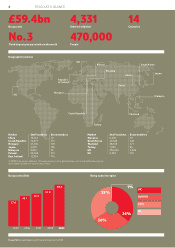

47%

30%

21%

UK

EUROPE

ASIA

US

2%

£41.5bn

£10.1bn

£7.6bn

UK

EUROPE

ASIA

US

£0.2bn

7

REPORT OF THE DIRECTORS

Tesco PLC Annual Report and Financial Statements 2009

a catalogue. Our retailing services have delivered another good year,

with tesco.com growing strongly, Tesco Personal Finance making good

progress and Telecoms continuing to build its customer base strongly

and grow profits. Finally, our work on community and environment

continues – we have recently opened our latest blueprint green store at

Cheetham Hill, Manchester, which has a carbon footprint 70% lower

than a normal store.

Markets served and business model

Tesco’s growth, driven by this strategy, has been predominantly

organic and we have used our skills and knowledge in understanding

customers, property development, supply chain management, new

product development, store formatting and adapting to local customer

needs – to create strong business models in our chosen markets. Where

we do not have all the required skills ourselves to be successful, we

regularly partner with existing businesses – and these relationships

have formed the basis of some of our most successful operations –

for example with Samsung in South Korea.

The UK grocery retail market remains our largest source of revenue,

representing some 50% of last year’s £59.4 billion of sales. International

retail sales – from our 12 markets in Europe, Asia and the United States,

comprise a further 30% of Group revenues and non-food (in a variety

of categories from health and beauty to electronics) accounts for most

of the remainder. Our services businesses have comparatively small

revenue streams, but they are increasingly material to our earnings base.

We have given them a renewed focus this year – deploying more capital

and management resources. A first key step in making these already

successful businesses much larger and more significant to the Group

was the acquisition of Royal Bank of Scotland’s share of Tesco Personal

Finance – and we expect these businesses, including our online shopping

channels, Telecoms and dunnhumby (our consumer research business)

to deliver £1 billion a year of profit for the Group within the next few years.

At the core of Tesco’s business model is a focus on trying to improve what

we do for customers. We aim to make their shopping experience as easy

as possible, lower prices where we can to help them spend less, give

them more choice about how they shop – in small stores, large stores or

online – and seek to bring simplicity and value to sometimes complicated

markets. We aim to be a good neighbour in the communities we serve,

be responsible, fair and honest in our dealings and give customers the

information and products they need to make greener choices. We are

also an inclusive business – everyone is welcome at Tesco.

Underpinning this approach is a relentless attitude to being the lowest

cost provider of goods and services in our chosen sectors – and this

combination of qualities is the reason we have been successful in some

of the world’s most competitive markets. We have recognised skills and

proprietary systems in key areas which help us deliver a low cost model

– particularly in customer relationship management, just-in-time supply

chain and distribution, property development and store formatting.

In some of our newer markets – such as telecoms or financial services, our

willingness to partner with established businesses has given us access

to their existing investment in systems and infrastructure and enabled

Tesco to develop competitive, profitable business models quickly and,

at the same time, limit our own investment and risk in the early years.

In the case of financial services, having successfully partnered with

Royal Bank of Scotland for a decade we now have the experience to take

sole ownership in order to pursue our aim of becoming a full-service retail

bank and give Tesco Personal Finance the focus that this will require.

My main challenge is to maintain the balance between staying on

strategy while living within our means. For a growth company like

Tesco it is vital of course that we meet the challenges posed by the

economic downturn – and the priorities there are the same as for

any finance director in the current environment – in helping the

business to find the resources to invest for customers, by keeping

a good grip on costs and cash.

At the same time though, I need to do what I can to help sustain Tesco’s

investment in future growth. By investing in the right opportunities,

protecting ourselves from unpredictable capital markets and trading

in a sustainable way we should exit this recession as an even stronger

company. That’s how Tesco emerged as a winner from the last

recession. Exciting opportunities are there to be grasped – for example,

land and property are already significantly cheaper, our online

businesses are not capital intensive and, given the loss of confidence in

the banking sector, our very conservative, straightforward approach in

Tesco Personal Finance may be exactly what customers are looking for.

Laurie Mcllwee Group Finance Director

Sales by region Sales growth contribution by region

As Group Finance Director, what are your

priorities at the moment?