Tesco 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

DIRECTORS’ REMUNERATION REPORT

Tesco PLC Annual Report and Financial Statements 2009

To find out more go to

www.tesco.com/annualreport09

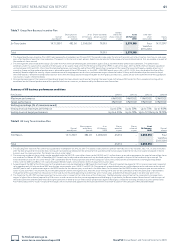

Performance related remuneration

The remuneration structures for Executive Directors and other key

executives are tailored to emphasise the delivery of strong year-on-year

earnings growth as well as sustained performance in the longer term.

More than two-thirds of total remuneration (excluding pension) is linked

to performance.

Long-term performance is rewarded through delivery of shares and short-

term performance through a combination of cash and compulsory deferred

shares. This ensures continued emphasis on strong annual performance

combined with long-term executive share ownership, providing a strong link

between the incentives received and shareholder value.

Performance measures

The Executive Directors have a range of performance targets across the

various incentive plans which reflect the objectives of the Group and their

own responsibilities. Targets are generally set to reward performance

improvement over prior periods.

The measures are summarised in the table below and are based on:

delivery of improved bottom-line financial results, measured through •

earnings, both in the present year and sustainably over time;

enhancement of profitability, measured through return on capital, •

whilst growing the business;

achievement of durable improvements in the underlying drivers •

of performance such as cost reduction, energy efficiency, reduced

environmental impact and sales growth, captured through the

corporate measures; and

laying foundations for future performance through measures such •

as developing new sales footage, developing people, implementing

community programmes, also captured through the corporate measures.

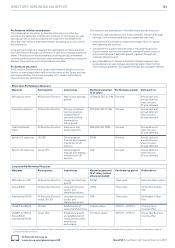

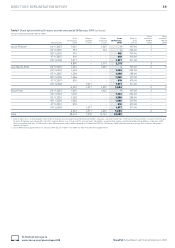

Short-term Performance Measures

Measures Participation Incentivises Maximum potential

% of salary

Performance period Delivered via

Earnings per share All Executive Directors Year on year earnings

growth

125% (US CEO 62.5%) One year Annual cash and

annual deferred

share bonuses

(3-year deferral)

Corporate objectives All Executive Directors Delivery of strategic

business priorities,

entrepreneurial

spirit and building

framework for

future growth

55% (US CEO 27.5%) One year Annual cash and

annual deferred

share bonuses

(3-year deferral)

Total shareholder

return

All Executive Directors Share price and

dividend growth

20% (US CEO 10%) One year Annual deferred

share bonuses

(3-year deferral)

Specific US objectives US CEO Delivery against

financial and strategic

milestones for US

business

200% One year Annual cash and

annual deferred

share bonuses

(3-year deferral)

Specific US objectives Group CEO Delivery against

financial and strategic

milestones for US

business

50% One year Annual deferred

share bonuses

(3-year deferral)

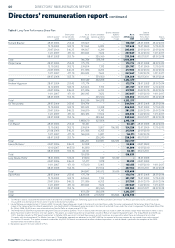

Long-term Performance Measures

Measures Participation Incentivises Maximum potential

% of salary (unless

otherwise stated)

Performance period Delivered via

EPS relative to RPI All Executive Directors Longer-term earnings

growth

200%* Three years Executive share options

Group ROCE All Executive Directors Long-term business

success and

shareholder returns

100% Three years Performance Share

Plan

International ROCE All Executive Directors

except US CEO

Long-term business

success and

shareholder returns

50% Three years Performance Share

Plan

US EBIT and ROCE US CEO Establishment of

successful US business

2 million shares 2010/11 – 2013/14 US Long Term

Incentive Plan

US EBIT and ROCE

Group ROCE

International ROCE

Group CEO Entrepreneurial spirit

and establishment of

new businesses within

whole Group

performance

2.5 million shares 2010/11 – 2013/14 Group New Business

Incentive Plan

* This is the amount on which the number of shares under option is calculated. The actual realisable value of these options will depend on any growth in share price between the date of

grant and the date of exercise.