Tesco 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

REPORT OF THE DIRECTORS

Tesco PLC Annual Report and Financial Statements 2009

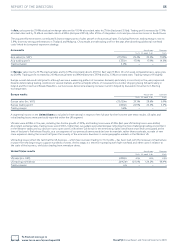

Capital and Liquidity. TPF’s core Tier 1 capital ratio is 12%. Looking

forward, TPF has strong earnings retention to support planned

business growth and the funding and liquidity position of the business

has also improved as a result of the successful re-launch of TPF as a

savings brand. This is demonstrated by the near-doubling of balances

from £2.5 billion in mid-October to in excess of £4.5 billion by the

year-end. Combined with securing long-term wholesale funding,

this has transformed TPF’s liquidity position – providing high quality

liquid assets and net short-term wholesale cash over £2 billion as

at year-end.

Commercial. Average lending balances grew slightly in the year,

even after tightening lending criteria to reflect the deteriorating

economic conditions. Good growth has been maintained in the

customer base with total accounts and policies increasing by 8%.

The ATM network continues to grow with over 2,700 now located

across the Tesco store portfolio, which account for 12% of total

market volumes. The insurance business continues to be a significant

contributor to the overall profits, accounting for over 65% of the

underlying profit. New asset quality has remained stable over 2008

and portfolio performance remains favourable to the industry.

TPF continues to monitor closely portfolio and new business quality.

However, the challenging economic conditions throughout the year

have resulted in some increase in bad debt levels and fraud. The

reduction in bank rates in recent months has, however, helped

lending margins, a trend which has continued into 2009/10.

TPF uses a range of techniques to ensure that risk and reward is

balanced and remains committed to responsible lending.

tesco.com delivered another excellent performance, with our online

businesses achieving a 20% increase in sales to £1.9bn, with profits

after initial start-up losses on Tesco Direct, rising to £109m. We are

continuing to see robust growth in customer and order numbers and

operationally the business made further progress, with improved

product availability, and strong productivity. Growth in the international

businesses – in South Korea and Ireland – was very strong.

Telecoms had a good year, with particularly robust growth in Tesco

Mobile. Mobile saw double-digit growth in customer numbers in a flat

pre-pay phone market and an encouraging early performance from our

new pay-monthly tariffs, which were launched during the year. Tesco

Mobile retained its status as the best service in the market for overall

customer satisfaction.

1.8m

Tesco Mobile customers.

To find out more go to

www.tesco.com/annualreport09