Tesco 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

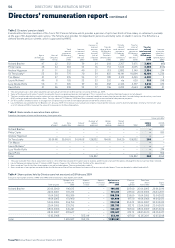

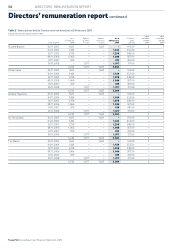

DIRECTORS’ REMUNERATION REPORT

Tesco PLC Annual Report and Financial Statements 2009

To find out more go to

www.tesco.com/annualreport09

Role of the Committee

The Committee’s purpose is to:

determine and recommend to the Board the remuneration policy for the •

Chairman and Executive Directors;

ensure the level and structure of remuneration is designed to attract, •

retain, and motivate the Executive Directors needed to run the

Company;

agree performance frameworks and targets, and review performance •

against these;

monitor the level and structure of remuneration for senior management; •

and

ensure the remuneration relationship between the Executive Directors •

and senior executives of the Company below this level is appropriate.

The Committee normally meets at least four times a year and has a

rolling schedule of items within its remit. In the financial year ended

28 February 2009 the Committee met ten times. During the year the

Committee reviewed its own performance and agreed steps to enhance

its effectiveness.

Governance Oversight Committee

The Governance Oversight Committee (GOC) has been established

to review and report at the end of each financial year on the allocation

of capital and other Group resources. The GOC comprises the Senior

Independent Director of the Company (who chairs the GOC), the

Chairman of the Audit Committee and the Chairman of the Remuneration

Committee. The Chairman attends the GOC and the Company Secretary

serves as its secretary. The GOC reports its findings to the Remuneration

Committee each year. The Remuneration Committee takes these into

account along with the view of the Audit Committee to ensure that financial

performance against targets is indicative of strong and robust business

performance. If appropriate, vesting under the plans may be adjusted by the

Remuneration Committee (in respect of Executive Directors) or the Board (in

respect of all other employees who are participants). In accordance with the

Combined Code, any such adjustments to vesting for Executive Directors will

be reported to shareholders in the Remuneration Report at the relevant time.

Compliance

In carrying out its duties, the Remuneration Committee gives full

consideration to best practice. The Committee was constituted and operated

throughout the period in accordance with the principles outlined in the

Listing Rules of the Financial Services Authority derived from the Combined

Code on Corporate Governance. The auditors’ report, set out on page 67,

covers the disclosures referred to in this report that are specified for audit by

the Financial Services Authority. This report also complies with disclosures

required by the Director Remuneration Report Regulations 2002. Details

of Directors’ emoluments and interests are set out on pages 55 to 64 of

this Report.

Charles Allen

Chairman of the Remuneration Committee

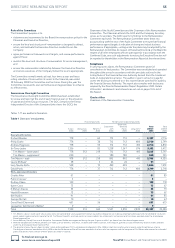

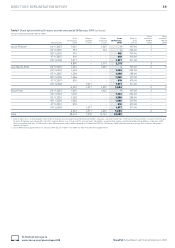

Tables 1-11 are audited information.

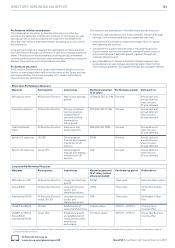

Table 1 Directors’ emoluments

Fixed emoluments Performance-related emoluments

Short-term

Short-term deferred Total Total

Salary Allowances Benefits3 cash shares Long-term4 2008/9 2007/8

£000 £000 £000 £000 £000 £000 £000 £000

Executive Directors

Richard Brasher 778 – 65 712 712 – 2,267 2,116

Philip Clarke 778 – 38 712 712 480 2,720 2,749

Andrew Higginson 778 – 59 712 712 493 2,754 2,810

Sir Terry Leahy 1,356 – 85 1,238 1,547 876 5,102 5,472

Tim Mason – base salary1 778 312 218 712 712 493 3,225 3,797

Tim Mason – supplement1 200 – – 180 180 – 560 733

Tim Mason – total 978 312 218 892 892 493 3,785 4,530

Laurie McIlwee2 38 – 5 24 24 – 91 –

Lucy Neville-Rolfe 538 – 70 499 499 – 1,606 1,451

David Potts 778 – 37 712 712 480 2,719 2,718

Non–executive Directors

Charles Allen 91 – – – – – 91 85

Patrick Cescau2 5 – 5 –

Rodney Chase 129 – – – – – 129 118

Karen Cook 73 – – – – – 73 67

E Mervyn Davies 55 – – – – – 55 79

Harald Einsmann 73 – – – – – 73 67

Ken Hydon 91 – – – – – 91 85

Carolyn McCall 10 – – – – – 10 67

David Reid (Chairman) 601 – 56 – – – 657 675

Jacqueline Tammenoms Bakker2 9 – – – – – 9 –

Total 7,159 312 633 5,501 5,810 2,822 22,237 23,089

1 Tim Mason’s salary is made up of a base salary and a non-pensionable salary supplement (shown separately). Allowances are made up of compensation payments for additional tax due on

equity awards made prior to his move to the US. Tim Mason’s benefits are made up of car, travel, medical, tax related costs and services and free shares awarded under the all employee

Share Incentive Plan.

2 Laurie McIlwee, Patrick Cescau and Jacqueline Tammenoms Bakker were appointed during the year. Figures in table 1 are shown from their date of appointment.

3 With the exception of Tim Mason, benefits are made up of car benefits, chauffeurs, disability and health insurance, staff discount, gym/leisure club membership and free shares awarded

under the all employee Share Incentive Plan.

4 The long-term bonus figures shown in table 1 relate to the additional 12.5% enhancements allocated in May 2008 on short-term and long-term awards under the old bonus scheme.

The long-term bonuses awarded on 8 July 2008 under the Performance Share Plan were awarded in the form of nil cost options with the exception of Tim Mason who received an unfunded

promise to deliver shares. Details of these awards are shown in table 6.