Tesco 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 REPORT OF THE DIRECTORS

Tesco PLC Annual Report and Financial Statements 2009

In most of our markets we are now amongst the largest, most profitable

and fastest growing businesses – and this is a good platform from

which to make further progress, even in tough times. Our experience

in Hungary of trading profitably and growing well during an already

prolonged recession which began in 2006, also gives us confidence

that by applying what we have learned there in our other markets, the

business can perform well through the current environment.

Europe – including Ireland, Turkey and the four Central European

countries – and the Western US have seen the most marked effects

of the economic downturn although more recently, as the export-led

economies of Asia – particularly South Korea and China – have also

slowed, trading conditions there too have deteriorated.

In Europe, these challenges have been joined by the consequences of

substantial exchange rate movements between the Euro or Euro-linked

currencies and other currencies within the European Union. These

movements have encouraged very significant increases in cross-border

shopping by consumers in several regions – the clearest examples

being Ireland into Northern Ireland, Czech Republic into Germany and

Slovakia into Poland. Our stores located close to these borders have

seen material sales impacts as customers take advantage of devalued

currencies and this has affected the rate of sales growth overall in

these markets.

Although in some markets we have moderated our rate of growth in space,

overall we have chosen to sustain strong growth in selling area – and this

will continue. With reductions in site, build and fitting costs for stores –

these have fallen substantially since last year – we are able to use our

capital more efficiently, and this should be helpful to long-term returns.

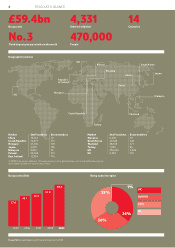

At the end of February, our operations in Asia and Europe were trading

from 1,911 stores, including 608 hypermarkets, with a total of 55.0m sq ft

of selling space. This year, we plan to open 320 new stores with a total

of 5.4m square feet of sales area in these markets and a further

0.6m sq ft is planned to open in the US.

Asia

We have delivered a strong performance in Asia. This has been achieved

whilst absorbing planned integration costs and initial trading losses

during conversion on the newly-acquired Homever stores in South Korea.

With all the stores now converted to our Homeplus format, we expect

this acquisition to provide a good underpinning to growth in Asia as

a whole in the current year and beyond as we realise the synergies

and scale benefits from the deal. The underlying business in South

Korea delivered solid profit growth and elsewhere in Asia we saw

excellent progress in Malaysia and Thailand, partly offset by a small

trading loss in Japan.

China, having studied the market carefully and developed our

long-term strategy, we have begun to accelerate store and

infrastructure development in the economically important and

populous coastal provinces, centred on the major cities. Our first

multi-level freehold shopping centre development will open in

Foshun in a few months’ time, with a further three planned in the

current year. Sites have been secured for a further 14. We saw

strong sales, including good like-for-like growth in the year as a

whole – although sales slowed in the final quarter, partly driven

by food price deflation – and we made a modest profit, similar

to last year.

Japan’s already difficult retail market saw a further sharp

deterioration towards the end of 2008. The new team in Japan is

building on last year’s introduction of the Tesco operating model –

a suite of systems and processes which is being rolled out across

our markets – by strengthening distribution, range and pricing

management. Our strategic focus remains on building a strong

offer for customers in the convenience sector based on Express

and on our Tsurukame small discount supermarket format and

this work is making progress. 13 new stores including six of our

new 24-hour Express stores opened during the year.

South Korea – which celebrates its tenth anniversary

this year – delivered another very good performance, coping well

with the twin challenges of subdued consumer spending and the

task of integrating the 36 Homever stores which were acquired in

September. Including the acquired stores, 3.9m square feet of space

– an increase of 63% – was opened during the year. Some of last

year’s organic development was deferred whilst we focused on

integrating Homever and our programme of new space this year will

reflect this. The customer response to the conversion of the stores

to Homeplus has been excellent, with sales uplifts on the converted

stores averaging well over 50%. The performance of our Express

stores, which saw sales growth of 64% in the year, has also been

very encouraging.

Malaysia has had an exceptional year – achieving rapid progress in

sales, profits and returns as it delivers the full benefits of the Makro

acquisition in early 2007. This success, combined with a fast rate of

organic expansion, has enabled us to become market leader in a

country which we entered only in 2001. Although economic growth

has slowed in recent months, our strong market position plus a good

pipeline of seven planned new hypermarkets in the current year,

mean we can extend our lead. Clubcard, which was launched at the

end of 2007, is being very well-received by customers.

Thailand has delivered strong growth against the

background of sustained political uncertainty and a weakening

economy. Consumer confidence levels are low but our continued

investment in improving our offer for customers has served the

business well and we are continuing to outperform our major

competitors. Our small format stores – particularly Talad

(supermarkets) and Express stores, which are very popular with

customers in the larger cities – have seen very good growth in

both sales and profit.

International continued

Poland

In Poland we have launched the first phase of

our new discount range designed to compete

with local limited range discounters.