Tesco 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Value

travels

Annual Report and

Financial Statements 2009

Table of contents

-

Page 1

Value travels Annual Report and Financial Statements 2009 -

Page 2

... Financial highlights Chairman's statement Tesco at a glance Chief Executive's Q&A Report of the Directors Business Review Long-term strategy Markets served and business model International Core UK Non-food Retailing Services Community People Resources and relationships Group performance Key... -

Page 3

... to help them spend less. So whether they are looking for lighter meal options, clothing, mobile phone tariffs or savings accounts, they can trust Tesco to deliver great value. More information is available online at www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 4

...start-up costs, and after adjusting for assets held for sale. § Using a 'normalised' tax rate before start-up costs in the US and Tesco Direct, and excludes the impact of foreign exchange in equity and our acquisition of a majority share of Dobbies. Tesco PLC Annual Report and Financial Statements... -

Page 5

... China and the United States, giving us access to another of the world's most important economies. Whilst many of our customers are focused on managing their shopping budgets, it is still important to them that we behave responsibly in the communities we serve. We now have a Community Plan for each... -

Page 6

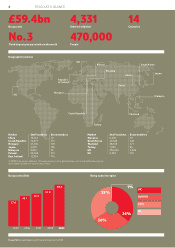

... 731 people working in other global locations such as international buying hubs. Store numbers exclude one store in Calais, France. Group sales (£bn) Group space by region 59.4 51.8 43.1 37.0 46.6 1% 33% UK EUROPE ASIA US 36% 30% 2005 2006 2007 2008 2009 Tesco PLC Annual Report and Financial... -

Page 7

...do it. Tesco PLC Annual Report and Financial Statements 2009 Sir Terry Leahy, Chief Executive At a time when customers everywhere are feeling the economic strain, we are responding to their changing needs in all our markets by lowering prices, introducing more affordable products and offering even... -

Page 8

... profits and returns. Our long-term strategy International Tesco is an international retailer and wherever we operate we focus on giving local customers what they want. Page 8 Core UK The UK is our biggest market and the core of our business. We aim to provide all our customers with excellent value... -

Page 9

... successful in some of the world's most competitive markets. We have recognised skills and proprietary systems in key areas which help us deliver a low cost model - particularly in customer relationship management, just-in-time supply chain and distribution, property development and store formatting... -

Page 10

8 REPORT OF THE DIRECTORS International sales up 31% Philip Clarke International and IT Director How do you run successful businesses in so many countries? We've long understood that retailing is local. Each team on the ground is able to adjust our offer to each market because customers in ... -

Page 11

...this year by sticking to our strategy as competitors falter. By continuing to focus on doing the right things for customers - lowering prices, introducing more affordable products, offering even stronger promotions - they have rewarded us with good sales and market share growth. By keeping our costs... -

Page 12

... are very popular with customers in the larger cities - have seen very good growth in both sales and profit. Poland In Poland we have launched the first phase of our new discount range designed to compete with local limited range discounters. Tesco PLC Annual Report and Financial Statements 2009 -

Page 13

... included the complete remodelling of our of customers locally has resulted in some changes to the product large department store in Leberec, which was completed last month. ranges, the introduction of a limited number of promotions and special offers, as well as improvements to the ambience of the... -

Page 14

12 REPORT OF THE DIRECTORS £540m in productivity savings David Potts Retail and Logistics Director Is 'Every Little Helps' still important? Making many small improvements in everything we do is what 'Every Little Helps' is about, because when we all work together on the little things, it ... -

Page 15

... to shop for customers who want to spend less. As well as introducing more affordable products we have been working hard to cut prices across the store. To help us do this we have been keeping very good control of costs and have put more focus on our efficiency saving programme we call Step-Change... -

Page 16

... us to absorb rising utility costs. Energy consumption in Tesco fell by 8% last year despite business growth. 70% of our products are delivered to stores in retail-ready packaging, including all of our new 'Discount Brands' saving many hours of staff time re-filling shelves. • We now have... -

Page 17

... number of Tesco stores to 2,282. In the current year, we aim to open a similar amount of new space across our formats - equivalent to an additional 6.4% of sales area. To reflect our customers' need to spend less, we have invested millions of pounds in cutting prices and introduced more promotions... -

Page 18

... increased our market share as customers appreciate the convenience of buying non-food from Tesco and the value that we offer. We've been adding new ranges with lower price-points and extending ranges that consumers see as essentials and we've seen real success on own-brand products such as Technika... -

Page 19

... the market. Non-food remains an important part of our strategy and we continue to grow both sales and market share. In our experience, customers will buy where they see value. To help customers we have been making changes to our ranges and cutting prices. For example, in the UK sales of... -

Page 20

... from Tesco Direct, have supported good market share growth. The profitability of our non-food business has also been pleasing. UK non-food sales rose by 5% in the year, compared with 9% in 2007/8, with total non-food sales increasing to £8.7 billion (included in reported UK sales). Second... -

Page 21

... to increase as more customers order and collect items from their local Tesco. We plan to add clothing to our online offer later this year. Group non-food sales rose 6% to £12.5 billion, including £3.8 billion in International. We want all of our products to be sourced responsibly and fairly, but... -

Page 22

... time customers have come to trust Tesco to deliver value whether they are buying their weekly shop or opening a savings account. Their trust is very important to us. So we take the same approach to financial services as we do to all other parts of our business and that means offering competitive... -

Page 23

... annual profit in the next few years. The aim is to develop our services business to offer customers the same convenience we have brought to food shopping, to all the other products and services we offer. Our dotcom grocery business and now our online non-food offer, Tesco Direct, have already added... -

Page 24

... rate of growth. Impairment losses on the cards and loans portfolios increased in the second half against the background of deteriorating market conditions. 1.5m Tesco Personal Finance has over 1.5 million car and home insurance customers. Tesco PLC Annual Report and Financial Statements 2009 -

Page 25

...improved product availability, and strong productivity. Growth in the international businesses - in South Korea and Ireland - was very strong. Telecoms had a good year, with particularly robust growth in Tesco Mobile. Mobile saw double-digit growth in customer numbers in a flat pre-pay phone market... -

Page 26

... want to see Tesco doing the right things on community and the environment at the same time as providing them with the value they expect from us. We've made some great progress this year and one of the things I'm most proud of is the work we have done in getting unemployed people back to work which... -

Page 27

...our business responsibly is important to our customers and increasingly crucial to our growth. We are working within communities to develop our own plans as well as involve customers in the journey. own buildings and distribution networks and we continue to make good progress. Over the past year we... -

Page 28

...for eight, and this year is the first year of 'Shop for Schools' in the US. In recent months, we have also moved some £11 million worth of business back to UK suppliers, supporting domestic orderbooks and production, and safeguarding employment. Tesco PLC Annual Report and Financial Statements 2009 -

Page 29

...our customers say that wider application of the labels could change their purchasing decisions. 3bn+ Since launching green Clubcard points in August 2006 to reward customers who re-use their bags, they have helped us to save over three billion bags. Tesco PLC Annual Report and Financial Statements... -

Page 30

... REPORT OF THE DIRECTORS 470,000 people Tim Mason President and CEO of Fresh & Easy Is training and developing staff still a priority? Having started a business from scratch in the US - one of the world's largest markets - I know how important it is to have a strong team around you. Developing... -

Page 31

...have developed a leadership development programme to help us meet the needs of our rapid expansion. This year 137 people completed the programme which is tailored to meet the development needs of each person and prepare them for leadership roles. Tesco PLC Annual Report and Financial Statements 2009 -

Page 32

... the UK, we offer our staff a market-leading package of pay and benefits: Employee share schemes Through share ownership and share incentive schemes, over 170,000 of our people have a personal stake in Tesco. Staff were awarded shares worth a record £91 million last May under our Shares in Success... -

Page 33

..., compared with 434 in 2007. We want Tesco to be a great place to work for all our people, so our new staff members will be given all the support and training they need to harness the potential and talent they can bring to our diverse workforce. Tesco PLC Annual Report and Financial Statements 2009 -

Page 34

... Our International business delivered a very strong performance, helped in part by favourable exchange rate movements during the year, and excluding the United States (US) contributed 51% of the growth in Group sales and 45% of the growth in Group trading profit. Underlying margins improved... -

Page 35

...stores. United States results US sales (inc. VAT) US trading profit/(loss) Trading margin £208m £(142)m n/a n/m 129.0% - Actual rates % ch. 52-week % ch. Constant % ch. n/m 124.2% - n/m 98.4% - To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements... -

Page 36

...35m compared with last year. Tesco Personal Finance delivered a good performance in a challenging financial services market and profit was reported within Joint Ventures and Associates for 50 weeks (50% share). Underlying growth in the business was encouraging - with the number of customer accounts... -

Page 37

...-use development schemes and we have purchased fewer existing trading stores from competitors, allowing UK capital expenditure to revert to the levels of four years ago. Importantly this is being achieved whilst continuing to meet our objective of adding some 6 to 7% to our UK selling space annually... -

Page 38

...associated with running the stores, depots and head office, and the cost of depreciation of the assets used to generate the profits. Trading profit is stated after adjusting operating profit for the impact of IAS 19, IAS 32 and IAS 39 (principally pension costs and the marking to market of financial... -

Page 39

... are set for local markets, with oversight from the Executive Directors, to ensure they are tailored to drive the priorities of each business. The following are some KPIs for the UK and Group operations: 2009 2008 UK market share Grocery market share** Non-food market share Employee retention This... -

Page 40

...the right thing for all our stakeholders and avoid the loss of such loyalty. The 'Tesco Values' are embedded in the way we do business at every level and our Code of Ethics guides our behaviour in our dealings with customers, employees and suppliers. Tesco PLC Annual Report and Financial Statements... -

Page 41

... non-food products are competitively priced to offer a broad range of products ranging from value to the luxury end of the market, in order to cater for the needs of as wide a range of customers as possible. IT systems and infrastructure The business is dependent on efficient information technology... -

Page 42

... objective is to reduce the effect of exchange rate volatility on short-term profits. Transactional currency exposures that could significantly impact the Group Income Statement are hedged, typically using forward purchases or sales of foreign currencies and currency options. At the year end... -

Page 43

...7bn compared with £3.9bn the previous year. In the Directors' opinion, the properties of the Group have a market value in excess of the carrying value of £7bn included in these financial statements. Share capital and control of the Company Details of the Company's share capital including changes... -

Page 44

... Sir Terry Leahy Richard Brasher Philip Clarke Andrew Higginson Tim Mason Laurie Mcllwee Lucy Neville-Rolfe David Potts Charles Allen Patrick Cescau Karen Cook Dr Harald Einsmann Ken Hanna Ken Hydon Jacqueline Tammenoms Bakker Jonathan Lloyd Tesco PLC Annual Report and Financial... -

Page 45

... UK Retail Operations. From 2004 David's responsibilities have included the UK Supply Chain and the Republic of Ireland. = Member of the Audit Committee ฀= Member of the Remuneration Committee To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements... -

Page 46

... governance Directors' report on corporate governance Tesco PLC is committed to the highest standards of corporate governance as we recognise that good governance is crucial in helping the business to deliver its strategy, generating shareholder value and safeguarding our shareholders' long-term... -

Page 47

... control systems; • group governance policies; and • succession planning for senior executives. All Directors have access to the services of the Company Secretary and may take independent professional advice at the Company's expense in conducting their duties. The Company provides insurance... -

Page 48

... presentations on whistleblowing, IT security, fraud, bribery and corruption, business continuity and updates from business units. Each year the Committee conducts a review of its own effectiveness and its Terms of Reference. From 1 April 2009: • Ken Hanna Tesco PLC Annual Report and Financial... -

Page 49

... and governance issues associated with operating a financial services business, following the acquisition of Tesco Personal Finance. Key to delivering effective risk management is ensuring our people have a good understanding of the Group's strategy and our policies, procedures, values and expected... -

Page 50

... by the CEO, Sir Terry Leahy, and membership includes Non-executive Directors with relevant financial expertise, Executive Directors and members of senior management. The Committee usually meets twice a year and its role is to review and agree the Finance Plan on an annual basis to review reports of... -

Page 51

... Summary Financial Statements, either in paper or electronic form. These reports, together with publicly-made trading statements, are available on the Group's website, www.tesco.com/corporate. The Tesco PLC AGM The Annual General Meeting offers the opportunity for the Board to communicate directly... -

Page 52

... remuneration levels of Executive Directors are reviewed annually by the Committee taking into account their value to the Company and competitive market practice. Consideration is also given to pay levels across the Group in order to sustain a common sense of purpose and sharing of success. When... -

Page 53

...-line financial results, measured through earnings, both in the present year and sustainably over time; • enhancement of profitability, measured through return on capital, whilst growing the business; • achievement of durable improvements in the underlying drivers of performance such as cost... -

Page 54

... Board, taking account of Company performance. • Buy as You Earn. An HMRC approved share purchase scheme under which employees invest up to a limit of £110 on a four-weekly basis to buy shares at the market value in Tesco PLC. • Save as You Earn. An HMRC approved savings-related share option... -

Page 55

...the level of vesting. Return on capital employed - Group and international The rules of the Performance Share Plan allow awards to be made over shares up to 150% of salary. In the year ended 28 February 2009 awards were made to all the Executive Directors except Tim Mason over Tesco PLC shares equal... -

Page 56

...which in time has the potential to become a significant source of value for our shareholders. The Tesco PLC US Long Term Incentive Plan 2007 (the US LTIP) has been designed to deliver reward only if the US business realises this potential. The US CEO was made an award of two million shares under the... -

Page 57

... emoluments Performance-related emoluments Short-term cash £000 Short-term deferred shares £000 Total 2008/9 £000 Total 2007/8 £000 Salary £000 Allowances £000 Benefits £000 3 Long-term4 £000 Executive Directors Richard Brasher Philip Clarke Andrew Higginson Sir Terry Leahy Tim Mason... -

Page 58

... Executive share option scheme and discretionary share option plan Value realisable1 Date of grant Date exercisable Date of exercise Number of options exercised Option price (pence) Market price at exercise 2008/9 £000 2007/8 £000 Total Richard Brasher Philip Clarke Andrew Higginson Sir Terry... -

Page 59

...market price at exercise is shown in table 3. The share price at 28 February 2009 was 333.20 pence. The share price during the 53 weeks to 28 February 2009 ranged from 285.90 pence to 437.00 pence. To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements... -

Page 60

... REPORT Directors' remuneration report continued Table 5 Share options held by Directors and not exercised at 28 February 2009 Savings-related share option scheme (1981) As at 23 February 2008 Options granted in year Options exercised in year 1 As at 28 February 2009 Exercise price (pence) Value... -

Page 61

... REPORT 59 Table 5 Share options held by Directors and not exercised at 28 February 2009 continued Savings-related share option scheme (1981) As at 23 February 2008 Options granted in year Options exercised in year 1 As at 28 February 2009 Exercise price (pence) Value realisable 2008/9 £000 Value... -

Page 62

... Plan replaced the long-term Executive Incentive Scheme. The first award under the new plan was made in 2004. All awards except those described in notes 1 and 2 above have been made in the form of nil cost options. The awards are subject to performance conditions based on Return on Capital Employed... -

Page 63

... REPORT 61 Table 7 Group New Business Incentive Plan Date of award/grant Share price on award date (pence) As at Shares awarded/ 23 February options granted 2008 in year Options exercised/ shares released in year As at 28 February 2009 Date from which exercisable Expiry date Sir Terry Leahy... -

Page 64

... 20.05.2015 26.05.2016 24.05.2017 02.05.2018 1 The Executive Incentive Plan replaced the short-term Executive Incentive Scheme. The first award under the new plan was made in 2005. The awards are subject to performance conditions based on TSR, earnings per share and corporate objectives. The awards... -

Page 65

DIRECTORS' REMUNERATION REPORT 63 Table 10 Directors' interests in the Long-Term Incentive Plan Number of shares as at 23 February 2008 Number of shares as at 28 February 2009 Value of shares released £000s Market price on release (pence) Year of release Award date Shares awarded 3 Shares ... -

Page 66

...a holding period and shares held under the all employee Share Incentive Plan which are subject to a holding period. Between 28 February 2009 and 20 April 2009, 483 shares were purchased by Executive Directors as part of the Buy As You Earn scheme and Tim Mason sold 631,384 ordinary shares. 2 Options... -

Page 67

...the Group financial statements Five year record Tesco PLC - Parent Company financial statements Independent auditors' report to the members of Tesco PLC 65 66 67 68 69 70 71 71 72 124 126 136 To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 68

..., as well as a description of the principal risks and uncertainties of the business. The Directors are responsible for the maintenance and integrity of the Annual Review and Summary Financial Statement and Annual Report and Financial Statements published on the Group's corporate website. Legislation... -

Page 69

... related notes. These Group financial statements have been prepared under the accounting policies set out therein. We have reported separately on the Parent Company financial statements of Tesco PLC for the 53 weeks ended 28 February 2009 and on the information in the Directors' Remuneration Report... -

Page 70

...FINANCIAL STATEMENTS Group income statement 53 weeks ended 28 February 2009 Continuing operations Revenue (sales excluding VAT) Cost of sales Gross proï¬t Administrative expenses Proï¬t arising on property-related items Operating proï¬t Share of post-tax profits of joint ventures and associates... -

Page 71

... ended 28 February 2009 Change in fair value of available-for-sale investments Foreign currency translation Total (loss)/gain on deï¬ned beneï¬t pension schemes Gains/(losses) on cash ï¬,ow hedges: Net fair value gains Reclassiï¬ed and reported in the Group Income Statement Tax on items taken... -

Page 72

...payables Deferred tax liabilities Provisions Net assets Equity Share capital Share premium account Other reserves Retained earnings Equity attributable to equity holders of the parent Minority interests Total equity Sir Terry Leahy Laurie McIlwee Directors The financial statements on pages 68 to 123... -

Page 73

... shares purchased Net cash from ï¬nancing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Effect of foreign exchange rate changes Cash and cash equivalents at end of year * Results for the year ended 23 February 2008 include 52 weeks of operation... -

Page 74

...includes 53 weeks of trading for the UK, Republic of Ireland (ROI) and United States of America (US) businesses. As described in the Report of the Directors, the main activity of the Group is that of retailing and financial services. Statement of compliance The consolidated financial statements have... -

Page 75

...a legal entitlement to payment arises. Operating profit Operating profit is stated after profit arising on property-related items but before the share of results of joint ventures and associates, finance income and finance costs. Property, plant and equipment Property, plant and equipment assets are... -

Page 76

... The Group accounts for pensions and other post-employment benefits (principally private healthcare) under IAS 19 'Employee Benefits'. In respect of defined benefit plans, obligations are measured at discounted present value (using the projected unit credit method) whilst plan assets are recorded... -

Page 77

... value through profit and loss. Loans and advances are initially recognised at fair value plus directly related transaction costs. Subsequent to initial recognition, these assets are carried at amortised cost using the effective interest method less any impairment losses. Income from these financial... -

Page 78

..., net of direct issue costs. Derivative financial instruments and hedge accounting The Group uses derivative financial instruments to hedge its exposure to foreign exchange and interest rate risks arising from operating, financing and investing activities. The Group does not hold or issue derivative... -

Page 79

... Statement within finance income or costs for the year. Where the liability is in a currency other than Pounds Sterling, the liability has been designated as a net investment hedge. Any change in the value of the liability resulting from changes in exchange rates is recognised directly in equity... -

Page 80

... cost of providing pension benefits in the future is discounted to a present value at the corporate bond yield rates applicable on the last day of the previous financial year. Corporate bond yield rates vary over time which in turn creates volatility in the Group Income Statement and Group Balance... -

Page 81

... reporting format is geographical, based on the Group's management and internal reporting structure. Secondary information is reported by business segments, which comprises retailing and financial services. In 2007/8, the UK reporting segment included the start-up operations in the United States... -

Page 82

... Total £m Operating proï¬t Adjustments for: (Proï¬t)/loss arising on property-related items IAS 19 Income Statement charge for pensions 'Normal' cash contributions for pensions IAS 17 'Leases' - impact of annual uplifts in rent and rent-free periods Trading proï¬t/(loss) Trading margin 2,164... -

Page 83

... of intangible assets Impairment losses recognised in the Group Income Statement Reversal of prior period impairment losses through the Group Income Statement Proï¬t/(loss) arising on property-related items Business segments The Group has two business segments, retailing and financial services. 18... -

Page 84

... and salaries Social security costs Post-employment beneï¬ts (note 28) Share-based payments expense (note 27) 4,707 410 439 242 5,798 4,246 349 470 228 5,293 The average number of employees by geographical segment during the year was: Average number of employees 2008* Average number of full-time... -

Page 85

... Net pension ï¬nance income (note 28) Total ï¬nance income (on historical cost basis) IAS 32 and IAS 39 'Financial Instruments' - Fair value remeasurements Total ï¬nance income Finance costs Interest payable on short-term bank loans and overdrafts repayable within ï¬ve years Finance charges... -

Page 86

... £m Current tax credit on: Foreign exchange movements Share-based payments Deferred tax credit/(charge) on: Share-based payments Pensions Total tax on items credited to equity (note 30) 199 46 245 14 176 190 435 250 5 255 (57) (75) (132) 123 Tesco PLC Annual Report and Financial Statements 2009 -

Page 87

...£647m (2008 - £57m in 2028) that will expire between 2014 and 2029. Other losses will be carried forward indefinitely. In addition, the Group has UK capital losses of £310m (2008 - £350m). To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 88

... pence/share Proï¬t Earnings from operations Adjustments for: IAS 32 and IAS 39 'Financial Instruments' - Fair value remeasurements Total IAS 19 Income Statement charge for pensions 'Normal' cash contributions for pensions IAS 17 'Leases' - impact of annual uplifts in rent and rent-free periods... -

Page 89

FINANCIAL STATEMENTS 87 Note 10 Goodwill and other intangible assets Internally generated development costs £m Pharmacy and software licences £m Other intangible assets £m Goodwill £m Total £m Cost At 23 February 2008 Foreign currency translation Additions Acquisitions through business ... -

Page 90

... regarding discount rates, growth rates and expected changes in margins. Management estimate discount rates using pre-tax rates that reflect the current market assessment of the time value of money and the risks specific to the cash-generating units. Changes in selling prices and direct costs are... -

Page 91

... 15,209 892 829 16,930 (e) Carrying value of land and buildings includes £4m (2008 - £6m) relating to the prepayment of lease premiums. (f) Capital work in progress does not include land. To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 92

...selling prices and direct costs are based on past experience and expectations of future changes in the market. The forecasts are extrapolated beyond five years based on estimated long-term growth rates of generally 2%-10% (2008: 3%-4%). The pre-tax discount rates used to calculate value in use range... -

Page 93

... use or fair value less costs to sell) do not exceed the asset carrying values. In all cases, impairment losses arose due to stores performing below forecasted trading levels. The reversal of previous impairment losses arose principally due to improvements in stores' performances over the last year... -

Page 94

...PLC* Fresh & Easy Neighborhood Market Inc* Tesco Personal Finance Group Limited Tesco Distribution Limited* Tesco Property Holdings Limited* Tesco International Sourcing Limited* dunnhumby Limited* Tesco Insurance Limited* Valiant Insurance Company Limited* Retail Retail Retail Retail Retail Retail... -

Page 95

FINANCIAL STATEMENTS 93 Note 13 Group entities continued Transferred to investment in subsidiary undertakings During the year ended 28 February 2009, the Group acquired the remaining 50% of the share capital of Tesco Personal Finance Group Limited, previously a joint venture, making the company a ... -

Page 96

... the Companies Act 1985. Note 14 Other investments 2009 £m 2008 £m Equity investment Available-for-sale ï¬nancial assets 259 - 259 - 4 4 The equity investment comprises an interest free subordinated loan made by Tesco Personal Finance Group Limited to Direct Line Group Limited. This loan has... -

Page 97

FINANCIAL STATEMENTS 95 Note 15 Inventories 2009 £m 2008 £m Goods held for resale Development properties 2,656 13 2,669 2,420 10 2,430 Note 16 Trade and other receivables 2009 £m 2008 £m Prepayments and accrued income Finance lease receivables (note 37) Other receivables Amounts owed by ... -

Page 98

... of £250m were held against these loans. In the period between the date of acquisition and year end, the gross income not recognised but which would have been recognised under the original terms of non-interest bearing loans was £25m. Tesco PLC Annual Report and Financial Statements 2009 -

Page 99

... Over three months past due 58 15 9 82 - - - - No loans have been renegotiated between the date of acquisition and the year end that would otherwise have been past due or impaired. Note 18 Loans and advances to banks and other financial assets Tesco Personal Finance Group Limited has loans and... -

Page 100

... on portfolios comprising variable rate personal credit cards. The maturity date of the notes matches the maturity date of the underlying assets and are repayable within one year from the balance sheet date. Non-current Par value Maturity year 2009 £m 2008 £m Finance leases (note 37) 5.125% MTN... -

Page 101

... Group Income Statement. Net investment hedges The Group uses forward foreign currency contracts, currency denominated borrowings and currency options to hedge the exposure of a proportion of its non-Sterling denominated assets against changes in value due to changes in foreign exchange rates. The... -

Page 102

...financial year ending: 2009 Carrying value £m Fair value £m Carrying value £m 2008 Fair value £m Assets Finance leases (Group as lessor - note 37) Cash and cash equivalents Loans and advances to customers - TPF Loans and advances to banks and other ï¬nancial assets - TPF Short-term investments... -

Page 103

...- TPF Short-term borrowings Long-term borrowings Finance leases (Group as lessee - note 37) Derivative ï¬nancial instruments: Interest rate swaps and similar instruments Cross currency swaps Forward foreign currency contracts Future purchases of minority interests Fair value through profit or loss... -

Page 104

... estimated using the prevailing rate at the Balance Sheet date. Cash flows in foreign currencies are translated using spot rates at the Balance Sheet date. For index linked liabilities, inflation is estimated at 3% for the life of the liability. Tesco PLC Annual Report and Financial Statements 2009 -

Page 105

...analysis, required by IFRS 7 'Financial Instruments: Disclosures', is intended to illustrate the sensitivity to changes in market variables, being UK interest rates, and foreign exchange risk. To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 106

... currency deals used as net investment hedges. The impact on equity will largely be offset by the revaluation in equity of the hedged assets. For changes in the USD/GBP exchange rate, the impact on equity results principally from forward purchases of USD as cash flow hedges. Tesco PLC Annual Report... -

Page 107

... Personal Finance Group Limited). Early in 2008/9 we purchased and cancelled £100m ordinary shares. In the financial year 2009/10 we expect to continue to use the proceeds from the sale of property to pay down debt. The policy for debt is to ensure a smooth debt maturity profile with the objective... -

Page 108

... for future rents above market value on unprofitable stores. The majority of the provision is expected to be utilised over the period to 2020. The balances are analysed as follows: 2009 £m 2008 £m Current Non-current 10 67 77 4 23 27 Tesco PLC Annual Report and Financial Statements 2009 -

Page 109

... nil consideration. The exercise of options will normally be conditional on the achievement of specified performance targets related to the return on capital employed over the seven-year plan. To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 110

... financial statements continued Note 27 Share-based payments continued The following tables reconcile the number of share options outstanding and the weighted average exercise price (WAEP): For the year ended 28 February 2009 Savings-related share option scheme Options WAEP Irish savings-related... -

Page 111

... related to the return on capital employed in the US business over the seven-year plan. Eligible ROI employees are able to participate in a Share Bonus Scheme, an all-employee profit sharing scheme. Each year, employees receive a percentage of their earnings as either cash or shares. The Executive... -

Page 112

... profits in the current year. Defined benefit plans United Kingdom The principal plan within the Group is the Tesco PLC Pension Scheme, which is a funded defined benefit pension scheme in the UK, the assets of which are held as a segregated fund and administered by trustees. Watson Wyatt Limited... -

Page 113

... directly from actual yields for gilts and corporate bond stocks. The above rate takes into account the actual mix of UK gilts, UK corporate bonds and overseas bonds held at the Balance Sheet date. Movement in pension deficit during the year Changes in the fair value of defined benefit pension plan... -

Page 114

...of Recognised Income and Expense: Actual return less expected return on pension schemes' assets Experience losses arising on the schemes' liabilities Foreign currency translation Changes in assumptions underlying the present value of the schemes' liabilities Total (loss)/gain recognised in the Group... -

Page 115

... are increasing to 11.1% from 10.9%. On this basis the Group expects to make contributions of approximately £410m to defined benefit pension schemes in the year ending 27 February 2010. To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 116

... Savings-related Share Option Scheme (2000). Between 1 March 2009 and 17 April 2009, options over 324,991 ordinary shares have been exercised under the terms of the Executive Share Option Schemes (1994 and 1996) and the Discretionary Share Option Plan (2004). As at 28 February 2009, the Directors... -

Page 117

... interests £m Total £m At 23 February 2008 393 Foreign currency translation differences - Actuarial loss on defined benefit schemes - Tax on items taken directly to or transferred from equity - Change in fair value of available-for-sale financial assets - Gains on cash ï¬,ow hedges - Purchase of... -

Page 118

... translation of the financial statements of foreign subsidiaries. It is also used to record the movements in net investment hedges. Treasury shares The employee benefit trusts hold shares in Tesco PLC for the purpose of the various executive share incentive and profit share schemes. At 28 February... -

Page 119

... of future results of operations of the combined companies. Tesco Personal Finance Group Limited (TPF) On 19 December 2008, the Group acquired the remaining 50% of the share capital of its joint venture TPF, a provider of banking and other financial services in the United Kingdom, making it a wholly... -

Page 120

... of services/management fees and loan interest. Purchases from related parties include £174m (2008 - £157m) of rentals payable to the Group's joint ventures, including those joint ventures formed as part of the sale and leaseback programme. Tesco PLC Annual Report and Financial Statements 2009 -

Page 121

... part of the Directors' Remuneration Report. Transactions on an arm's length basis with Tesco Personal Finance Group Limited which became a wholly-owned subsidiary on 19 December 2008 were as follows: Credit cards and personal loan balances Number of key management personnel Saving deposit accounts... -

Page 122

...than period end exchange rates. Note 34 Analysis of changes in net debt At 23 February 2008 £m Other non-cash movements £m Elimination of TPF £m At 28 February 2009 £m Cash flow £m Acquisitions £m Cash and cash equivalents Short-term investments Finance lease receivables Joint venture loan... -

Page 123

...The Financial Services Compensation Scheme ('FSCS') compensates customers of UK financial institutions when those institutions are unable to pay out. Firms are being levied only for interest costs and management expenses of the scheme (and not for the capital repayments which will ultimately need to... -

Page 124

... with the present value of the net minimum lease receivables are as follows: Minimum lease payments 2009 £m 2008 £m Present value of minimum lease payments 2009 £m 2008 £m Within one year Net ï¬nance lease receivables - - 5 5 - - 5 5 Tesco PLC Annual Report and Financial Statements 2009 -

Page 125

... at market value, options at the end of the lease for the Group to repurchase the properties at market value, market rent reviews and 20-25 year lease terms. The Group reviews the substance as well as the form of the arrangements when making the judgement as to whether these leases are operating or... -

Page 126

... 3,128 1 Results for the year ended 25 February 2006 include 52 weeks for the UK and ROI and 14 months for the majority of the remaining International businesses. 2 Operating profit includes integration costs and profit/(loss) arising on sale of fixed assets. Operating margin is based upon revenue... -

Page 127

...number of full-time equivalent employees in the UK, revenue exclusive of VAT and operating profit. 15 Based on weighted average sales area and sales excluding property development. 16 Excludes one-off gain from 'Pensions A-Day', with this one-off gain ROCE was 13.6%. 17 Using a 'normalised' tax rate... -

Page 128

... Net assets Capital and reserves Called up share capital Share premium account Proï¬t and loss reserve Total equity Accounting policies and notes forming part of these financial statements are on pages 127 to 135. Sir Terry Leahy Laurie McIlwee Directors The Parent Company financial statements on... -

Page 129

... in foreign currencies are translated into Pounds Sterling at the financial year end exchange rates. Share-based payments Employees of the Company receive part of their remuneration in the form of share-based payment transactions, whereby employees render services in exchange for shares or rights... -

Page 130

... financial instruments and hedge accounting The Company uses derivative financial instruments to hedge its exposure to foreign exchange and interest rate risks arising from operating, financing and investing activities. The Company does not hold or issue derivative financial instruments for trading... -

Page 131

...the year primarily relates to the revaluation of the Company's listed fixed asset investments to fair value based on quoted market prices at the Balance Sheet date (note 14 of the Group financial statements). To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial... -

Page 132

...2,970 491 Note 8 Other creditors 2009 £m 2008 £m Amounts falling due within one year: Other tax and social security Amounts owed to Group undertakings Other liabilities Accruals and deferred income - 2,141 421 7 2,569 1 1,725 304 7 2,037 Tesco PLC Annual Report and Financial Statements 2009 -

Page 133

... two years Amounts falling due between two and ï¬ve years Amounts falling due after more than ï¬ve years 1,981 1,981 867 2,784 8,099 11,750 13,731 1,114 1,114 277 1,166 4,202 5,645 6,759 To find out more go to www.tesco.com/annualreport09 Tesco PLC Annual Report and Financial Statements 2009 -

Page 134

... number of options and weighted average exercise price (WAEP) of share option schemes relating to Tesco PLC employees are: Savings-related share option scheme Approved share option scheme Options WAEP Unapproved share option scheme Options WAEP Options Nil cost share options WAEP For the year ended... -

Page 135

... - - b) Share bonus schemes The number and weighted average fair value (WAFV) of share bonuses awarded during the period relating to Tesco PLC employees are: 2009 Shares number WAFV pence Shares number 2008 WAFV pence Shares in Success Executive Incentive Scheme Performance Share Plan US Long-term... -

Page 136

... in 2009. Capital redemption reserve Upon cancellation of the shares purchased as part of the share buy-back, a capital redemption reserve is created representing the nominal value of the shares cancelled. This is a non-distributable reserve. Tesco PLC Annual Report and Financial Statements 2009 -

Page 137

...Share premium account At beginning of year Premium on issue of shares less costs At end of year Proï¬t and loss reserve At beginning of year Share-based payment Purchase of treasury shares Dividend Change in fair value of available-for-sale ï¬nancial assets Share buy-back Share buy-back - capital... -

Page 138

... of Tesco PLC for the 53 weeks ended 28 February 2009 which comprise the Balance Sheet and the related notes. These parent company financial statements have been prepared under the accounting policies set out therein. We have also audited the information in the Directors' Remuneration Report that... -

Page 139

...associated with this production. CTD are FSC and ISO 14001 certified with strict procedures in place to safeguard the environment through all processes. Designed and produced by 35 Communications. Go online Every year, more and more information is available for our shareholders, staff and customers... -

Page 140

www.tesco.com/annualreport09 Tesco PLC Tesco House Delamare Road Cheshunt Hertfordshire EN8 9SL