Square Enix 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

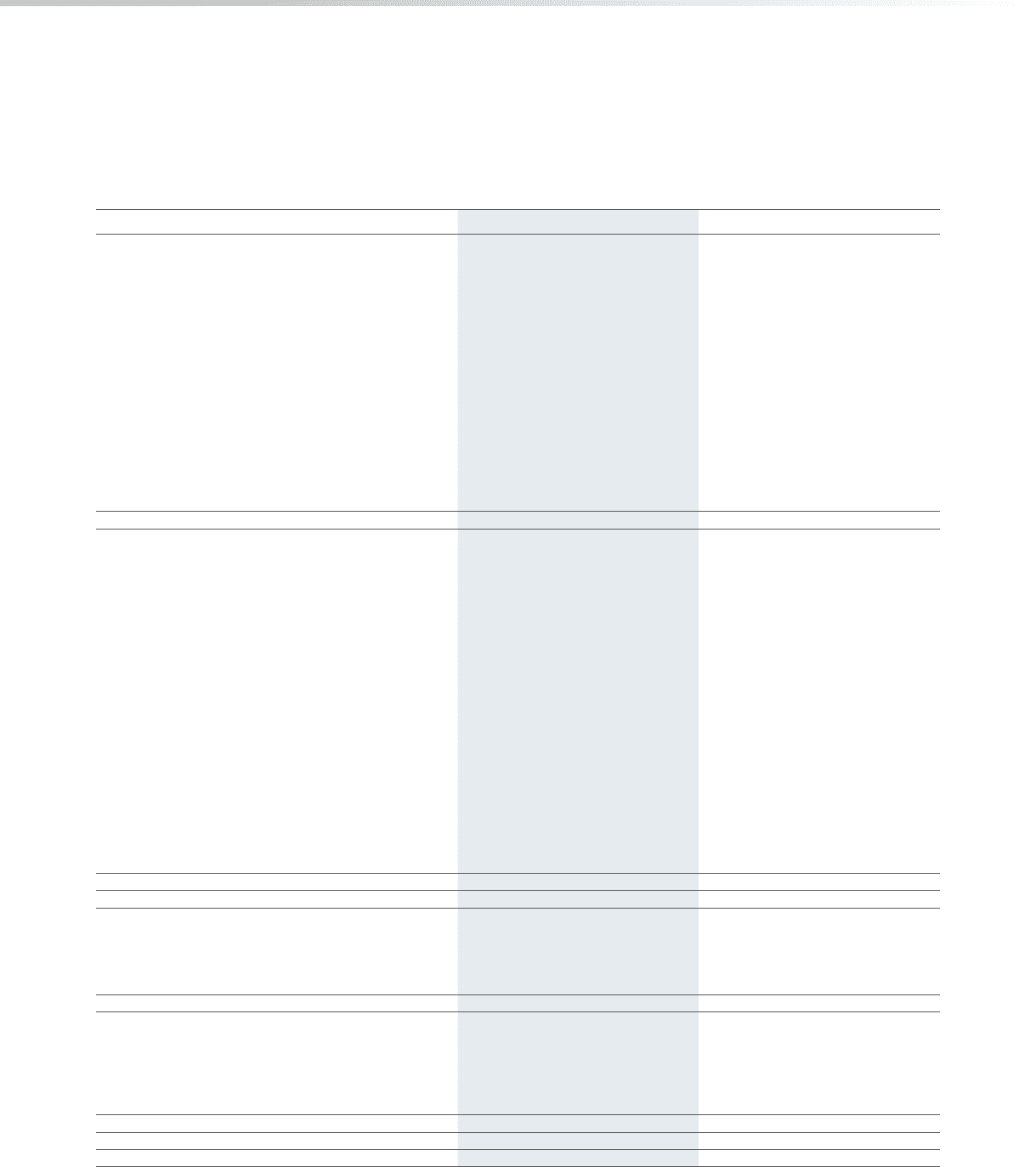

61

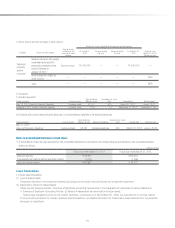

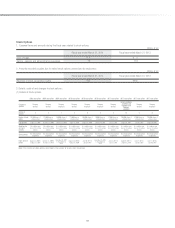

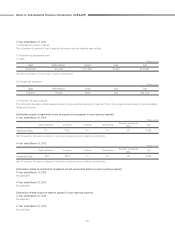

Tax Effect Accounting

1. Significant components of deferred tax assets and liabilities are summarized as follows:

Millions of yen

As of March 31, 2014 As of March 31, 2013

Deferred tax assets

1) Current assets

Enterprise tax payable ¥ 207 ¥ 121

Business office tax payable 39 44

Provision for bonuses 552 344

Accrued expenses 632 547

Provision for sales returns 1,106 780

Non-deductible portion of allowance for doubtful accounts 49 94

Tax credits 985

Loss on write-offs of content production account 3,673 4,802

Loss on inventory revaluation 613 711

Provision for game arcade closings 89 97

Loss carried forward 1—

Other 226 268

Valuation allowance (2,260) (1,993)

Offset to deferred tax liabilities (current) (121) (466)

Total 4,819 5,438

2) Non-current assets

Non-deductible portion of provision for employees’ retirement

benefits — 1,729

Net defined benefit liabilities 1,716 —

Provision for directors’ retirement benefits 62 84

Expense for stock-based compensation 121 232

Non-deductible depreciation expense of property and equipment 299 438

Asset retirement obligations 287 284

Impairment loss 324 290

Loss on evaluation of investments in securities 369 303

Non-deductible portion of allowance for doubtful accounts 94 25

Non-deductible portion of excess expenses on lump-sum

depreciable assets 117 182

Loss carried forward, and others, at overseas subsidiaries 1,044 883

Provision for game arcade closings 135 168

Tax credits 29 145

Loss carried forward 58 200

Other 110 325

Valuation allowance (2,304) (2,897)

Offset to deferred tax liabilities (non-current) (1,343) (1,169)

Total 1,125 1,229

Total deferred tax assets 5,945 6,668

Deferred tax liabilities

1) Current liabilities

Accrued expenses and other cost calculation details 115 179

Other 8 286

Offset to deferred tax assets (current) (121) (466)

Total 3—

2) Non-current liabilities

Non-current assets 1,483 1,006

Tax effects from intangible non-current assets relating to

business combinations 1,721 1,779

Other 117 39

Offset to deferred tax assets (non-current) (1,343) (1,169)

Total 1,978 1,655

Total deferred tax liabilities 1,981 1,655

Balance: Net deferred tax assets ¥ 3,963 ¥ 5,012