Square Enix 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• CPAs performing audits:

Limited-liability partners: Takashi Nagasaka,

Tatsuya Yokouchi and Hiroyoshi Konno

• Personnel providing audit assistance:

15 CPAs, 9 assistant CPAs

(7) Overview of liability limitation agreements

The Company has liability limitation agreements in place with

its outside directors and audit & supervisory board

members (external) in accordance with Article 427,

Paragraph 1, of the Companies Act to limit liabilities provided

under Article 423, Paragraph 1, of the Companies Act.

These agreements limit the liability of each outside director

and audit & supervisory board member (external) to ¥10

million or the legally specified amount, whichever is greater,

on condition that the directors or audit & supervisory board

members have performed their duties in good faith and

without gross negligence.

(8) Prescribed number of directors

The Company’s Articles of Incorporation stipulate that the

number of directors shall not exceed 12.

(9) Resolution requirements for the election of directors

The Company’s Articles of Incorporation stipulate that

resolutions for the election of directors shall not be made by

cumulative voting, but by the majority of votes of shareholders

exercising their voting rights at the General Meeting of

Shareholders where shareholders in attendance hold one-

third or more of outstanding voting rights.

(10) Bodies able to determine dividends paid from

retained earnings

The Company’s Articles of Incorporation stipulate that matters

provided under Article 459, Paragraph 1, of the Companies

Act may be determined by the Board of Directors unless

legally stipulated otherwise. The objective of this provision is

to expand the range of options enabling flexible execution of

capital policies.

(11) Exemption from liability of directors and audit &

supervisory board members

Pursuant to Article 426, Paragraph 1, of the Companies Act,

the Company’s Articles of Incorporation stipulate that a

director (including former directors) and an audit & supervisory

board member (including former audit & supervisory board

members) may be exempted from liability for actions related

to Article 423, Paragraph 1, of the Companies Act, up to the

limit provided by law, through a resolution passed by the

Board of Directors. This provision aims to ensure the

maintenance of an environment in which directors and audit

& supervisory board members may exercise their duties to

the maximum of their abilities and are able to fulfill the roles

expected of them.

(12) Matters requiring special resolutions at the

General Meeting of Shareholders

The Company’s Articles of Incorporation stipulate that the

special resolutions provided under Article 309, Paragraph 2,

of the Companies Act may be passed by a majority of

two-thirds or more of the votes of shareholders present at

the General Meeting of Shareholders where shareholders in

attendance hold one-third or more of outstanding voting

rights. The objective of this relaxation of special resolution

requirements is to ensure smooth proceedings of the

General Meeting of Shareholders.

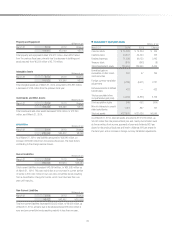

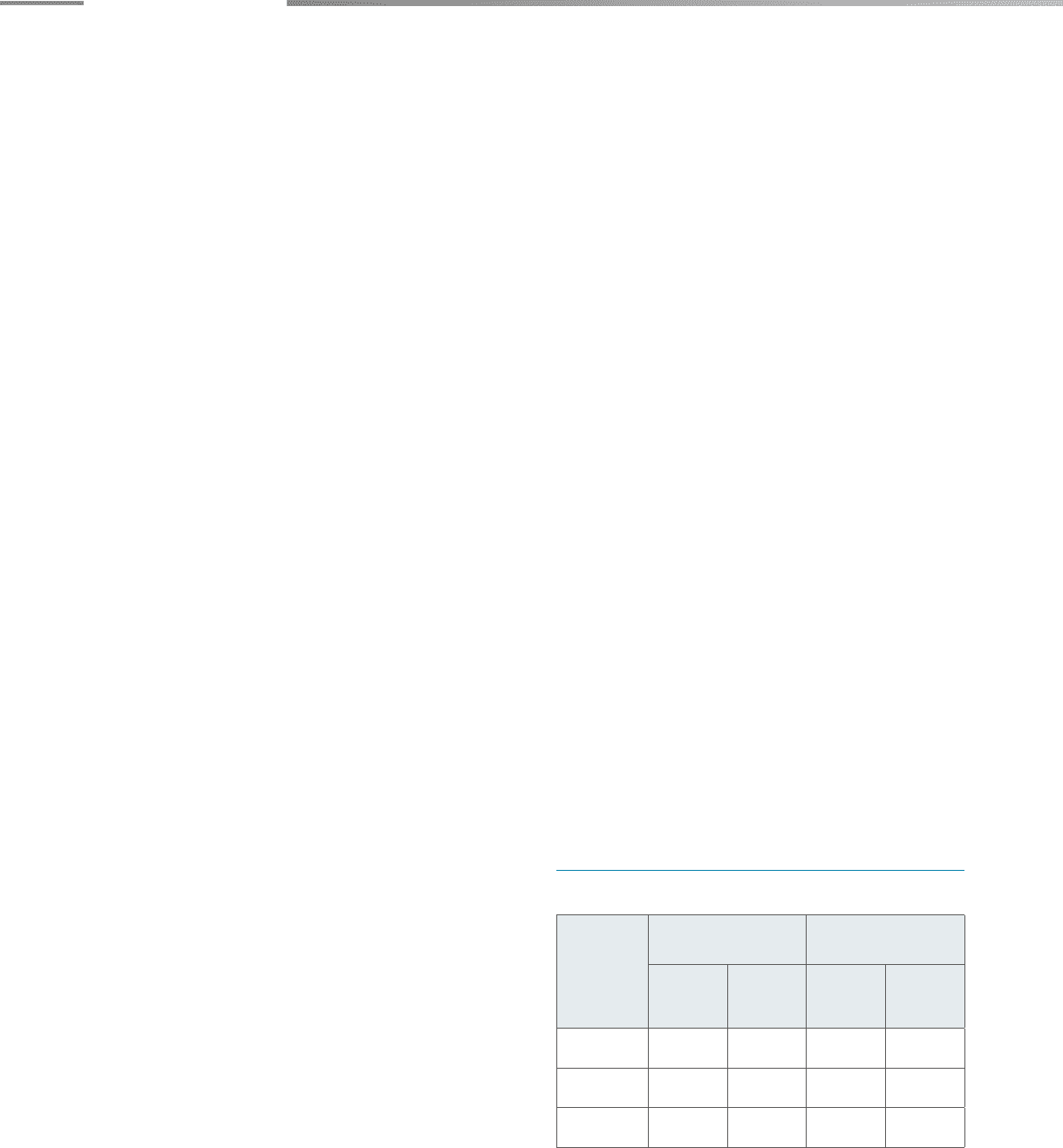

2. Compensation to Statutory Audit Firm, Etc.

(1) Compensation paid to statutory audit firm

Millions of yen

Category

Fiscal year ended

March 31, 2013

Fiscal year ended

March 31, 2014

Compensation

for

statutory audit

operations

Compensation

for

non-audit

operations

Compensation

for

statutory audit

operations

Compensation

for

non-audit

operations

Parent

company 47 1 47 1

Consolidated

subsidiaries 70 — 70 —

Total 117 1 117 1

Corporate Governance

26