Square Enix 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following statements are based on management’s view of SQUARE ENIX

HOLDINGS CO., LTD. (the “Company”) as of June 30, 2014 and have not

been audited. The following management discussion and analysis also

contains forward-looking statements concerning the future performance of

the Company. Please read the disclaimer regarding forward-looking

statements at the beginning of this Annual Report.

1. Significant Accounting Policies and Estimates

The consolidated financial statements of the SQUARE ENIX Group (the

“Group”) are prepared in accordance with generally accepted

accounting principles in Japan (JPNGAAP). In preparing the

consolidated financial statements, management chooses and applies

accounting policies, and makes estimates that affect the disclosure

of amounts in assets, liabilities, income and expenses. Management

formulated these estimates based on historical performance and

certain other factors. However, actual results may differ materially

from these estimates due to uncertainties inherent in the estimates.

Important accounting policies used in the preparation of the Group’s

consolidated financial statements are contained in the section titled

“Summary of Significant Accounting Policies Used in the Preparation

of Consolidated Financial Statements,” of this report. In particular,

judgments used in making estimates in the preparation of the

consolidated financial statements are affected by the following

accounting policies.

(1) Revenue recognition

Sales revenue of the Group is ordinarily recognized when products

are shipped or services are provided, while royalty revenue is

recognized based on receipt of a statement from the licensee. In

certain cases, the recognition of sales is determined based on

contracts entered into with suppliers and product type.

(2) Allowance for doubtful accounts

The Group provides an allowance for doubtful accounts based on

estimated irrecoverable amounts to prepare for bad debt losses on

receivables. In the event that the financial condition of a counterparty

deteriorates and its solvency declines, the Group may provide

additional amounts to the allowance for doubtful accounts or record

bad debt losses.

(3) Content production account

When the Group determines that the estimated market value of the

content production account—based on expected future demand and

market conditions—has fallen below actual costs, the Group

recognizes a write-down of the content production account. If future

demand and market conditions are worse than management’s

forecasts, there is the possibility that further write-downs will become

necessary.

(4) Unrealized losses on investments

The Group owns shares in certain financial institutions and

companies with which it sells or purchases goods. These

shareholdings include stock in listed companies subject to price

fluctuation risk in the stock market and stock in privately held

companies for which share prices are difficult to calculate. In the

event that the fair value of these shares as of the end of the fiscal

year declines by 50% or more of their acquisition cost, the entire

amount is treated as an impairment loss. In addition, in the event that

the fair value of marketable shares declines 30% to 50%, an amount

determined as necessary considering the importance and potential

for recovery of the shares is treated as an impairment loss.

Worsening market conditions or unstable performance at the invested

companies may require the recording of revaluation losses in the

event that losses are not reflected in current book value or the book

value becomes irrecoverable.

(5) Deferred tax assets

The Group records a valuation allowance to provide for amounts of

deferred tax assets thought likely to be recovered. In evaluating the

necessity of a valuation allowance, the Company examines future

taxable income and possible tax planning for deferred tax assets with

a high likelihood of realization. If the Company determines that all or

a portion of net deferred tax assets cannot be realized in the future,

the Company writes down such deferred tax assets during the fiscal

year in which the determination is made. If the Company determines

that deferred tax assets in excess of the recorded amount can be

realized in the future, the Company recognizes deferred tax assets to

the recoverable amount and increases profits by the same amount

during the period in which the determination is made.

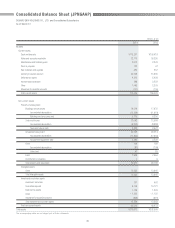

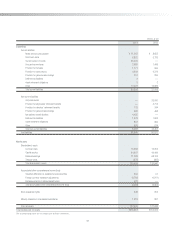

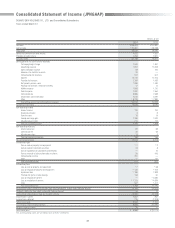

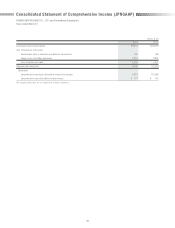

Management Discussion and Analysis of Operating Results and Financial Position (JPNGAAP)

SQUARE ENIX HOLDINGS CO., LTD. and Consolidated Subsidiaries

Years ended March 31

29