Square Enix 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

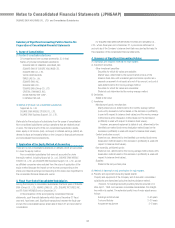

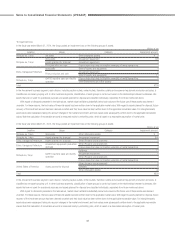

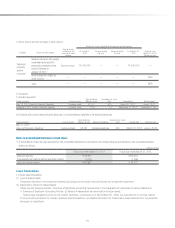

Changes in Accounting Policy

(Application of accounting standard for retirement benefi ts, etc.)

The Accounting Standard for Retirement Benefi ts (Accounting Standards

Board of Japan [ASBJ] Statement No. 26, issued May 17, 2012, the

“Retirement Benefi ts Accounting Standard”) and the Guidance on Accounting

Standard for Retirement Benefi ts (ASBJ Guidance No. 25, issued May 17,

2012, the “Guidance on Retirement Benefi ts”) were applied from the end of

the fi scal year (provided, however, that they are not applied for the provisions

specifi ed in the main clause of Paragraph 35 of the Retirement Benefi ts

Accounting Standard and the main clause of Paragraph 67 of the Guidance

on Retirement Benefi ts). The accounting treatment method has been changed

so that the amount of retirement benefi t obligations less the fair value of plan

assets is recognized as net defi ned benefi t liability, and the unrecognized

actuarial gains and losses are also recognized as net defi ned benefi t liability.

The application of the Retirement Benefi ts Accounting Standards is

subject to the transitional treatment provided for in Paragraph 37 of the

Retirement Benefi ts Accounting Standard. Consequently, the impact of this

change has been recognized as increases or decreases to remeasurements

of defi ned benefi t plans under accumulated other comprehensive income at

the end of the fi scal year.

As a result, as of March 31, 2014, a net defi ned benefi t liability of

¥4,425 million was posted, while accumulated other comprehensive income

increased ¥432 million.

The impact of this change on net assets per share was insignifi cant.

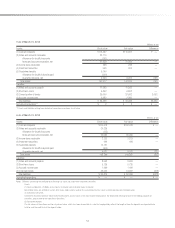

Accounting Standards Issued but Not Yet Applied

• Accounting Standard for Retirement Benefi ts (ASBJ Statement No. 26,

issued May 17, 2012)

• Guidance on Accounting Standard for Retirement Benefi ts (ASBJ Guidance

No. 25, issued May 17, 2012)

(1) Overview

The standards provide guidance for the accounting methods for

unrecognized actuarial gains and losses and unrecognized prior service

costs, the calculation method of retirement benefi t obligations and service

costs, and the enhancement of disclosures.

(2) Effective dates

The Company will apply the revised calculation method of retirement

benefi t obligations and service costs from the beginning of the fi scal year

ending March 31, 2015.

These accounting standards will not be applied retroactively to

the consolidated fi nancial statements of prior years since transitional

measures are provided for in said accounting standards.

(3) Impact from application of new accounting standard

The impact from application of the new accounting standard is expected to

be insignifi cant.

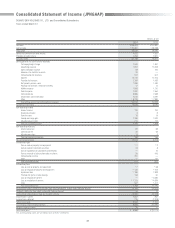

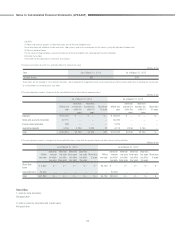

Change in the Method of Presentation

(Consolidated Statement of Income)

“Loss on evaluation of investment securities” was presented separately

under “Extraordinary loss” in the fi scal year ended March 31, 2013, but

is included in “Other” as of the fi scal year ended March 31, 2014, due to

reduced signifi cance as the amount is not greater than 10 percent of total

extraordinary loss. To refl ect this change in the method of presentation, the

consolidated fi nancial statement for the fi scal year ended March 31, 2013

has been reclassifi ed.

Consequently, the ¥0 million in “Loss on evaluation of investment

securities” recorded under “Extraordinary loss” on the consolidated statement

of income for the fi scal year ended March 31, 2013 has been incorporated

into “Other.”

(Consolidated Statement of Cash Flows)

“Loss (gain) on valuation of investment securities” was presented separately

under “Cash fl ows from operating activities” in the fi scal year ended March

31, 2013, but is included in “Other, net” as of the fi scal year ended March

31, 2014, due to reduced signifi cance. To refl ect this change in the method

of presentation, the consolidated fi nancial statement for the fi scal year ended

March 31, 2013 has been reclassifi ed.

Consequently, the ¥0 million in “Loss (gain) on valuation of investment

securities” recorded under “Cash fl ows from operating activities” on the

consolidated statement of cash fl ows for the fi scal year ended March 31,

2013 has been incorporated into “Other, net.”

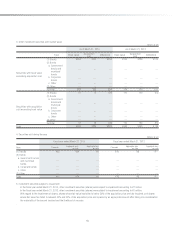

Notes to Consolidated Financial Statements (JPNGAAP)