Square Enix 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

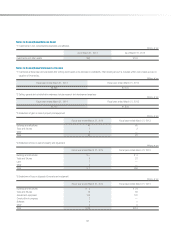

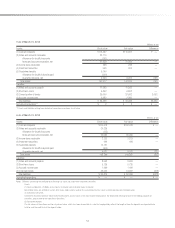

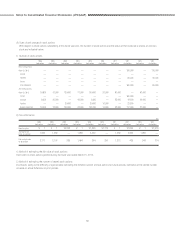

(3) Reconciliation of the ending balances of retirement benefi t obligations and plan assets, and net defi ned benefi t liabilities and net defi ned benefi t assets recorded in the

consolidated balance sheet

Millions of yen

Retirement benefit obligation for funded plans ¥10,054

Plan assets (7,872)

2,181

Retirement benefit obligation for unfunded plans 2,244

Net defined benefit liabilities and assets recorded in the consolidated balance sheet

4,425

Net defined benefit liabilities 4,425

Net defined benefit liabilities and assets recorded in the consolidated balance sheet

¥ 4,425

(4) Components and amounts of net periodic pension costs

Millions of yen

Service cost ¥ 514

Interest cost 87

Expected return on plan assets (44)

Amortization of net actuarial gain (loss) 588

Net periodic pension costs relating to defined benefit plan ¥1,145

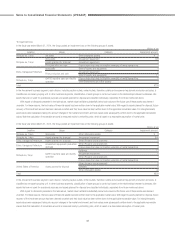

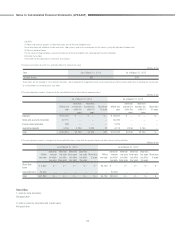

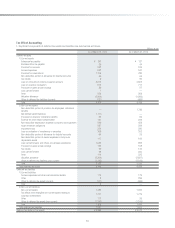

(5) Remeasurements of defi ned benefi t plan

The following items (prior to adjustments for tax effect) have been recorded as components of remeasurements of the defi ned benefi t plan.

Millions of yen

Unrecognized actuarial gains (losses) ¥(449)

Total ¥(449)

(6) Plan assets

1) Main components of plan assets

The percentage of plan assets by major asset class to total plan assets is as follows:

Percent

Bonds 45

Stocks 22

General accounts 9

Cash and deposits 7

Others 17

Total 100

Note: Total plan assets include 4% of the retirement benefit trust plan, which has been set up for the corporate pension plan.

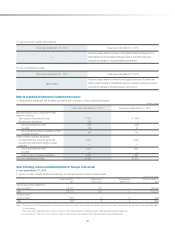

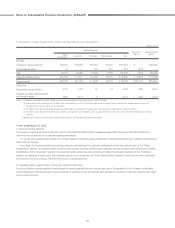

2) Method of setting the long-term expected rate of return

The long-term expected rate of return on plan assets is determined by taking into account the current and expected allocation of plan assets, and the long-term return rates,

which are expected currently and in the future based on the various assets that comprise the plan assets.

(7) Assumptions used to determine actuarial gains or losses

Major (weighted-average) assumptions used to determine actuarial gains or losses as of March 31, 2014

Discount rate: 0.597% to 0.978%

Long-term expected rate of return on plan assets: 2.000%

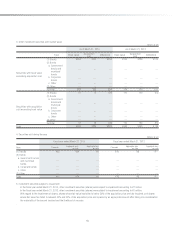

3. Defi ned contribution plan:

The amount of contribution required for the defi ned contribution plan by the Company and its consolidated subsidiaries was ¥302 million.