SkyWest Airlines 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

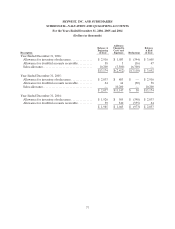

TheStock Purchase Planisa compensatory plan under SFAS 123(R) because the shares are

purchased semi-annuallyat a 15% discount based on the lower of the beginning or the end of the period

price.During the year ended December 31, 2006, the Company recorded compensation expense of $1.8

million related to StockPurchase Plan. The fair value of theshares purchasedunder the StockPurchase

Plan wasdetermined using theBlack-Scholes option pricing model with the following assumptions: a risk

free rate of 4.8%, a volatility factor of 29.4%, a weighted average life of four months and an expected

annualdividend rate of 0.7%.

During the year ended December 31, 2005, the Company discovered that it had issued329,606 more

shares of common stock than originally authorized to certain of its employees participatingin its Employee

Stock PurchasePlan. Of the shares sold in excess of the EmployeeStock Purchase Plan’s authorized limit,

154,126 shares were sold on January 4, 2005 at a price of $14.35 per share and 175,480 shares were sold on

July 5, 2005 at aprice of $15.45per share. Because the shares that exceedtheoriginal authorized shares

were not deemed to be qualified under theStock Purchase Plan,the intrinsicvalueoftheseshareson the

purchase date wasrecordedas compensation expense.

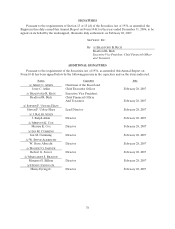

(8) Related-Party Transactions

TheCompany’s President, Chairman of the Boardand Chief Executive Officer, serveson the Board

of Directors of Zion’s Bancorporation (“Zion’s”). The Company maintains a line of credit (see Note 2)

and certain bank accounts with Zion’s.Zion’s is an equity participant in leveragedleases on two CRJ200

and four Brasilia turboprop aircraft operated by theCompany. Zion’s also serves as the Company’s

transfer agent. The Company’s cash balance in the accounts held at Zion’s as of December 31, 2006 and

2005 was $10,974,000, and $30,693,000, respectively.

One of theCompany’s former directors is a shareholder in Soltis InvestmentAdvisors, Inc. (“Soltis”).

Priorto June 2006, Soltis provided cash management advisory services for aportion of the Company’s cash

programs, to the SkyWest Plan and the Company’s deferred executive compensation plan. Soltis received

no amount in 2006 and $263,000 in 2005 for fees from Fidelity relating to the Company’s cash programs.

Soltis received approximately$156,000 in 2006 and $144,850 in 2005 for fees for advisory servicestothe

SkyWest Plan and the Company’s executive deferredcompensation plan. With respectto the Company’s

executive deferred compensation plan, Soltis provided consulting servicesin conjunction with the Newport

Group. Soltis received $20,000 during 2006 and 2005from the Newport Group.