SkyWest Airlines 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

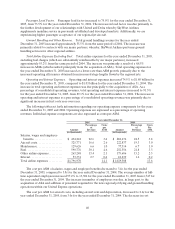

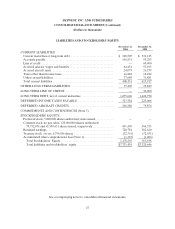

At December31, 2006, our total capital mixwas41.3% equity and 58.7% debt, compared to 39.1%

equity and60.9% debt at December 31, 2005. The increase in the total capital mix during 2006 was

primarily due to the completion of apublicoffering of 4,000,000 sharesof common stock at a price of $26.05

per share on April 17, 2006. We received approximately $95.4 million in net proceeds from theoffering which

were used to pay off two revolving lines of credit, to provide working capital and for general corporate

purposes.

During 2005, SkyWest Airlinesincreasedan existing $10.0million line-of-creditfacility, with abank,

to $40.0 million. As of December 31, 2006, SkyWestAirlines hadnoborrowings outstandingunder the

facility. The facility expires on January 31, 2007 andbears interest at a rate equal to prime less 0.25%.

Additionally, during 2005, SkyWest Airlines entered into another borrowing facility with afinancing

company andborrowed $60.0 million. As of December 31, 2006, SkyWestAirlines had repaid the

borrowings underthe facility andthe facility was terminated.

As of December31, 2006, we had $33.6 million in letters of credit andsurety bonds outstanding with

various banks and suretyinstitutions.

As of December 31,2006 and2005, we classified$16.4 million and $24.8million, respectively, as

restricted cash, related to ourworkers compensation policies and the purchase of ASA.

SignificantCommitments and Obligations

General

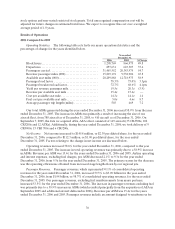

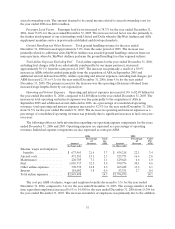

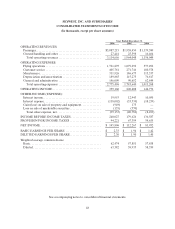

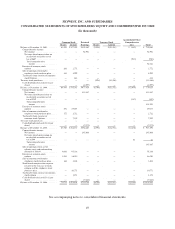

Thefollowing table summarizes our commitments and obligations as noted for each of thenext five

years and thereafter (in thousands):

Total2007 2008 2009 2010 2011Thereafter

Firm aircraft commitments..............$363,500 $363,500 $—$—$—$ — $ —

Operating leasepayments for aircraft and

facility obligations...................3,457,576 295,045 285,647 299,830 293,441 289,5901,994,023

Principalmaturities on long-termdebt .....1,784,131 108,505 113,034 117,890 122,970 125,9461,195,786

Total commitments andobligations.......$5,605,207 $ 767,050 $398,681 $417,720 $416,411 $415,536$3,189,809

Purchase Commitments and Options

On November 21,2006, we announced that SkyWest, through SkyWest Airlines or ASA, had been

selected by Delta to operate 12 CRJ700s previously operated by Comair. Deliveries of these aircraft began

in January 2007and are scheduled to be completed by April2007. On December 21,2006 we announced

that SkyWest Airlines wasselected by Midwest Airlines to enter into theAirline Services Agreement.

Under theterms of the Airline ServicesAgreement, SkyWest Airlines has agreed to operate up to 25

additional CRJ200s. The initial15aircraft arescheduled for deliverybeginning in April 2007. Our total

firm aircraft orders and commitments, as of December 31, 2006, consisted of orders for eightnew

CRJ900s, and commitments to place into service eleven CRJ200sthroughthird-party arrangements and to

sublease 12 CRJ700’s from Delta. Total expenditures forthese aircraft and related flight equipment,

including amounts for contractual price escalationsare estimated to be approximately $363.5 million.

Additionally, our agreement with Bombardier includes options foranother 38 aircraft that can be delivered

in either 70 or 90-seat configurations. Delivery datesfor theseaircraftremainsubject to final

determination as agreed upon by us and ourmajor partners.

SkyWest Airlines hasnot historically funded asubstantial portion of its aircraft acquisitions with

working capital. Rather, it has generally funded its aircraft acquisitions through a combination of operating

leases anddebt financing.At the timeof each aircraft acquisition, we evaluate the financing alternatives

available, and select one or more of these methods to fund the acquisition. In theevent that alternative