SkyWest Airlines 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

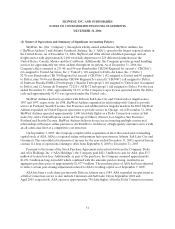

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an

allowance for obsolescence based on historical results and management’s expectationsof future

operations. Expendable inventory partsare chargedto expense as used. An obsolescenceallowance for

flight equipment expendable parts is accrued basedon estimated lives of the corresponding fleet types and

salvage values. The inventory allowance as of December31,2006 and 2005 was$3.6 million and$2.9

million, respectively. These allowances are based on management estimates, which aresubject to change.

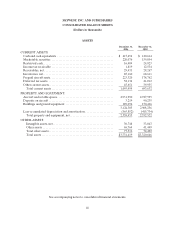

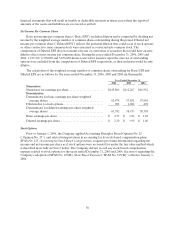

Property and Equipment

Property and equipment arestated at cost and depreciated overtheir usefullives to their estimated

residual values using thestraight-line method as follows:

DepreciableResidual

Assets Life Value

Aircraft androtablespares. ...................................10-18 years0-30%

Ground equipment..........................................5-7 years0%

Office equipment............................................5-7 years0%

Leaseholdimprovements.....................................15years

or life of

the lease 0%

Buildings...................................................20-39.5years 0%

Impairmentof Long Lived and Intangible Assets

As of December 31,2006, the Company hadapproximately $2.6 billion of property and equipment

and relatedassets. Additionally, as of December 31, 2006, the Company had approximately $30.7 million in

intangible assets. In accounting for these long-livedand intangible assets, theCompany makes estimates

abouttheexpected useful lives of the assets, the expected residual values of certainof these assets, and the

potential for impairment based on the fair value of the assets and the cash flows they generate. The

Companyrecorded an intangible asset of approximately $33.7million relating to the acquisition of ASA.

Theintangible is being amortizedover fifteen years underthe strait-line method. As of December 31, 2006

and2005, theCompany recorded $3.0 million and $718,000 in accumulated amortization expense,

respectively. Factors indicating potential impairment include, but arenot limited to, significant decreases

in themarketvalue of the long-lived assets, asignificant change in the condition of thelong-lived assets

and operating cash flow losses associated with the use of the long-lived assets. On a periodic basis, the

Companyevaluates whether thebook valueof its aircraft is impairedinaccordance with Statementof

FinancialAccounting Standards(“SFAS”)No. 144, Accountingfor theImpairment or Disposal of Long-

Lived Assets. Based on theresults of theevaluations, the Company’s management concluded no

impairment was necessary as of December 31, 2006.

Capitalized Interest

Interest is capitalized on aircraft purchase deposits and long-termconstruction projectsas a portion of

the cost of the asset and is depreciated over the estimated useful life of the asset. During the years ended

December31, 2006, 2005 and 2004, the Company capitalized interest costs of approximately $592,000,

$2,833,000, and $3,397,000, respectively.

Maintenance

TheCompany operates under an FAA-approved continuous inspection andmaintenance program.

TheCompany uses the direct expense method of accounting for its regionaljet engine overhauls where the