SkyWest Airlines 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

SFAS No.123(R)on net income andbasicanddiluted earnings per sharealsoincludes the impact of the

employeestock purchase plan (see Note 7).

Prior to the adoption of SFAS No. 123(R), the Company presented all tax benefits of deductions

resulting from theexercise of stock options as operating cash flows in the statement of cash flows. SFAS

No.123(R) requires the cash flows resulting from the tax benefits of deductions in excess of the

compensation cost recognized for those options (excess tax benefit) to be presented as financing cash flows

in thestatement of cash flows. During the year ended December 31,2006,the Company had no taxbenefit

from deductions in excess of the compensation cost recognized for those options.

As of December 31,2006, the Company had$12.3million of total unrecognized compensation cost

related to non-vested stock options and non-vested restricted stock grants. Total unrecognized

compensation cost will be adjusted forfuture changes in estimated forfeitures. The Company expects to

recognize this cost over a weighted average period of 1.0 years.

Options areexercisablefor aperiod as defined by theCompensation Committee at thedate granted;

however, no stock option will be exercisable before six months have elapsedfrom thedate it is granted and

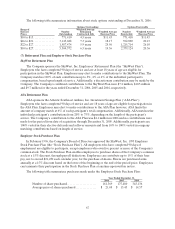

no incentivestockoptionshallbe exercisable afterten years from the date of grant. Thefollowing table

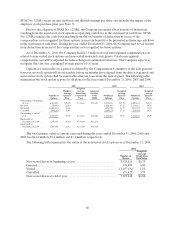

summarizes thestock optionactivity for allplans for the yearsended December 31,2006,2005and 2004:

2006 2005 2004

Number of

Options

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

($000)

Number of

Options

Weighted

Average

Exercise

Price

Number of

Options

Weighted

Average

Exercise

Price

Outstandingat beginning

of year. ............6,301,002 $18.38 7.1years $53,452 5,531,101 $ 19.39 4,690,122 $19.27

Granted .............376,890 23.80 1,826,050 17.11 1,134,812 19.18

Exercised ............(1,069,073) 15.16 (891,292)21.71 (207,755) 12.12

Cancelled ............(104,247) 19.03 (164,857)17.58 (86,078)18.31

Outstandingat end of

year ..............5,504,572 19.36 6.5years $33,862 6,301,002 18.38 5,531,101 19.39

Exercisable at

December 31,2006 ...2,379,124 20.36 4.4 years $12,251

Exercisable at

December 31,2005 ...2,365,386 22.42 5.0 years $10,510

Thetotal intrinsic value of options exercised during the years ended December31,2006, 2005 and

2004 was $14.2million, $7.1 million and $1.1 million, respectively.

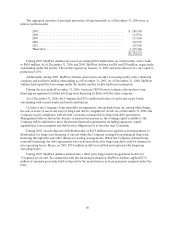

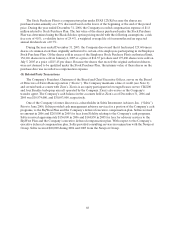

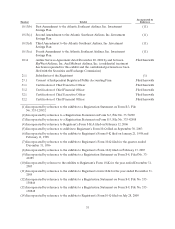

Thefollowing table summarizes the status of the non-vested stock options as of December 31, 2006:

2006

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Non-vested shares at beginning of year ............................ 3,935,616 $6.35

Granted ....................................................... 376,890 6.80

Vested ........................................................ (1,107,631) 4.85

Cancelled...................................................... (79,427) 5.79

Non-vested shares at end of year ................................. 3,125,448 $6.88