SkyWest Airlines 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

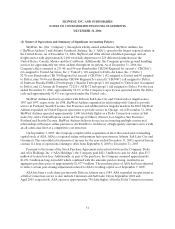

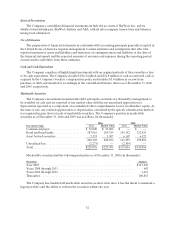

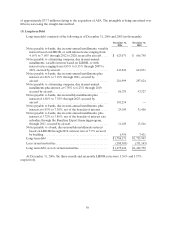

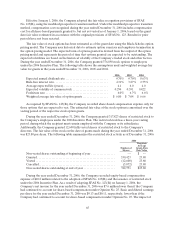

thefair value of theoutstanding interest rate swap agreement. The Company decreased interest expense

by $123,000,$347,000 and $209,000 duringthe years endedDecember 31, 2006, 2005 and 2004

respectively,relating to adjustmentsto the fairvalueand of the derivatives.

Segment Reporting

SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information requires

disclosures related to components of a company for which separate financial information is available that is

evaluated regularly by theCompany’s chief operating decision maker in deciding howto allocate resources

andin assessingperformance. Management believes that theCompany has only one reportable segment in

accordance with SFAS No. 131 because the Company’s business consists of scheduledregional airline

service.

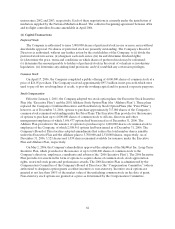

New Accounting Standard

In July 2006, the FASB issued Interpretation No. 48,Accounting for Uncertainty in Income Taxes,

(“FIN No. 48”). FINNo.48 prescribes a recognition threshold and measurement process for recording in

the financialstatementsuncertain taxpositions taken or expected to be taken in atax return.Additionally,

FIN No. 48 provides guidance on classification, accountingin interim periods and disclosure requirements

for uncertain tax positions. Theprovisions of FIN No. 48 will become effective for theCompany beginning

January 1, 2007. The Company is currently evaluating theimpact that FIN No. 48 will have on its results of

operations and financial position, however, the Company does notexpect that the adoption of FIN No. 48

will have a material impact on its results of operations and financial position.

(2) Acquisition of ASA

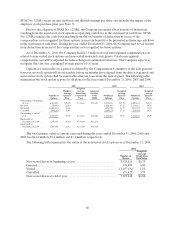

On September 7, 2005, the Company completed the acquisition of allof the issued and outstanding

capitalstock of ASA. ASAisaregional airline with primaryhub operations in Atlanta, Salt Lake City and

Cincinnati. The consolidated statements of income forthe year ended December 31, 2005 reported herein

contain 114 days of operations relating to ASA from September 8, 2005 to December 31,2005.

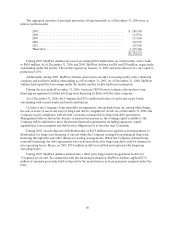

Pursuanttothe terms of theStock Purchase Agreement entered into between the Company, Delta

and ASA Holdings theCompany paid $421.3 million in cash for ASA, plus $5.3 million of transaction fees.

Additionally, as part of the purchase,the Company assumed approximately $1,251.3 million in long-term

debt which combined with the amounts paid at closing, resulted in an aggregate purchase price of

approximately $1,677.9 million. The purchase price of ASAhas been adjusted to reflect certain post-

closing adjustments relatedto ASA’s workingcapital as of September 7, 2005.

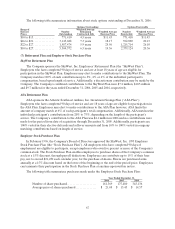

In connection withthe acquisition of ASA, SkyWest Airlines, ASAandDelta entered into Delta

Connection Agreements whereby SkyWest Airlines and ASA agreed to provideregionalairline service in

theDeltaflight system throughSkyWest Airlines and ASA. Among other provisions, the Delta Connection

Agreements provide for the transfer of certain ownership and lease rights among SkyWest Airlines,

ASA, Delta andComair Inc., a wholly-owned subsidiaryofDelta (“Comair”). As part of the Delta

Connection Agreements,SkyWest Airlines, ASA, Delta and/or Comair, as applicable,have terminatedtwo

master sublease agreements with respect to ten Bombardier CRJ200s andtransferredto Delta ten

CRJ200sfinanced in part by an affiliate of Bombardier, and ASA and Deltaentered into a sublease

agreement whereby ASAissubleasing the ten CRJ200s from Delta.

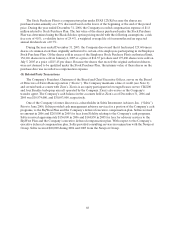

Theacquisition value of ASAwas accounted for using thepurchase method of accounting.

Accordingly, the aggregatepurchaseprice was assigned to the assets and liabilitiesassumed based on

respective fair marketvalues at thepurchase date.During the year ended December 31, 2006, the

Company finalized the purchase price allocation associated with theASA acquisition, which resulted in a

$5.0 million decrease in liabilities andproperty and equipment. The Company recorded an intangible asset