SkyWest Airlines 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

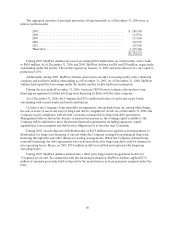

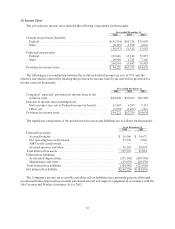

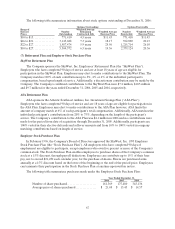

Theaggregate amounts of principal maturitiesof long-term debt as of December 31, 2006 were as

follows (inthousands):

2007 ............................................................$108,505

2008 ............................................................113,034

2009 ............................................................117,890

2010 ............................................................122,970

2011 ............................................................125,946

Thereafter.......................................................1,195,786

$1,784,131

During 2005, SkyWest Airlinesincreasedan existing $10.0million line-of-creditfacility, with abank,

to $40.0 million. As of December 31, 2006 and 2005, SkyWest Airlines had$0 and $30million, respectively,

outstanding under thefacility. The facility expiredon January 31, 2007 and bears interest at a rate equal to

prime less 0.25%.

Additionally, during 2005, SkyWest Airlines entered into another borrowing facility with afinancing

company andhad$60.0 million outstandingasof December 31, 2005.As of December 31, 2006, SkyWest

Airlines hadrepaid the borrowings under the facility andthefacility had been terminated.

During the year ended December 31, 2006, fourteen CRJ700s were refinanced from short-term

financing arrangement facilities into long-term financingfacilities withthesame company.

As of December 31,2006, the Company had $33.6million in letters of credit and surety bonds

outstanding with various banks and surety institutions.

Certain of the Company’s long-term debt arrangements contain limitations on, among other things,

the sale or lease of assets and ratio of long-term debt to tangible net worth. As of December31, 2006, the

Companywas in compliance with all debt covenants contained in its long-term debt agreements.

Management believes that in the absence of unusual circumstances, the working capital available to the

Company will be sufficient to meet the present financial requirements, including expansion, capital

expenditures, lease payments and debt service obligations for at least the next 12 months.

During 2005, aircraft deposits with Bombardier of $22.0 million were applied as down payments to

Bombardier for temporary financing of aircraft while the Company arranged for permanent long-term

financing throughdebt and other thirdparty leasing arrangements. When theCompany obtained long-

term debt financing, thedebt agreements were written such that thelong-term debt could be refinanced

into operating leases. Hence, in 2005,$55.4 million in debt wassettled and replacedwithlong-term

operating leases.

During 2005, SkyWest Airlines entered into athird party long-term leveraged lease facility for

32 regional jetaircraft.Inconjunction with this financing transaction, SkyWest Airlinesapplied $37.0

million of amounts previously held on deposit by the manufacturer as lease payments required under the

lease.