SkyWest Airlines 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

leases, whichresults in rental payments being chargedto expense over the termsofthe related leases.

Additionally, operating leasesare not reflected in our condensed consolidated balance sheet and

accordingly, neither a leaseassetnor an obligation for future lease payments is reflected in our condensed

consolidated balance sheet.

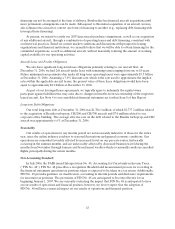

Impairment of Long-Lived and Intangible Assets

As of December 31,2006, we hadapproximately $2.6 billion of property andequipment and related

assets. Additionally, as of December 31, 2006, we hadapproximately $30.7 million in intangible assets. In

accounting for these long-lived and intangible assets, we make estimates about the expected useful lives of

the assets, theexpectedresidual values of certain of these assets, and thepotential for impairment based

on the fair value of the assets and the cash flows they generate. We recorded an intangible of

approximately $33.7 million relating to the acquisition of ASA. The intangible is being amortized over

fifteen years under the strait-line method. As of December 31, 2006, we had recorded $3.0 million in

accumulated amortization expense. Factors indicating potential impairment include, but are not limited to,

significant decreases in themarketvalue of thelong-lived assets, asignificant change in the condition of

the long-lived assetsand operating cash flow losses associated with the useof thelong-livedassets. On a

periodicbasis, we evaluate whether thebook value of our aircraft is impairedin accordance with SFAS

No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” Based on the results of the

evaluations, ourmanagement concluded no impairment was necessary as of December 31, 2006. However,

there is inherent risk in estimating the future cash flows usedin the impairment test. If cash flows do not

materialize as estimated, there is arisk the impairmentcharges recognized to date may be inaccurate, or

further impairment charges may be necessary in the future.

Stock-BasedCompensation Expense

Effective January 1, 2006,weadopted the fair value recognition provisions of Statement of Financial

Accounting Standards No. 123(R), Share-Based Payment (“SFAS No. 123(R)”), using the modified-

prospective transitionmethod.Under the modified-prospectivetransition method,compensationcost

recognized during theyear ended December 31,2006 includes compensation cost for all share-based

payments granted to, but not yet vested as of January 1, 2006, based on thegrant date fair value estimated

in accordance with the original provisions of SFAS No.123(R). Prior to January 1, 2006, we applied

Accounting PrinciplesBoard(“Opinion No. 25”), and related interpretations in accounting for our stock-

based compensation plans. Results for prior periods have not been restated. As aresult of adopting SFAS

No.123(R) on January 1, 2006, our net income for the year ended December 31, 2006 was$7.6 million

lower than if we had continuedtoaccount for share-based compensation under Opinion No. 25. Basic and

diluted earnings pershare for the year endedDecember31, 2006 were $0.13 and $0.11 lower, respectively,

than if we hadcontinued to account for share-based compensation under Opinion No. 25.

Applying SFAS No. 123(R), we estimatethe fair value of stock options as of the grant date using the

Black-Scholes option pricing model.We use historical data to estimateoption exercises and employee

termination in theoption pricing model.Theexpected term of options granted is derived from the output

of the optionpricing model and represents the period of timethat options granted are expected to be

outstanding. The expected volatilities are basedonthe historical volatility of ourcommon stockandother

factors.

During the yearended December 31, 2006,wegranted 376,890 stock options to ouremployeesand

317,823 shares of restricted stock to our employees under the 2006 Incentive Plan. The restricted stock has

a three-yearvesting period, during which the recipient must remain employedwith SkyWest or one of our

subsidiaries. Additionally,we granted 12,600 fully vested shares of restricted stock to ourdirectors. As of

December31, 2006, we had$12.3 million of total unrecognized compensation cost related to non-vested