SkyWest Airlines 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

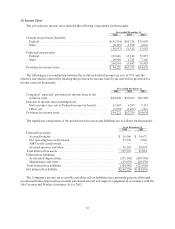

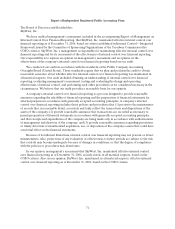

(4) Income Taxes

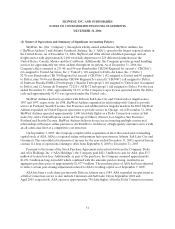

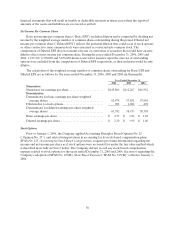

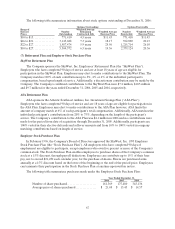

Theprovision for income taxes includes the following components (in thousands):

Year ended December 31,

2006 2005 2004

Currenttaxprovision(benefit):

Federal...............................................$(41,914) $45,714 $13,009

State.................................................(8,419) 5,798 4,643

(50,333) 51,512 17,652

Deferred taxprovision:

Federal...............................................123,646 13,124 33,817

State.................................................20,908 2,723 3,166

144,554 15,847 36,983

Provisionfor income taxes................................$94,221 $67,359 $54,635

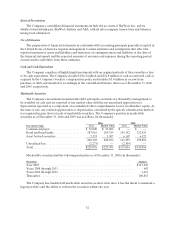

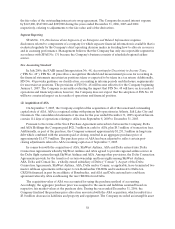

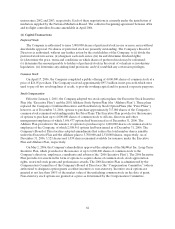

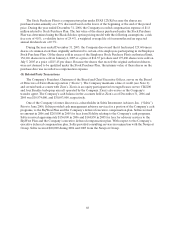

Thefollowing is a reconciliation betweenthe statutory Federal income tax rate of 35%and the

effective rate which is derived by dividing the provision for income taxes by income before provision for

income taxes (in thousands):

Year ended December 31,

2006 20052004

Computed “expected” provision for income taxes at the

statutoryrates.......................................... $84,009$62,869$47,805

Increase in income taxes resulting from:

Stateincome taxes, net of Federal income tax benefit .......11,867 6,3875,313

Other, net............................................. (1,655) (1,897) 1,516

Provisionfor income taxes................................. $94,221$67,359$54,634

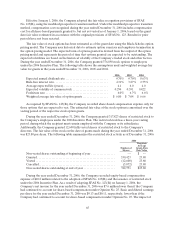

The significant componentsof the netdeferred tax assetsand liabilitiesare as follows (in thousands):

As of December 31,

2006 2005

Deferred taxassets:

Accruedbenefits............................................$16,560 $14,673

Net operatingloss carryforward...............................57,5987,265

AMTcredit carryforward .....................................——

Accruedreserves andother...................................41,57419,074

Totaldeferred tax assets ........................................115,732 41,012

Deferred taxliabilities:

Accelerated depreciation .....................................(355,103) (204,598)

Maintenance andother.......................................(29,879) (20,470)

Totaldeferred taxliabilities .....................................(384,982) (225,068)

Net deferred taxliability. .......................................$(269,250) $(184,056)

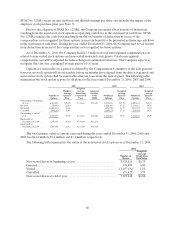

TheCompany’s income tax receivable anddeferredtaxliabilities wereprimarily generated through

accelerated bonus depreciation on newly purchased aircraft and support equipment in accordance with the

Job Creation and Worker Assistance Actof 2002.