SkyWest Airlines 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

unions since 2002 and 2003, respectively. Each of these negotiations is currently under the jurisdiction of

mediators supplied by the National Mediation Board. The collectivebargaining agreement between ASA

andits flight controllers became amendablein April 2006.

(6) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series without

shareholder approval. No shares of preferred stock are presently outstanding. TheCompany’s Board of

Directors is authorized, without any further action by the stockholders of the Company, to (i) divide the

preferred stock into series; (ii) designate each such series;(iii) fix and determine dividend rights;

(iv) determine theprice, terms and conditions on whichshares of preferred stock may be redeemed;

(v)determinethe amount payabletoholders of preferred stock in theevent of voluntary or involuntary

liquidation; (vi) determine any sinkingfund provisions; and (vii) establish any conversion privileges.

Common Stock

On April17, 2006, the Company completed a public offering of 4,000,000 shares of common stock at a

price of $26.05 per share. The Company received approximately $95.3 million in netproceeds which were

used to pay offtwo revolvinglines of credit, to provideworking capital andfor general corporate purposes.

Stock Compensation

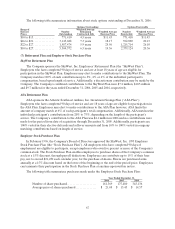

Effective January 1, 2001,the Company adopted two stock option plans: the Executive Stock Incentive

Plan (the“Executive Plan”)and the2001 Allshare Stock Option Plan(the “Allshare Plan”). Theseplans

replaced the Company’s Combined Incentive andNon-Statutory Stock Option Plans (the “Prior Plans”);

however, as of December 31, 2006, options to purchase approximately 717,000 shares of the Company’s

commonstock remained outstanding underthe Prior Plans. The Executive Plan provides forthe issuance

of options to purchase up to 4,000,000 shares of common stocktoofficers, directors andother

management employees of which3,696,477 options hadbeenissued as of December31,2006. The

Allshare Plan provides forthe issuance of options to purchase up to 4,000,000 shares of common stock to

employees of the Company, of which 2,508,961 options had been issued as of December 31, 2006. The

Company’s Board of Directors has adopted amendments that reduce the total number shares issuable

under the Executive Plan and theAllshare plan to 3,700,000and 2,510,000shares, respectively. As of

December 31,2006, 3,523shares and 1,039 shares remainedavailable for issuance under the Executive

Plan andAllsharePlan, respectively.

On May 2, 2006, theCompany’s shareholders approved the adoption of the SkyWestInc. Long-Term

Incentive Plan, which providesfor the issuance of up to 6,000,000 shares of common stock to the

Company’s directors, employees, consultantsand advisors (the “2006 Incentive Plan”). The 2006 Incentive

Plan provides for awards in the form of options to acquire shares of common stock, stock appreciation

rights, restricted stock grants and performance awards. The 2006 Incentive Plan is administered by the

CompensationCommittee of the Company’s BoardofDirectors (the “CompensationCommittee”) whois

authorized to designateoption grants as either incentive or non-statutory. Incentive stock options are

granted at not less than 100% of themarket value of the underlying common stock on the date of grant.

Non-statutory stock options are granted at a price as determined by theCompensation Committee.