SkyWest Airlines 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To our Shareholders

I’mhappy to report thatfor calendar 2006 we continued to execute on ourstrategy of additional

regional jet growth, expandedprofitability and continuedcost improvement. Thisisyet another year, in a

string of many, where we have beenable to add additional regional jet capacity to our business model and

do it profitably.Wehave also continued to integratethe acquisition of ASA thatwe completed late in

2005, and successfully deal with the challenges associated on the acquisition.

During the year ended December 31, 2006, we acquired 24 new regional jetaircraftconsisting of 15

CRJ700’s and 9 CRJ900’s that we added to ourSkyWest Airlines operations. Additionally, we added6

previously owned CRJ200 aircraft to our Atlantic Southeast Airlines (ASA) operations. As aresult of

adding a totalof 30 regional jetaircraft to our combined fleet, we were able to generate $3.1 billion dollars

in total operating revenues, $145.8 million of net income or $2.30 perdiluted share. Our earnings per

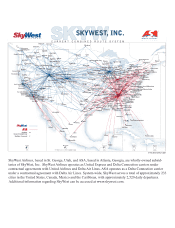

dilutedshare increased 21%comparedtoour2005 performance. By year end, ourcombined companies

generated approximately 2,400 daily departures to 229destinations in the UnitedStates, Canada, Mexico

and theCaribbean. We also hada combined totalfleet of 410 aircraft, whichwe believe is the5 th largest

operating fleetin the world for scheduledairline operators.

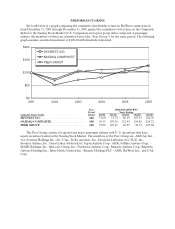

During 2006, fuel costs increased, year over year, at a rate of 7.4% with average cost per gallon of fuel

moving from $2.06 per gallon to $2.20 per gallon. In spite of this increase in the largest absolute dollar cost

component of our operating costs, ourtotal cost peravailable seat mile increasedslightly to $.143 for 2006

from $.141 for 2005. In fact after excludingfuel costs, which arepassed through 100% to ourmajor

partners, our cost peravailable seat mile reduced 2.1% to $.093 for 2006 from $.095 for 2005. The slight

reduction is the result of continuingto addregional jet capacity to our fleet that typically fly longer stage

lengths at loweroverall unit costs.

As mentioned previously, our combined fleet consisted of 410 aircraft as of December 31, 2006 that

breaks down as follows: 1) 336regional jets (118 United and 218 Delta), 2) 62 EMB-120aircraft (48

United and 14 Delta) and 3) 12 ATR72 aircraft (all Delta). Based on recent developments late in 2006, we

expect to acquire 31 additional regional jet aircraft during 2007 to supply contracted capacity needs for our

partners.

Late in the calendar 2006 yearwehad two very positive developments thathelped to buildour

business for 2007 and beyond. First, Deltaawarded us 12 CRJ700 regionaljet aircraft that were previously

operated by their wholly owned subsidiary Comair. We began taking delivery of these aircraft in

January 2007 with all12 aircraft scheduled to be delivered to us by April 2007. Second, we announced a

newairline services agreement with Midwest Airlines for up to 25 CRJ200 aircraft. Initially we will operate

these aircraft, primarily in Midwest’shubsof Milwaukee and KansasCity, with deliveries beginning in

March 2007 and ramping up to 15 aircraft by October 2007. We are currently sourcing aircraft in the

market to be able to meet our contract needs.

At December 31, 2006, we reported $651.9 million of cash and marketable securities. I’m pleasedwith

this result since we started the year with $324.5 million after spending $476.6 millionon the ASA

acquisition during the 2005 time frame. As aresult of primarily operating activities and completinga

successful equity offering during 2006, we were able to increase our liquidity position andadd $327.4

million of cash and marketablesecurities to our balance sheet. Our long-termdebt at December 31, 2006

was$1.67 billion compared to $1.42 billionatthe end of 2005, consistent with our refinancing of ASA short

term obligations, new aircraft deliveries financed with long-term debt andnormal recurringlong-term debt

reductions. We currently anticipate that ourliquidity position will build during 2007 as part of our normal

operations.

Amidst the positive resultsgenerated, our continued growth and adding new partners we continue to

have challenges to address. During 2007,we will be committed to improving thequality of both our

operating platforms by improving ourcompletion and on-time performance factors.We were not able to

make as much progress on these items with regards to ourASA operating company andSkyWest Airlines

did not perform in accordance with its usually high operating standards. We arealsocommitted to bringing