SkyWest Airlines 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

upon satisfaction of certain performance goals. Under the ASA Delta Connection Agreement, excess

margins over certain percentages must be returned or shared with Delta, depending on various conditions.

Thepartiesto the Delta ConnectionAgreements make customary representations,warranties and

covenants, and theagreements contain other provisions typical of agreements of this kind,including with

respect to various operational, marketing and administrative matters.

TheSkyWest Airlines and ASA Delta Connection Agreementsalso providerevenuedesignated as an

amount per aircraft designed to reimburse the Companyfor certain aircraft ownership costs. In accordance

with Emerging Issues Task Force No. 01-08, Determining Whether an ArrangementContains a Lease

(“EITF 01-08”), the Company has concluded that a component of its revenue under the Delta Connection

Agreements is rental income, inasmuch as theDeltaConnection Agreements identify the“right of use” of

aspecific typeand number of aircraft over a stated period of time. The amounts deemed to be rental

income under theDeltaConnection Agreements for the years ended December 31, 2006, 2005 and 2004

were $290.5 million, $139.9 millionand$72.5 million, respectively. These amounts wererecorded as

passenger revenue on theCompany’s consolidated statements of income.

Effective July 31, 2003, SkyWest Airlines entered into the United Express Agreement, which setsforth

theterms and conditions governing the Company’s United Express operations. The United Express

Agreement has received all necessary approvals from the U.S. Bankruptcy Court chargedwith

administration of United’s Chapter 11 reorganization proceedings. Under the terms of the United Express

Agreement, SkyWestAirlines is compensated primarily on a fee-per-completed-block hour anddeparture

basis and is reimbursed for fuel and other costs. Additionally, SkyWest Airlines is eligible for incentive

compensation upon theachievement of certain performance criteria.

TheUnited Express Agreement also provides that we earn revenue for an amount peraircraft

designed to reimburse theCompany forcertain aircraft ownership costs. In accordance with EITF01-08,

theCompany has concluded that acomponent of its revenue under the United Express Agreement is

rental income, inasmuch as the United Express Agreement identifies the “right of use” of a specific type

and number of aircraft over a stated period of time. The amounts deemed to be rental income under the

United ExpressAgreement for theyears ended December 31,2006,2005 and 2004 were $196.1, $168.4 and

$114.5 million, respectively. These amounts were recorded in passengerrevenue on the Company’s

consolidated statements of income. The United Express Agreement contains certain provisions pursuant to

which theparties could terminate theagreement, subject to certain rights of theotherparty, if certain

performance criteria are not maintained.

The Company’s revenues could be impacted by a number of factors, including changes to its code-

share agreements with Delta and United, contract modifications resulting fromcontract re-negotiations

andthe Company’s ability to earn incentive payments contemplated under its code-shareagreements.

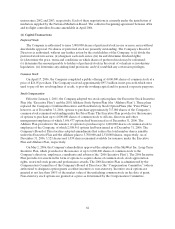

Deferred Aircraft Credits

The Companyaccounts forincentives provided by aircraft manufacturers as deferred credits. The

deferred creditsrelated to leased aircraft areamortized on a straight-line basis as a reduction to rent

expense over thelease term. Credits related to owned aircraft reduce thepurchase price of the aircraft,

which has the effect of amortizing the credits on a straight-line basis as a reduction in depreciation expense

over the life of therelated aircraft. The incentives arecredits that may be used to purchase spare parts and

pay for training and other expenses.

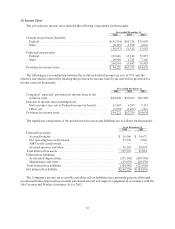

Income Taxes

TheCompany recognizes a liability or asset for the deferred tax consequences of all temporary

differences between the tax basisofassets and liabilities and their reported amounts in theconsolidated