SkyWest Airlines 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

ITEM 7A. QUANTITATIVE ANDQUALITATIVE DISCLOSURES ABOUT MARKET RISK

Aircraft Fuel

In thepast, we have not experienced difficultieswith fuel availability and we currently expect to be

able to obtain fuel at prevailing prices in quantities sufficientto meet our future needs. Pursuant to our

contract flyingarrangements, United has agreed to bear theeconomic risk of fuel price fluctuations on our

United Express flights. On our Delta Connection regional jetflights, Delta hasagreed to bear the

economic risk of fuel price fluctuations. On the majority of ourDelta Connection routes flown using

Brasiliaturboprops, we are required to bear the economic risk of fuel fluctuations. At present, we believe

that our results from operations will not be materially and adversely affected by fuel price volatility.

Interest Rates

Our earnings are affected by changes in interest ratesdue to theamounts of variable rate long-term

debt and the amountof cash and securities held.Theinterestrates applicable to variable rate notesmay

rise and increase the amount of interest expense. We would also receive higher amounts of interest income

on cash and securities held at thetime; however, the market value of our available-for-sale securities would

likely decline. At December 31, 2006, we hadvariable rate notes representing 55.4% of ourtotal long-term

debt compared to 74.7% of our long-term debt at December 31, 2005. For illustrative purposes only, we

have estimatedthe impactofmarket riskusingahypothetical increase in interest rates of one percentage

point forboth variable rate long-term debt and cash andsecurities. Based on this hypotheticalassumption,

we would have incurredan additional $10,170,000 in interest expense and received $4,605,000 in additional

interest incomefor theyear ended December31, 2006 and we would have incurred an additional

$6,701,000 in interest expense and received $4,895,000 in additional interest income for the year ended

December31,2005.

We currently intend to finance the acquisition of aircraftthrough manufacturer financing, third-party

leases or long-term borrowings. Changes in interest ratesmay impactouractual costs of acquiring these

aircraft. To theextentwe placethese aircraft into service underour code-shareagreements with Deltaand

United, ourcode-share agreements currently provide that reimbursement rates will be adjusted to levels

we believe are adequate to address any changes in ouraircraft ownership costs.

We have an interest rate swap agreementto manage its exposure on the debt instrument relatedto

ourheadquarters. Our policies do not permit us to enter into derivative instruments for any purpose other

than cash flowhedging purposes. Accordingly, we do notspeculate using derivative instruments. We assess

interest rate cash flow risk by identifying and monitoring changes in interest rate exposures that may

adversely impactexpectedfuture cash flowsand by evaluatinghedgingopportunities. Thefair valuesofthe

Company’s derivative instrumentsarerecognized as other current liabilities in theaccompanying balance

sheet. In accordance with provisions of SFAS No. 133, we recorded liabilities of $221,000 and $344,000 at

December31, 2006 and 2005 respectively, in theaccompanying consolidated balance sheets setforth in

Item 8 below representing the fair value of the outstanding interest rate swap agreement. We decreased

interest expense by $123,000 and $347,000 during the years ended December 31, 2006 and 2005,

respectively, relating to adjustments to the fairvalueof the derivatives.

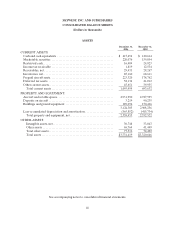

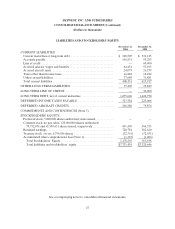

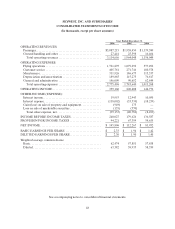

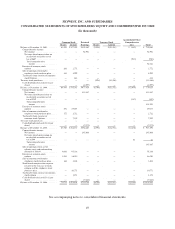

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information set forth belowshouldbe readtogether with the “Management’sDiscussion and

Analysis of Financial Condition and Resultsof Operations,” appearing elsewhere herein.