SkyWest Airlines 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

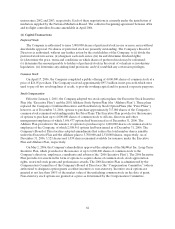

Effective January 1, 2006, the Company adopted thefair value recognition provisions of SFAS

No. 123(R), using the modified-prospective transition method. Under the modified-prospective transition

method, compensation cost recognized during theyear ended December 31,2006 includes compensation

cost for all share-based payments granted to, but not yet vested as of January 1, 2006, based on the grant

date fair value estimated in accordance with theoriginal provisionsof SFAS No. 123. Results for prior

periods have not been restated.

Thefair value of stock optionshas been estimated as of thegrant date usingtheBlack-Scholes option

pricing model. TheCompany uses historical data to estimate option exercises and employeetermination in

the option pricing model.Theexpected term of options granted is derived from the output of the option

pricing model and represents theperiod of time that options granted are expected to be outstanding. The

expected volatilities are based on thehistoricalvolatility of the Company’s traded stockand other factors.

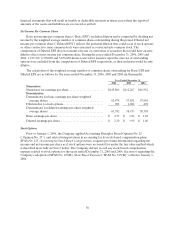

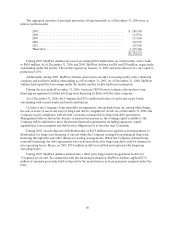

During the year ended December 31, 2006,the Company granted 376,890 stock options to employees

under the 2006 Incentive Plan. The following table shows the assumptions usedand weighted average fair

valuefor grants in the years ended December 31, 2006, 2005 and 2004.

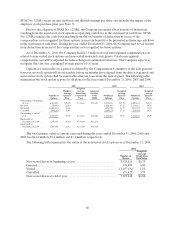

2006 2005 2004

Expected annual dividend rate ..............................0.70% 0.70%0.63%

Risk-freeinterestrate ......................................4.31% 3.87%2.75%

Average expected life (years). ...............................4.1 6.04.0

Expected volatility of common stock.........................0.294 0.3910.422

Forfeiture rate ............................................6.0%6.7%6.6%

Weighted averagefair value of optiongrants ..................$6.80 $7.04$ 6.66

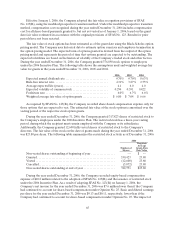

As required by SFAS No.123(R), the Company recorded share-based compensationexpense only for

thoseoptions that areexpected to vest. The estimated fair value of the stock optionsis amortized over the

vesting period of the respectivestock option grants.

During the year ended December 31, 2006, the Company granted 317,823shares of restricted stockto

theCompany’s employeesunder the 2006 Incentive Plan. The restricted stock has a three-year vesting

period, during which the recipient must remain employed with the Company or its subsidiaries.

Additionally, the Company granted 12,600 fully vested shares of restricted stocktothe Company’s

directors. Thefair value of the stock on the date of grants made during the year ended December 31, 2006

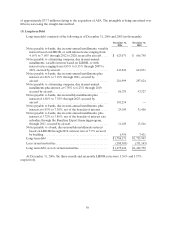

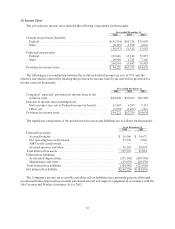

was$23.80 per share. Thefollowing table summarizes therestricted stock activity as of December 31,2006:

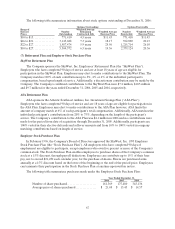

2006

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Non-vested shares outstanding at beginning of year ................. —$—

Granted....................................................... 330,42323.80

Vested ........................................................ (12,600) 23.80

Cancelled...................................................... (5,072) 23.80

Non-vested shares outstanding at endofyear ...................... 312,751$23.80

During the year ended December 31, 2006, the Company recorded equity-based compensation

expense of $10.8 million relatedto the adoption of SFAS No. 123(R) andtheissuance of restricted stock

under the 2006 Incentive Plan. As a result of adopting SFAS No. 123(R) on January 1, 2006, the

Company’s net incomefor the year ended December 31, 2006was$7.6 million lower than if the Company

hadcontinuedto account for share-based compensation under Opinion No. 25. Basic and diluted earnings

per shareforthe yearended December 31,2006 was $0.13 and$0.11,respectively, lower than if the

Company hadcontinued to account for share-based compensation under Opinion No. 25.The impact of