SkyWest Airlines 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

financial statements that will result in taxable or deductible amounts in future years when the reported

amounts of the assets and liabilities are recovered or settled.

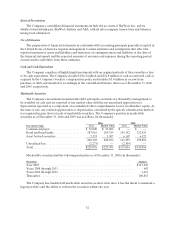

Net Income Per CommonShare

Basicnetincome per common share (“Basic EPS”) excludes dilution and is computed by dividing net

income by the weighted average number of commonshares outstanding during the period.Diluted net

income percommonshare (“Diluted EPS”)reflectsthe potential dilutionthat could occur if stock options

or other contracts to issue common stock were exercised or converted into common stock. The

computation of Diluted EPSdoes not assume exercise or conversion of securities that would have an anti-

dilutive effect on net income per common share. During theyears ended December 31, 2006,2005 and

2004, 1,219,212, 2,378,000 and 3,836,000 shares reserved for issuance upon the exercise of outstanding

options were excluded from the computation of Diluted EPS respectively,as their inclusion would be anti-

dilutive.

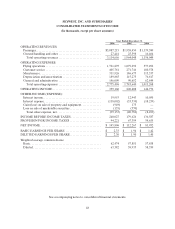

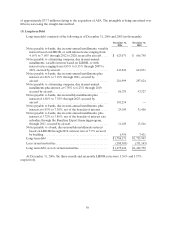

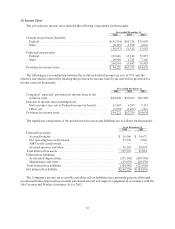

Thecalculationofthe weightedaverage number of common shares outstanding forBasic EPS and

Diluted EPS are as follows forthe years ended December 31, 2006, 2005and2004 (in thousands):

Year Ended December 31,

2006 2005 2004

Numerator:

Numeratorforearnings pershare......................... $145,806$112,267 $81,952

Denominator:

Denominator for basic earnings per-share weighted

averageshares....................................... 62,474 57,851 57,858

Dilution dueto stockoptions............................. 9081,082 492

Denominator fordiluted earnings per-shareweighted

averageshares....................................... 63,382 58,933 58,350

Basicearnings per-share................................. $2.33 $ 1.94 $1.42

Dilutedearnings per-share............................... $2.30 $ 1.90 $1.40

Stock Options

PriortoJanuary 1, 2006, the Company applied Accounting Principles Board Opinion No. 25

(“Opinion No. 25”), and related interpretations in accounting for its stock-based compensation plans.

SFAS No. 123, Accounting for Stock-Based Compensation, requires pro forma informationregarding net

incomeand net incomeper shareasif stock options were accounted for under thefair value method which

is describedmorefully in Note 6below. TheCompany didnot record any stock-based compensation

expense related to stockoptions for the yearsended December 31, 2005 and 2004. See note 6 regarding the

Company’s adoption of SFAS No. 123(R), Share Based Payment(“SFAS No.123(R)”) effective January 1,

2006.