SkyWest Airlines 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

of approximately $33.7 million relating to the acquisition of ASA. The intangible is being amortized over

fifteen years using the straight-line method.

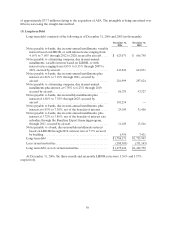

(3) Long-term Debt

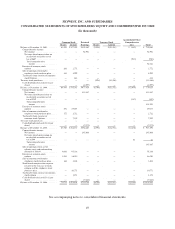

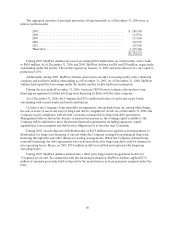

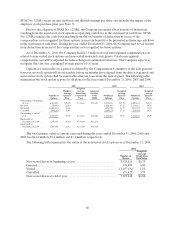

Long-term debt consisted of thefollowing as of December 31,2006 and 2005 (in thousands):

December 31,December 31,

2006 2005

Notespayable to banks, due in semi-annual installments,

v

ariable

interest basedonLIBOR, or with interest rates ranging from

4.16% to 7.18% through 2012to2020, secured by aircraft.....$623,071 $666,758

Notespayable to a financing company, due in semi-annual

installments, variable interest basedonLIBOR, or with

interest rates ranging from 4.83% to 8.33% through 2007 to

2021, securedby aircraft..................................643,826 643,831

Notespayable to banks, due in semi-annual installments plus

interestat 6.06% to 7.18% through 2021, secured by

aircraft................................................. 281,999 297,624

Notespayable to a financing company, due in semi-annual

installments plus interest at 5.78%to 6.23% through 2019,

secured by aircraft .......................................86,375 93,327

Notes payable to banks, due in monthly installments plus

interest of 6.86% to 7.38% through2025, secured by

aircraft................................................. 101,254 —

Notespayable to banks, due in semi-annual installments, plus

interest at 6.05% to 7.38%, net of the benefits of interest .....29,545 31,406

Notespayable to banks, due in semi-annual installments, plus

interest at 3.72% to 3.86%, net of the benefits of interest rate

subsidies through the Brazilian Export financing program,

through2011, secured by aircraft .......................... 11,10513,546

Notes payable to a bank, due in monthly installments interest

based on LIBOR through 2012, interest rate at 7.9% secured

by building..............................................6,956 7,411

Long-term debt ........................................... $1,784,131 $1,753,903

Less currentmaturities..................................... (108,505) (331,145)

Long-term debt,net of currentmaturities. .................... $1,675,626 $1,422,758

At December31, 2006, the three-month and six-month LIBOR rates were 5.36% and 5.37%,

respectively.