SkyWest Airlines 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

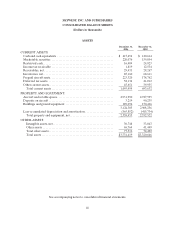

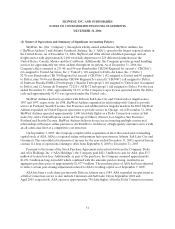

Basis of Presentation

The Company’sconsolidatedfinancial statements includethe accountsofSkyWest,Inc. andits

wholly-owned subsidiaries, SkyWest Airlines and ASA, with all inter-company transactions and balances

havingbeen eliminated.

Use of Estimates

Thepreparation of financial statements in conformity with accounting principals generally accepted in

theUnited States of America requires management to make estimatesand assumptions that affectthe

reported amounts of assets and liabilities and disclosureof contingent assets and liabilities at thedate of

the financial statements and thereported amounts of revenues and expenses duringthe reportingperiod.

Actual results could differ from those estimates.

Cash andCashEquivalents

TheCompany considers all highly liquid investments with an original maturity of three months or less

to be cash equivalents. The Company classified $16.4 million and $24.8 million of cash as restricted cash as

required by the Company’s workers’ compensation policy and includes $5.0 million in escrow from

purchaseof ASAand classified it accordingly in the consolidated balance sheets as of December 31, 2006

and 2005, respectively.

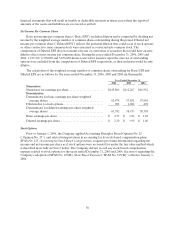

Marketable Securities

The Company’sinvestmentsinmarketabledebtand equity securities are deemed by management to

be available for sale and are reported at fair market value with thenetunrealized appreciation or

depreciation reported as acomponent of accumulated other comprehensive loss in stockholders’ equity. At

the time of sale,anyrealized appreciation or depreciation,calculated by the specific identificationmethod,

is recognized in gain (loss) on sale of marketable securities. The Company’s position in marketable

securities as of December 31, 2006 and 2005 wasas follows(inthousands):

2006 2005

Investment Types CostMarket ValueCost Market Value

Commercial paper......................$32,000 $ 32,000$—$—

Bond andbondfunds...................187,016184,769 155,192152,929

Assetbacked securities ..................3,3333,3076,167 6,125

222,349220,076 161,359159,054

Unrealized loss.........................(2,273)—(2,305)—

Total. .................................$220,076$220,076 $159,054$159,054

Marketable securities hadthefollowing maturities as of December 31, 2006 (in thousands):

Maturities Amount

Year 2007.................................................................$117,247

Years2008 through 2011 ....................................................603

Years2012 through 2016 ....................................................1,413

Thereafter .................................................................100,813

TheCompany hasclassified all marketable securities as short-term since it hasthe intentto maintain a

liquid portfolio and the ability to redeem the securities within one year.