Singapore Airlines 2013 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2013 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172

SINGAPORE AIRLINES

NOTES TO THE FINANCIAL STATEMENTS

36 Contingent Liabilities (in $ million) (continued)

(d) Australian Travel Agents’ Representative Actions

A former Australian travel agent, Leonie’s Travel Pty Limited, filed a representative action in the Federal Court of

Australia (New South Wales District Registry) on 15 December 2006 against 6 airlines, namely Qantas Airways Limited,

British Airways plc, Air New Zealand Limited, Malaysian Airline System Berhad, Cathay Pacific Airways Limited (“CX”)

and Singapore Airlines Limited, in a claim on behalf of Australian travel agents for alleged non-payment of commissions

on fuel surcharges applied to passenger tickets issued in Australia from May 2004 onwards (the “Leonie’s Case”).

In May 2007, the applicant’s solicitors filed a fresh similar representative application on behalf of Paxtours International

Travel Pty Ltd, another Australian travel agent, against CX and the Company, as Leonie’s Travel did not issue fares

against CX or the Company (the “Paxtours Case”).

On 19 August 2011, the Leonie’s Case was discontinued against the Company.

Following discussion with Paxtours’ solicitors, the parties have agreed on a settlement mechanism, which has been

approved by the court. The settlement amount paid by the Company was not material and the case is now concluded.

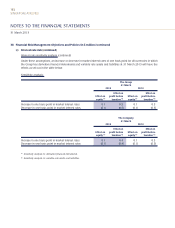

37 Financial Instruments (in $ million)

(a) Classification of financial instruments

Financial assets and financial liabilities are measured on an ongoing basis either at fair value or at amortised cost.

The principal accounting policies in Note 2 describe how the classes of financial instruments are measured, and how

revenue and expenses, including fair value gains and losses, are recognised.

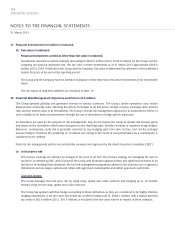

The following tables analyse the financial assets and liabilities in the statement of financial position by the class of

financial instrument to which they are assigned, and therefore by the measurement basis:

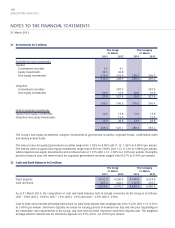

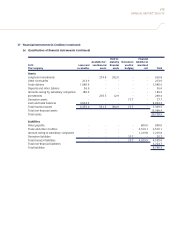

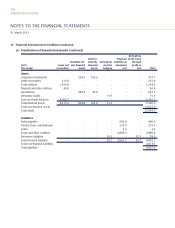

Derivatives

Held-to- Financial at fair value

Available-for- maturity Derivatives liabilities at through

2013 Loans and sale financial financial used for amortised profit or

The Group receivables assets assets hedging cost loss Total

Assets

Long-term investments - 354.9 352.0 - - - 706.9

Other receivables 213.9 - - - - - 213.9

Trade debtors 1,578.4 - - - - - 1,578.4

Deposits and other debtors 54.9 - - - - - 54.9

Investments - 336.5 12.9 - - - 349.4

Derivative assets - - - 79.1 - - 79.1

Cash and bank balances 5,059.6 - - - - - 5,059.6

Total financial assets 6,906.8 691.4 364.9 79.1 - - 8,042.2

Total non-financial assets 14,385.9

Total assets 22,428.1

Liabilities

Notes payable - - - - 800.0 - 800.0

Finance lease commitments - - - - 208.4 - 208.4

Loans - - - - 5.7 - 5.7

Trade and other creditors - - - - 3,201.1 - 3,201.1

Derivative liabilities - - - 31.9 - 41.3 73.2

Total financial liabilities - - - 31.9 4,215.2 41.3 4,288.4

Total non-financial liabilities 4,722.4

Total liabilities 9,010.8

31 March 2013