Singapore Airlines 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

148

SINGAPORE AIRLINES

NOTES TO THE FINANCIAL STATEMENTS

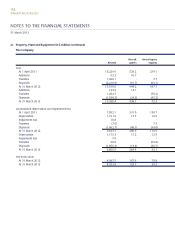

19 Long-Term Liabilities (in $ million)

The Group The Company

31 March 31 March

2013 2012 2013 2012

Notes payable

Non-current 800.0 800.0 800.0 800.0

Loans

Current 5.7 2.4 - -

Finance lease commitments

Current 67.8 64.8 - -

Non-current 140.6 210.6 - -

208.4 275.4 - -

Maintenance reserve

Current 4.3 - 4.3 -

Non-current 3.9 7.9 3.9 7.9

8.2 7.9 8.2 7.9

Total long-term liabilities 944.5 1,018.5 803.9 807.9

Notes payable

Notes payable at 31 March 2013 comprise unsecured notes and bonds issued by the Company.

$500 million fixed rate notes due 2020 (“Series 001 Notes”) bear fixed interest at 3.22% per annum and are repayable

on 9 July 2020. The fair value of notes payable amounted to $513.4 million as at 31 March 2013 (2012: $504.2 million)

for the Company.

$300 million bonds bear fixed interest at 2.15% per annum and are repayable on 30 September 2015. The fair value of

notes payable amounted to $306.8 million as at 31 March 2013 (2012: $301.3 million) for the Company.

Loans

The revolving credit facility denominated in USD taken by a subsidiary company is unsecured and bears a fixed interest at

2.30% (2011-12: 2.50%) per annum. The carrying amounts of the loans are reasonable approximation of their fair value

due to their short-term nature.

Finance lease commitments

SIA Cargo holds 4 B747-400 freighters under finance leases, which mature between 2014 and 2018, without any options

for renewal. 3 leases have options for SIA Cargo to purchase the aircraft at the end of the lease period of 12 years. The

fourth lease has an option for SIA Cargo to purchase the aircraft at the end of the 12th or 15th year of the lease period.

Sub-leasing is allowed under the lease agreements.

Interest rates on 3 of SIA Cargo’s finance lease commitments are charged at a margin above the London Interbank Offered

Rate (“LIBOR”). These ranged from 0.34% to 1.41% (2011-12: 0.28% to 1.14%) per annum. The interest rate on the fourth

finance lease commitment is fixed at 5.81% (2011-12: 5.81%) per annum. The net carrying amounts approximate the fair

value as the interest rate approximates the market rate.

31 March 2013