Sharp 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

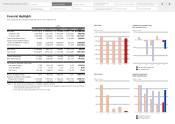

Fiscal 2014 in review

In fiscal 2014, ended March 31, 2015, the Japanese economy followed a moderate recovery path, as corpo-

rate earnings showed signs of improvement and personal consumption firmed overall. Despite indications of

slowdown in economic growth in China, overseas economies were generally solid, with stable growth in the

United States and ongoing signs of a turnaround in the Eurozone.

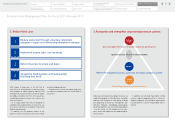

Amid these circumstances, the Sharp Group strove to create and strengthen sales of original products and

distinctive devices. Seeking to achieve “recovery and growth,” we also made concerted efforts to restructure

our business in Europe, reduce company-wide costs, and rigorously cut general expenses as outlined in our

Medium-Term Management Plan for Fiscal 2013 through 2015.

However, consolidated net sales for the year totaled ¥2,786.2 billion, down 4.8% from the previous year.

This was due mainly to declines in sales of LCD TVs and our energy solutions business, as well as falling prices

of small- and medium-size LCDs.

The Group posted an operating loss of ¥48.0 billion, compared with operating income of ¥108.5 billion

in fiscal 2013. This was due mainly to provision of a valuation reserve for inventory purchase commitments

on polysilicon materials used in solar panels and a write-down of LCD inventories. The Group also reported

an impairment loss of ¥104.0 billion on a solar cell plant in Sakai and on LCD plants, as well as restructuring

charges in Europe and other regions of ¥21.2 billion and a settlement of ¥14.3 billion on the solar cell busi-

ness in Europe. The result was a net loss of ¥222.3 billion, compared with net income of ¥11.5 billion in the

previous year.

For fiscal 2014, we passed a dividend, due to the net loss and a loss of retained earnings carried forward.

In fiscal 2015, as well, we do not plan to pay dividends in light of our financial status. We sincerely regret

this situation and request the understanding of all shareholders.

Message to our Shareholders

0

1,000

(billions of yen)

4,000

3,000

2,000

1413121110

Operating Income (Loss)/Net Income (Loss)

-600

-400

(billions of yen)

(FY)

(FY)

200

0

-200

10 11 12 13 14

Operating Income (Loss) Net Income (Loss)

Net Sales

4

Message to our Shareholders

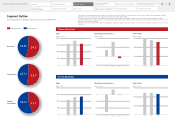

Segment Outline

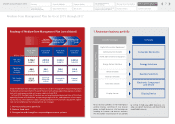

Medium-Term Management Plan

for Fiscal 2015 through 2017

Financial Section

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015