Sharp 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

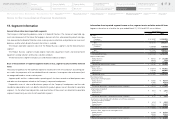

Notes to the Consolidated Financial Statements

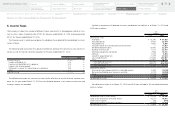

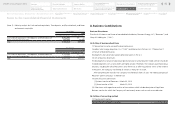

4. Income Taxes

The Company is subject to a number of different income taxes which, in the aggregate, indicate a statu-

tory tax rate in Japan of approximately 37.9% for the years ended March 31, 2014 and approximately

35.5% for the year ended March 31, 2015.

The Company and its wholly owned domestic subsidiaries have adopted the consolidated tax return

system of Japan.

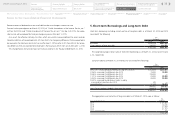

The following table summarizes the significant differences between the statutory tax rate and the ef-

fective tax rate for financial statement purposes for the year ended March 31, 2014:

The differences between the statutory tax rate and the effective tax rate for financial statement pur-

poses for the year ended March 31, 2015 are not disclosed because a loss before income taxes and

minority interests was recorded.

2014 2015

Statutory tax rate 37.9% —

Foreign withholding tax 13.6 —

Expenses not deductible for tax purposes 10.4 —

Income taxes for prior periods 15.7 —

Differences in normal tax rates of overseas subsidiaries (8.0) —

Other 2.1 —

Effective tax rate 71.7% —

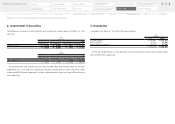

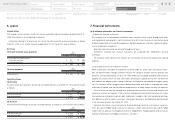

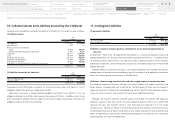

Significant components of deferred tax assets and deferred tax liabilities as of March 31, 2014 and

2015 were as follows:

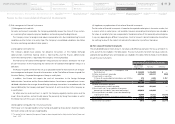

Net deferred tax assets as of March 31, 2014 and 2015 were included in the consolidated balance

sheets as follows:

Yen

(millions)

2014 2015

Deferred tax assets:

Inventories ¥ 42,240 ¥ 47,420

Accrued expenses 19,165 23,184

Accrued bonuses 9,635 3,950

Valuation reserve for inventory purchase commitments — 17,927

Net defined benefit liability 35,463 27,379

Buildings and structures 11,712 25,767

Machinery, equipment and vehicles 7,986 13,611

Software 9,183 4,494

Long-term prepaid expenses 21,319 21,624

Loss carried forward 278,536 291,067

Other 58,957 40,701

Gross deferred tax assets 494,196 517,124

Valuation allowance (448,022) (479,297)

Total deferred tax assets 46,174 37,827

Deferred tax liabilities:

Retained earnings appropriated for tax allowable reserves (2,342) (2,294)

Net unrealized holding gains (losses) on securities (3,770) (5,059)

Other (11,156) (3,205)

Total deferred tax liabilities (17,268) (10,558)

Net deferred tax assets ¥ 28,906 ¥ 27,269

Yen

(millions)

2014 2015

Deferred tax assets (Current Assets) ¥ 23,733 ¥ 16,576

Other assets (Investments and Other Assets) 16,173 18,961

Other current liabilities (96) (541)

Deferred tax liabilities (Long-term Liabilities) (10,904) (7,727)

Net deferred tax assets ¥ 28,906 ¥ 27,269

37

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

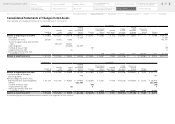

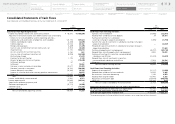

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

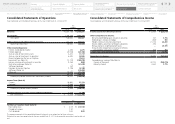

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

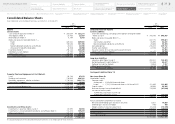

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary