Sharp 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

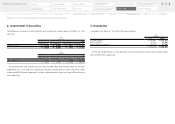

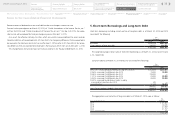

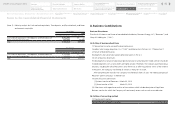

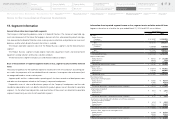

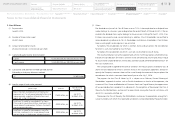

(2) Appropriate book value of the assets and liabilities transferred and its main items

(3) Accounting method

The difference between the amount received as a value of transferred business and the amount of

owner’s equity regarding the transferred business is recognized as profit or loss. This accounting

method assumes that the investment regarding the transferred business of development and sale of

solar power generation plants in the U.S. is liquidated.

(c) The name of reportable segment in which transferred business was included

Product Business segment

(d) Estimated amount of profit and loss regarding divested business, which was recorded in

consolidated financial results for the year ended March 31, 2015

Current assets ¥ 11,566 million

Noncurrent assets ¥ 25,411 million

Total assets ¥ 36,977 million

Current liabilities ¥ 3,936 million

Long-term liabilities ¥ 2,056 million

Total liabilities ¥ 5,992 million

Net sales ¥ 20,116 million

Operating loss ¥ 719 million

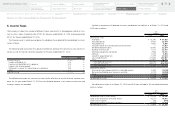

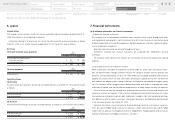

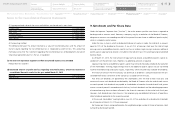

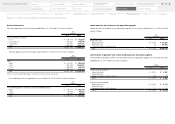

9. Net Assets and Per Share Data

Under the Japanese Corporate Law (“the Law”), the entire amount paid for new shares is required to

be designated as common stock. However, a company may, by a resolution of the Board of Directors,

designate an amount not exceeding one-half of the price of the new shares as additional paid-in capital,

which is included in capital surplus.

Under the Law, in cases in which a dividend distribution of surplus is made, the smaller of an amount

equal to 10% of the dividend or the excess, if any, of 25% of common stock over the total of legal

earnings reserve and additional paid-in capital must be set aside as legal earnings reserve or additional

paid-in capital. Legal earnings reserve is included in retained earnings in the accompanying consolidated

balance sheets.

As of March 31, 2015, the total amount of legal earnings reserve and additional paid-in capital ex-

ceeded 25% of the common stock, therefore, no additional provision is required.

Legal earnings reserve and additional paid-in capital may not be distributed as dividends. By resolution

of the shareholders’ meeting, legal earnings reserve and additional paid-in capital may be transferred

to other retained earnings and capital surplus, respectively, which are potentially available for dividends.

The maximum amount that the Company can distribute as dividends is calculated based on the non-

consolidated financial statements of the Company in accordance with the Law.

Year end cash dividends are approved by the shareholders after the end of each fiscal year, and

semiannual interim cash dividends are declared by the Board of Directors after the end of each interim

six-month period. Such dividends are payable to shareholders of record at the end of each fiscal year or

interim six-month period. In accordance with the Law, final cash dividends and the related appropriations

of retained earnings have not been reflected in the financial statements at the end of such fiscal year.

However, cash dividends per share shown in the accompanying consolidated statements of operations

reflect dividends applicable to the respective period.

At the annual shareholders’ meeting held on June 23, 2015 a resolution of no dividend to sharehold-

ers of record as of March 31, 2015 was approved.

Net income per share is computed based on the weighted average number of shares of common stock

outstanding during each period.

Notes to the Consolidated Financial Statements

43

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary