Sharp 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

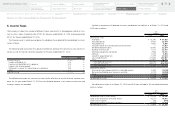

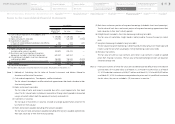

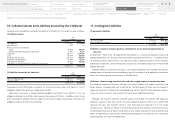

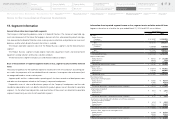

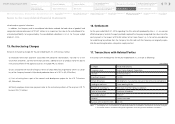

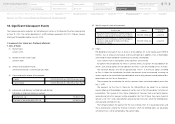

13. Segment Information

General information about reportable segments

The Company’s chief operating decision maker is its Board of Directors. The Company’s reportable seg-

ments are components of the Group that engage in business activities, whose operating results are regu-

larly reviewed by the Board of Directors when making resource allocation and performance assessment

decisions, and for which discrete financial information is available.

The Group’s reportable segments consist of the Product Business segment and the Device Business

segment.

The Product Business segment includes digital information equipment, health and environmental

equipment, energy solutions and business solutions products.

The Device Business segment includes LCDs and electronic devices products.

Basis of measurement of reported segment income or loss, segment assets and other material

items

The accounting policies for the reportable segments are consistent with the Company’s accounting poli-

cies used in the preparation of its consolidated financial statements. Intersegment sales and income (loss)

are recognized based on current market prices.

Segment profit and loss is determined as operating profit less basic research and development costs

and administrative expenses related to the Company’s corporate headquarters.

Depreciable assets of sales and distribution groups of the Company’s headquarters and the sales

subsidiaries depreciable assets not directly allocated to product groups are not allocated to reportable

segments. On the other hand, depreciation and amortization of these assets are allocated to reportable

segments based mainly on sales of each reportable segment.

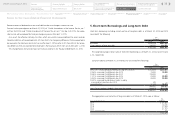

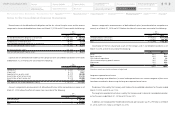

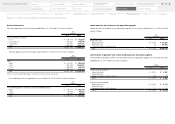

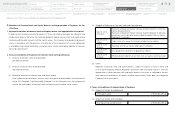

Information about reported segment income or loss, segment assets and other material items

Segment information as of and for the years ended March 31, 2014 and 2015 was as follows:

Yen (millions)

2014 2015

Net Sales:

Product Business:

Customers ¥ 1,818,097 ¥ 1,596,552

Intersegment 71 79

Total 1,818,168 1,596,631

Device Business:

Customers 1,109,089 1,189,704

Intersegment 208,378 158,870

Total 1,317,467 1,348,574

Eliminations (208,449) (158,949)

Consolidated Net Sales ¥ 2,927,186 ¥ 2,786,256

Segment Income (Loss):

Product Business ¥ 96,802 ¥ (12,295)

Device Business 44,853 1,270

Adjustments (33,095) (37,040)

Consolidated operating (loss) income ¥ 108,560 ¥ (48,065)

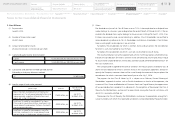

Segment Assets:

Product Business ¥ 839,474 ¥ 778,092

Device Business 726,209 698,006

Adjustments 615,997 485,811

Consolidated Assets ¥ 2,181,680 ¥ 1,961,909

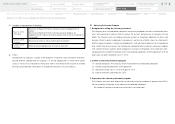

Other Material Items

Depreciation and Amortization:

Product Business ¥ 38,605 ¥ 49,739

Device Business 81,667 57,219

Adjustments 4,311 4,680

The amount presented in Consolidated Financial Statements ¥ 124,583 ¥ 111,638

Amortization of Goodwill:

Product Business ¥ 4,072 ¥ 2,542

Device Business — —

Adjustments 65 11

The amount presented in Consolidated Financial Statements ¥ 4,137 ¥ 2,553

Investments in Nonconsolidated Subsidiaries and Affiliates accounted

for using the equity methods:

Product Business ¥ 6,529 ¥ 4,286

Device Business 75,217 72,507

Adjustments 28,310 31,098

The amount presented in Consolidated Financial Statements ¥ 110,056 ¥ 107,891

Increase in Plant, Equipment and Intangible Assets:

Product Business ¥ 45,356 ¥ 52,797

Device Business 30,436 37,518

Adjustments 6,308 8,169

The amount presented in Consolidated Financial Statements ¥ 82,100 ¥ 98,484

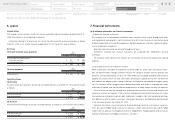

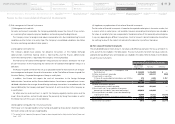

Notes to the Consolidated Financial Statements

47

Notes to the Consolidated

Financial Statements

Financial Section

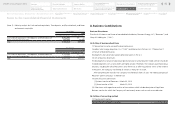

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary