Sharp 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

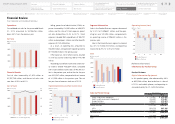

Financial Review

Sharp Corporation and Consolidated Subsidiaries

Operations

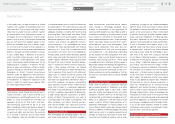

Consolidated net sales for the year ended March

31, 2015 amounted to ¥2,786,256 million,

down 4.8% from the previous year.

Financial Results

Cost of sales increased by ¥1,405 million to

¥2,397,749 million, and the cost of sales ratio

rose from 81.9% to 86.1%.

Selling, general and administrative (SG&A) ex-

penses increased by ¥14,290 million to ¥436,572

million, and the ratio of SG&A expenses against

net sales climbed from 14.4% to 15.7%. SG&A

expenses included R&D expenditures of ¥36,707

million and employees’ salaries and other benefits

expenses of ¥120,448 million.

As a result, an operating loss amounted to

¥48,065 million, compared with operating income

of ¥108,560 million in the previous year.

Other expenses, net of other income, resulted

in a net loss position and amounted to ¥140,769

million.

Accordingly, loss before income taxes and minor-

ity interests totaled ¥188,834 million, compared

with income before income taxes of ¥45,970 mil-

lion in the previous year, and net loss for the year

was ¥222,347 million, compared with net income

of ¥11,559 million in the previous year. The net

loss per share of common stock was ¥131.51.

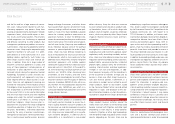

Segment Information

Sales in the Product Business segment decreased

by 12.2% to ¥1,596,631 million, and the oper-

ating loss was ¥12,295 million, compared with

an operating income of ¥96,802 million in the

previous year.

Sales in the Device Business segment increased

by 2.4% to ¥1,348,574 million, and operating

income fell by 97.2% to ¥1,270 million.

[Reference Information]

Information by Product Group

Product Business

Digital Information Equipment

In this product group, sales decreased by 8.6%

to ¥670,388 million, due to declines in sales of

LCD TVs and mobile phones, and operating in-

come declined by 76.2% to ¥3,054 million.

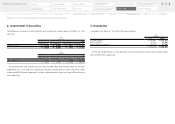

Net Sales

(billions of yen)

151411 12 13

3,000

2,000

1,000

0

4,000

Sales

(billions of yen)

2,000

1,500

1,000

500

0

2,500

151411 12 13

Product Business

Device Business

Operating Income (Loss)

(billions of yen)

-50

-100

-150

-200

100

50

0

151411 12 13

Product Business

Device Business

Cost of Sales

(billions of yen) (%)

2,000

1,000

0

3,000

60

30

0

90

151411 12 13

Ratio to net sales [right axis]

Operating Income (Loss)/Net Income (Loss)

(billions of yen)

0

100

-100

-200

-300

-400

-500

-600

200

151411 12 13

Operating income (loss)

Net income (loss)

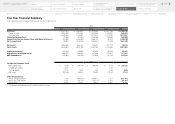

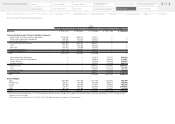

Sales by Product Group Yen (millions)

2014 2015

Digital Information Equipment ¥ 733,361 ¥ 670,388

Health and Environmental Equipment 326,890 315,037

Energy Solutions 439,040 270,874

Business Solutions 318,877 340,332

Product Business 1,818,168 1,596,631

LCDs 991,074 907,105

Electronic Devices 326,393 441,469

Device Business 1,317,467 1,348,574

Adjustments (208,449) (158,949)

Total 2,927,186 2,786,256

26

Financial Review

Financial Section

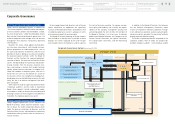

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

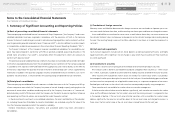

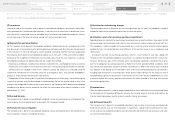

Notes to the Consolidated

Financial Statements

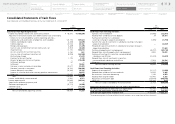

Consolidated Statements of

Cash Flows

Consolidated Statements of

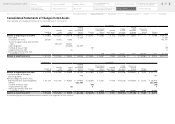

Changes in Net Assets

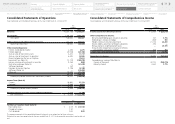

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

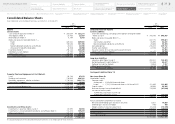

Consolidated Balance Sheets

Five-Year Financial Summary