Sharp 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

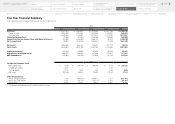

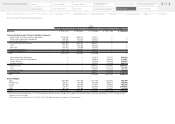

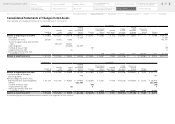

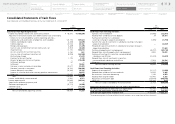

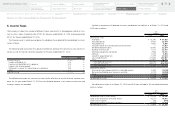

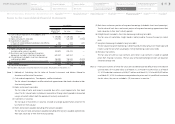

Consolidated Statements of Cash Flows

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2014 and 2015

Yen

(millions)

2014 2015

Cash Flows from Operating Activities:

Income (loss) before income taxes and minority interests ¥ 45,970 ¥ (188,834)

Adjustments to reconcile income (loss) before income taxes and minority

interests to net cash provided by (used in) operating activities—

Depreciation and amortization of properties and intangibles 123,776 109,324

Interest and dividends income (2,388) (2,870)

Interest expenses 20,726 23,182

Foreign exchange gains (1,469) (1,479)

Gain on sales and retirement of noncurrent assets, net (1,851) (8,324)

Impairment loss 11,770 104,015

Loss on valuation of investment securities 2,162 622

Gain on sales of investment securities, net (5,976) (22,532)

Restructuring charges — 21,239

Provision for loss on litigation 1,135 2,140

Reversal of provision for loss on litigation — (19,234)

Settlement package 67 —

Settlement — 14,382

Decrease in notes and accounts receivable 25,577 33,409

Decrease (increase) in inventories 26,700 (30,858)

Increase (decrease) in payables (15,840) 19,136

Increase in valuation reserve for inventory purchase commitments — 54,655

Other, net 20,491 (17,944)

Total 250,850 90,029

Interest and dividends income received 2,981 4,371

Interest expenses paid (20,845) (23,221)

Special extra retirement payments paid (201) —

Settlement package paid (13,712) (2,585)

Settlement paid — (13,202)

Income taxes paid (20,089) (38,053)

Net cash provided by operating activities 198,984 17,339

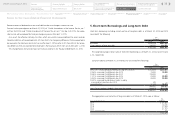

Yen

(millions)

2014 2015

Cash Flows from Investing Activities:

Payments into time deposits (20,986) (22,961)

Proceeds from withdrawal of time deposits 34 20,161

Purchase of investments in subsidiaries

resulting in change in scope of consolidation (1,898) (1,794)

Payments for sales of investments in subsidiaries resulting in change in

scope of consolidation — (2,437)

Proceeds for sales of investments in subsidiaries resulting in change in

scope of consolidation — 17,633

Purchase of property, plant and equipment (45,707) (49,710)

Proceeds from sales of property, plant and equipment 8,920 18,072

Purchase of investments in securities, nonconsolidated

subsidiaries and affiliates (25,328) (2,429)

Proceeds from sales of investments in securities,

nonconsolidated subsidiaries and affiliates 17,508 30,326

Other, net (17,483) (22,904)

Net cash used in investing activities (84,940) (16,043)

Cash Flows from Financing Activities:

Deposits of restricted cash (25,117) (1,999)

Proceeds from withdrawal of restricted cash 20,970 3,442

Net increase in short-term borrowings 2,190 6,453

Proceeds from long-term debt 182,442 5,282

Repayments of long-term debt (289,479) (148,646)

Other, net 141,747 (622)

Net cash (used in) provided by financing activities 32,753 (136,090)

Effect of Exchange Rate Change on Cash and Cash Equivalents 15,971 16,371

Net (Decrease) Increase in Cash and Cash Equivalents 162,768 (118,423)

Cash and Cash Equivalents at Beginning of Year 187,866 350,634

Cash and Cash Equivalents at End of Year ¥ 350,634 ¥ 232,211

The accompanying notes to the consolidated financial statements are an integral part of these statements.

32

Consolidated Statements of

Cash Flows

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

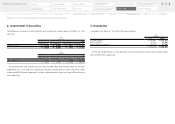

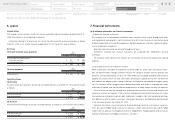

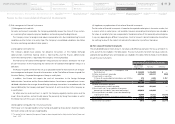

Notes to the Consolidated

Financial Statements

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

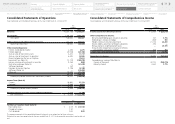

Comprehensive Income

Consolidated Statements of

Operations

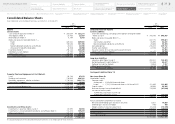

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary