Sharp 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

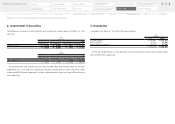

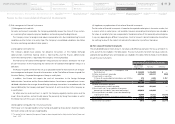

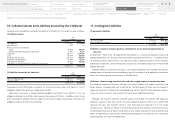

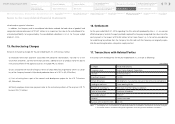

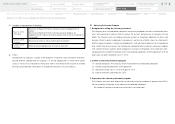

Reconciliations of the defined benefit obligation and the fair value of the plan assets and the amount

recognized in the consolidated balance sheets as of March 31, 2014 and 2015 consisted of the following:

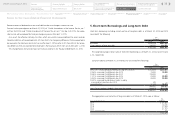

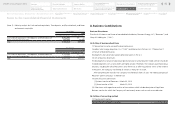

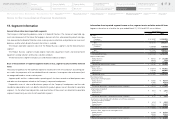

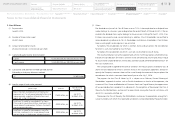

Amounts recognized in remeasurements of defined benefit plans (accumulated other comprehensive

income) as of March 31, 2014 and 2015 before the effect of income taxes consisted of the following:

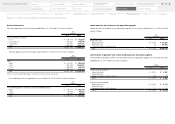

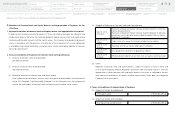

Classification of the fair value of plan assets of the Company and its consolidated subsidiaries as of

March 31, 2014 and 2015 consisted of the following:

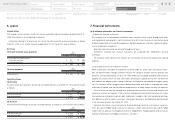

Long-term expected rate of return

Current and target asset allocations, historical and expected returns on various categories of plan assets

have been considered in determining the long-term expected rate of return.

The discount rate used by the Company and its domestic consolidated subsidiaries for the years ended

March 31, 2014 and 2015 was 1.5%.

The Long-term expected rate of return used by the Company and its domestic consolidated subsidiar-

ies for the years ended March 31, 2014 and 2015 was 3.0%.

In addition, cost recognized for the defined contribution pension plans was ¥1,279 million as of March

31, 2014 and ¥1,131 million as of March 31, 2015.

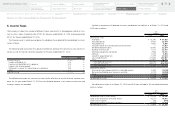

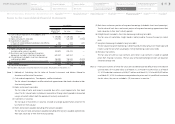

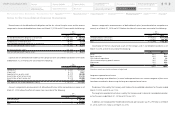

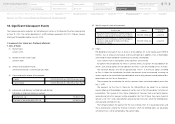

Expenses for net defined benefit liability of the Company and its consolidated subsidiaries for the years

ended March 31, 2014 and 2015 consisted of the following:

Amounts recognized in remeasurements of defined benefit plans (other comprehensive income) as of

March 31, 2015 before the effect of income taxes consisted of the following:

Yen

(millions)

2014 2015

Funded defined benefit obligation at end of year ¥ 370,832 ¥ 383,728

Fair value of plan assets at end of year (274,341) (304,574)

Funded status at the end of year 96,491 79,154

Unfunded defined benefit obligation at end of year 4,892 6,123

Total net defined benefit liability (asset) ¥ 101,383 ¥ 85,277

Net defined benefit liability 101,383 85,277

Total net defined benefit liability (asset) ¥ 101,383 ¥ 85,277

Yen

(millions)

2014 2015

Service cost ¥ 12,489 ¥ 11,979

Interest cost 6,712 7,027

Expected return on plan assets (8,107) (8,938)

Amortization of net actuarial loss 17,810 21,818

Amortization of past service cost (3,512) (4,553)

Other (17) 153

Total expenses for net defined benefit liability ¥ 25,375 ¥ 27,486

Yen

(millions)

2014 2015

Past service cost — ¥ (4,519)

Net actuarial gain — 31,604

Total — ¥ 27,085

Yen

(millions)

2014 2015

Unrecognized past service cost ¥ (16,502) ¥ (11,983)

Unrecognized net actuarial loss 131,951 100,346

Total ¥ 115,449 ¥ 88,363

2014 2015

Bonds 35% 31%

Equity securities 23% 26%

Cash and cash equivalents 9% 1%

Life insurance company general accounts 18% 17%

Alternatives 13% 23%

Other 2% 2%

Total 100% 100%

Notes to the Consolidated Financial Statements

Alternatives mainly consisted of investment in hedge funds.

46

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary