Sharp 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

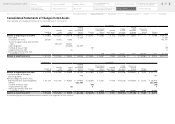

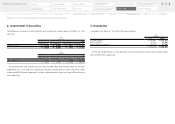

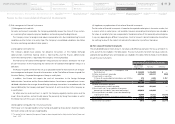

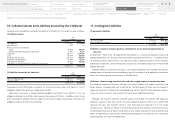

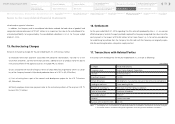

*Net receivables and payables arising from derivative transactions. Net payables are indicated by “( )”.

Yen (millions)

2014

Consolidated

Balance Sheet

Amount

Fair Value Difference

(1) Cash and cash equivalents, Time deposits, and

Restricted cash ¥ 379,596 ¥ 379,596 ¥ —

(2) Notes and accounts receivable 574,702 572,769 (1,933)

(3) Investments in securities

1) Shares of nonconsolidated subsidiaries and affiliates

382 610 228

2) Other securities 36,449 36,449 —

Total Assets 991,129 989,424 (1,705)

(4) Notes and accounts payable

(excluding other accounts payable) 374,470 374,470 —

(5) Bank loans and Current portion of long-term

borrowings (included in short-term borrowings) 681,557 681,557 —

(6) Straight bonds (included in short-term borrowings

and long-term debt) 160,340 154,520 (5,820)

(7) Long-term borrowings (included in long-term debt) 229,479 231,671 2,192

Total Liabilities 1,445,846 1,442,218 (3,628)

(8) Derivative transactions* 310 (63) (373)

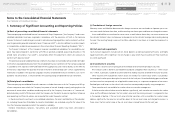

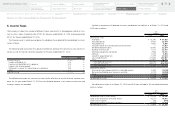

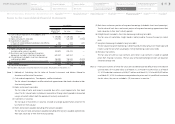

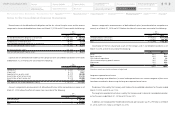

(Note 1) Methods of Calculating the Fair Value of Financial Instruments and Matters Related to

Securities and Derivative Transactions

(1) Cash and cash equivalents, Time deposits, and Restricted cash

The fair value of time deposits and Restricted cash approximates their book value due to their

short maturity periods.

(2) Notes and accounts receivable

The fair value of notes and accounts receivable due within a year approximates their book

value. The fair value of notes and accounts receivable with long maturity periods is discounted

using a rate which reflects both the period until maturity and credit risk.

(3) Investments in securities

The fair value of investments in securities is based on average quoted market prices for the

last month of the fiscal year.

(4) Notes and accounts payable (excluding other accounts payable)

The fair value of notes and accounts payable (excluding other accounts payable) approximates

their book value due to their short maturity periods.

(5) Bank loans and current portion of long-term borrowings (included in short-term borrowings)

The fair value of bank loans and current portion of long-term borrowings approximates their

book value due to their short maturity periods.

(6) Straight bonds (included in short-term borrowings and long-term debt)

The fair value of marketable straight bonds is determined by the over-the-counter market

price.

(7) Long-term borrowings (included in long-term debt)

The fair value of long-term borrowings is determined by the total amount of the principal and

interest using the rate which would apply if similar borrowings were newly made.

(8) Derivative transactions

The fair value of currency swap contracts and interest swap contracts is based on quoted

prices from financial institutions. The fair value of forward exchange contracts are based on

forward exchange rate.

(Note 2) Financial instruments of which fair values are considered to be too difficult to be estimated are

unlisted stocks of ¥110,308 million as of March 31, 2014 and ¥110,240 million as of March

31, 2015 and other investments of ¥26,871 million as of March 31, 2014 and ¥25,633 million

as of March 31, 2015. Since there are no quoted market prices and it is too difficult to estimate

the fair values, they are not included in “(3) Investments in securities.”

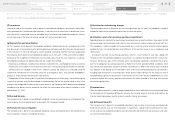

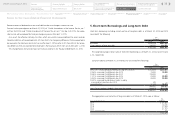

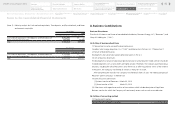

Notes to the Consolidated Financial Statements

41

Notes to the Consolidated

Financial Statements

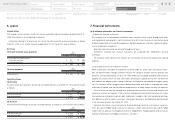

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

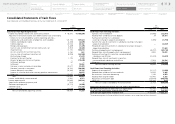

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary