Sharp 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

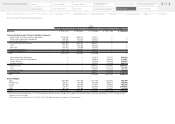

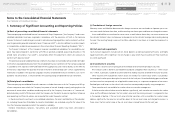

Notes to the Consolidated Financial Statements

(f) Inventories

Inventories held by the Company and its domestic consolidated subsidiaries are primarily measured at

moving average cost. For balance sheet valuation, in the event that an impairment is determined, inven-

tory impairment is computed using net realizable value. For overseas consolidated subsidiaries, invento-

ries are measured at the lower of moving average cost and net realizable value.

(g) Depreciation and amortization

For the Company and its domestic consolidated subsidiaries, depreciation of plant and equipment other

than lease assets is computed using the declining-balance method, except for machinery and equipment

at the LCD plants in Mie and Kameyama and the buildings (excluding attached structures) acquired by

the Company and its domestic consolidated subsidiaries on or after April 1, 1998; all of which are depre-

ciated using the straight-line method over the estimated useful life of the asset. Properties at overseas

consolidated subsidiaries are depreciated using the straight-line method.

Maintenance and repairs, including minor renewals and betterments, are charged to income as incurred.

Amortization of intangible assets except for lease assets is computed using the straight-line method.

Software costs are included in other assets. Software used by the Company is amortized using the

straight-line method over the estimated useful life of principally 5 years, and software embedded in

products is amortized over the forecasted sales quantity.

Depreciation of lease assets under finance leases that do not transfer ownership is computed using the

straight-line method, using the lease period as the depreciable life and the residual value as zero. Lease

payments are recognized as expenses for finance leases of the Company and its domestic consolidated

subsidiaries that do not transfer ownership for which the starting date of the lease transaction is on or

before March 31, 2008.

(h) Accrued bonuses

The Company and its domestic consolidated subsidiaries accrue estimated amounts of employees’ bo-

nuses based on the estimated amounts to be paid in the subsequent period.

(i) Provision for loss on litigation

The Company and its domestic consolidated subsidiaries accrue estimated amounts for possible future

loss on litigation in amounts considered necessary.

(j) Provision for restructuring charges

The estimated amounts of allowance for restructuring charges are set aside. This procedure is made to

provide for expenses for possible future loss due to structural reform.

(k) Valuation reserve for inventory purchase commitments

Regarding long-term contracts for purchasing raw materials over a long time frame, the amounts of dif-

ference between contracted price and current market price are set aside as allowance for contract loss.

This procedure is made to provide for future possible loss in case the market price of materials decline

significantly from the contracted price and fulfillment of the contract causes a loss in production and

sale business.

A long-term contract for purchasing polysilicon, which is a raw material of solar cells, obliges the

Company and its consolidated subsidiaries to purchase it at a significantly higher price than current mar-

ket price. The business plan of the Company and its consolidated subsidiaries is based on the assump-

tion that its obligation to purchase polysilicon at higher than market price be fulfilled. In addition, there

was intense price competition caused by overseas manufacturers, a drop in the price of solar panels due

to a decrease in the buying rate of the feed-in tariff system and a deteriorated business environment,

including large fluctuations in exchange rates. These factors made it difficult for the Company and its

consolidated subsidiaries to secure profit. In connection with this, from the year ended March 31, 2015,

a valuation reserve for inventory purchase commitments has been recorded as for a long-term contract

for purchasing polysilicon.

(l) Income taxes

The asset-liability approach is used to recognize deferred tax assets and liabilities for the expected future

tax consequences of temporary differences between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for income tax purposes.

(m) Retirement benefits

The Company and its domestic consolidated subsidiaries have primarily a trustee non-contributory de-

fined benefit pension plan for their employees to supplement a governmental welfare pension plan.

Certain overseas consolidated subsidiaries primarily have defined contribution pension plans and lump-

sum retirement benefit plans.

34

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

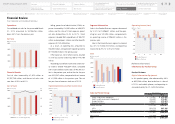

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

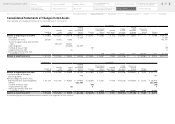

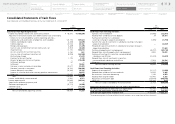

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

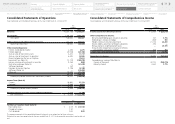

Comprehensive Income

Consolidated Statements of

Operations

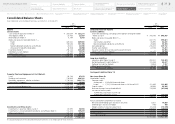

Consolidated Balance Sheets

Financial Review

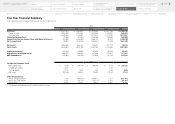

Five-Year Financial Summary