Sharp 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

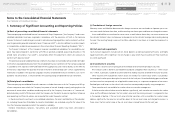

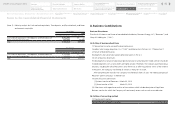

Notes to the Consolidated Financial Statements

(3) Risk management of financial instruments

[1] Management of credit risk

For notes and accounts receivable, the Company periodically reviews the status of its key custom-

ers, monitoring their respective payment deadlines and remaining outstanding balances.

The Company strives to recognize and reduce irrecoverable risks, due to deteriorating financial

conditions or other factors at an early stage. The Company’s consolidated subsidiaries also follow

the same monitoring and administration process.

[2] Management of market risk

The Company decides basic policies for derivative transactions at the Foreign Exchange

Administration Committee meeting which is held monthly and the Finance Administration

Committee meeting which is required by the Company’s internal procedure.

The Finance Unit of Corporate Management Group executes transactions and reports the result

of such transactions to the Accounting and Control Unit of Corporate Management Group on a

daily basis.

The Accounting and Control Unit has set up a specialized section for transaction results and posi-

tion management and reports the result of transactions to the Chief officer of Accounting and Cost

Structural Reform, Corporate Management Group on a daily basis.

In addition, the Finance Unit reports the result of transactions to the Foreign Exchange

Administration Committee and the Finance Administration Committee on a periodic basis. Its con-

solidated subsidiaries also manage forward foreign exchange transactions in accordance with the

rules established by the Company and report the content of such transactions to the Company on

a monthly basis.

For other securities and investments in capital, the Company regularly monitors prices and the

issuer’s financial position, and continually reviews the possession by taking these indices as well as

the relationship with the issuers into consideration.

[3] Management of liquidity risk in financing activities

The Finance Unit manages liquidity risk by making and updating financial plans based on reports

from each section and maintains ready liquidity.

(4) Supplementary explanation of fair value of financial instruments

The fair value of financial instruments is based on the quoted market price in the active market, but

in cases in which a market price is not available, however, reasonably estimated prices are included in

fair value. As variable factors are incorporated in the determination of this reasonably estimated price,

it may vary depending on different assumptions. Contract amounts related to derivative transactions

has nothing to do with the market risk related to the derivative transactions themselves.

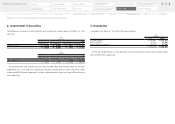

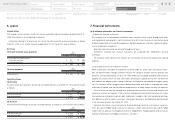

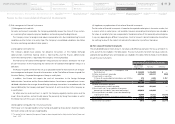

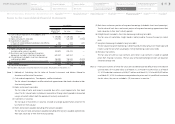

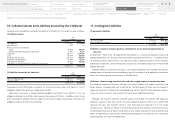

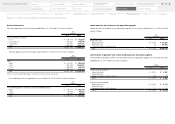

(b) Fair values of financial instruments

The consolidated balance sheet amounts, fair values and differences between the two as of March 31,

2014 and 2015 are included in the tables below. Financial instruments for which fair values were con-

sidered to be too difficult to be estimated are not included in the tables. Refer to (Note 2) for the details

of such financial instruments.

(*) The control Unit of Corporate Management Group has been changed into the Administrative Control Group as of

June 1, 2015

Yen (millions)

2015

Consolidated

Balance Sheet

Amount

Fair Value Difference

(1) Cash and cash equivalents, Time deposits, and

Restricted cash ¥ 258,493 ¥ 258,493 ¥ —

(2) Notes and accounts receivable 609,725 608,741 (984)

(3) Investments in securities

1) Shares of nonconsolidated subsidiaries and affiliates

475 2,632 2,157

2) Other securities 31,447 31,447 —

Total Assets 900,140 901,313 1,173

(4) Notes and accounts payable

(excluding other accounts payable) 423,883 423,883 —

(5) Bank loans and Current portion of long-term

borrowings (included in short-term borrowings) 840,026 840,026 —

(6) Straight bonds (included in short-term borrowings

and long-term debt) 60,000 53,122 (6,878)

(7) Long-term borrowings (included in long-term debt) 53,470 55,144 1,674

Total Liabilities 1,377,379 1,372,175 (5,204)

(8) Derivative transactions* 4,018 1,404 (2,614)

40

Notes to the Consolidated

Financial Statements

Financial Section

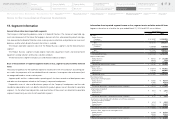

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

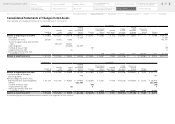

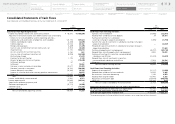

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

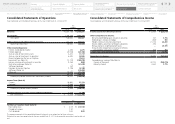

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary