Sharp 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

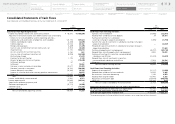

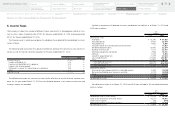

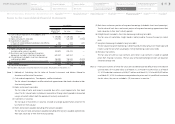

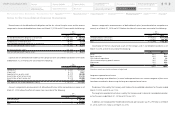

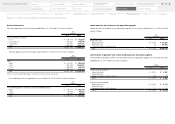

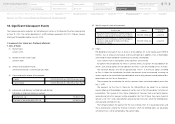

Yen (millions)

2015

Due in one year or less Due after one year

Cash and cash equivalents, Time deposits, and Restricted cash ¥ 258,493 ¥ —

Notes and accounts receivable 582,335 27,390

Total ¥ 840,828 ¥ 27,390

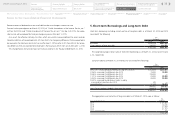

Yen (millions)

2014

Due in one year or less Due after one year

Cash and cash equivalents, Time deposits, and Restricted cash ¥ 379,596 ¥ —

Notes and accounts receivable 542,630 32,072

Total ¥ 922,226 ¥ 32,072

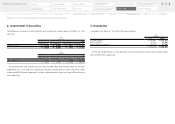

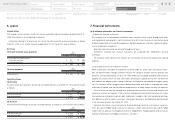

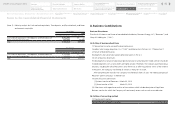

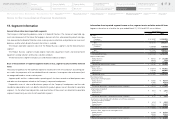

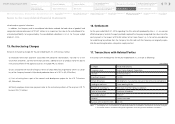

8. Business Combinations

Business Divestitures

Transfer of all interests and shares of consolidated subsidiaries, Recurrent Energy, LLC (“Recurrent”) and

Sharp US Holding Inc. (“SUH”)

(a) Outline of business divestitures

(1) Name of parties who succeed the divested business

Canadian Solar Energy Acquisition Co. (“CSEA”) and Momentum Partners, LLC (“Momentum”)

(2) Nature of divested business

Development and sale of solar power generation plants in the U.S.

(3) Aim of business divestitures

The development and sale of solar power generation plants run by Recurrent needs sufficient funds for

initial development costs, and its profits are highly variable. Therefore, the Company examined various

solutions, including the sale of Recurrent. Since there was an offer to purchase 100% of the interests

in Recurrent, the Company transferred all interests in Recurrent to CSEA.

After completing the transfer, the Company transferred all shares of SUH, the holding company of

Recurrent (parent company), to Momentum.

(4) Date of business divestitures

[1] Interest transfer of Recurrent March 30, 2015

[2] Share transfer of SUH March 30, 2015

(5) Other items with regard to an outline of transactions which include description of legal form

Business transfer for which the Company will receive only assets such as cash as consideration

(b) Outline of accounting method

(1) Transfer profit and loss

Gain on sales of investment in securities ¥ 11,006 million

Notes to the Consolidated Financial Statements

(Note 3) Maturity analysis for Cash and cash equivalents, Time deposits, and Restricted cash, and Notes

and accounts receivable.

42

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary