Sharp 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the supply chain, or legal restrictions, or limited

suppliers with capability of providing certain ma-

terial provisions. Due to these and other factors,

Sharp may be unable to access sufficient supplies

of materials/parts from procurement sources, or

the quality of such materials/parts may be inade-

quate. In such an event, Sharp may be forced to do

business with alternative suppliers subject to con-

ditions less favorable than with its current suppli-

ers, or Sharp may be unable to find a supplier in a

timely manner. Any of these factors could lead to a

decline in the quality of Sharp’s products, increases

in costs, and/or delays in deliveries to customers,

which may affect Sharp’s business results and fi-

nancial position. Under agreements with certain

clients, Sharp receives advanced payments for the

trading value of its products. At present, the obli-

gation to repay such advances is offset by Sharp’s

accounts receivable in connection with said clients.

Depending on Sharp’s financial circumstances,

however, under the agreements with said clients,

Sharp may be requested to repay a major portion

of the advances. If a request for repayment of ad-

vances is made, this could have a negative effect

on Sharp’s operating cash flows.

(7) Other Factors Affected by Financial Position

Sharp procures funds through borrowings from fi-

nancial institutions, such as banks and life insur-

ance companies, and through bond issues. As of

March 31, 2015, the balance of such debt was

equivalent to 48.6% of total assets, and short-

term borrowings accounted for 88.1% of such

debt. Accordingly, Sharp might become subject to

restrictions on how it uses its cash flows in order

to repay such debt, and also faces the possibility

of an increase in expenses due to rising interest

rates. Moreover, Sharp has possibility of increases

in fund procurement costs as well as limitations on

fund procurement. This may be because necessary

funds cannot be obtained at the required time with

adequate conditions, including for the refinancing

of existing debt. These factors may affect Sharp’s

business results and financial position. Sharp has

borrowing agreements with multiple financial in-

stitutions, and some of the agreements entail fi-

nancial covenants. If its consolidated net assets

fall below the levels specified under such financial

covenants, or if Sharp fails to undertake faithful

consultations in the event that its consolidated op-

erating income and net income fall below specified

levels, Sharp may forfeit the benefit of time at the

lender’s request. Moreover, Sharp may also forfeit

the benefit of time on bonds and other borrow-

ings if it violates the relevant financial covenants.

Sharp’s major lending institutions are Mizuho

Bank, Ltd. and The Bank of Tokyo-Mitsubishi UFJ,

Ltd. As necessary, Sharp consults with both banks

about ways to improve its financial position and

other matters. In June 2013, one of member of

each bank was appointed as a director of Sharp. In

June 2015, moreover, two persons nominated by

Japan Industrial Solutions Fund I—which will pur-

chase Class B Shares in a subscription agreement

with Sharp—have been elected as outside directors

of Sharp. In addition, dependence on borrowings,

a credit ratings reduction caused by it, or deteri-

oration of Sharp’s financial position may work to

its disadvantage with respect to competition with

other companies with robust financial positions,

and contract-related issues could also arise be-

tween Sharp and its lenders or business partners.

(8) Technological Innovation

New technologies are emerging rapidly in the mar-

kets where Sharp operates. Resultant changes in

social infrastructure, intensified market compe-

tition, changes in technology standards, obso-

lescence of technologies, or the appearance of

substitute technologies may make Sharp unable to

introduce new products in a timely manner, or lead

to an increase in inventories, or the inability to re-

cover product development costs. These and other

factors may impact Sharp’s business results and fi-

nancial position. Apart from technologies, Sharp

faces intense competition from price and mar-

keting perspectives as well, and winning against

such competition is not guaranteed. Depending

on the outcome of fierce competition with other

companies, Sharp may be forced to downsize or

withdraw from existing businesses, which could

incur additional costs. Moreover, Sharp engages in

R&D under collaborative development agreements

with other companies, and it is possible that such

relationships cannot be maintained, or that satis-

factory outcomes cannot be produced, or that ter-

mination of such relationships cannot be handled

smoothly.

(9) Intellectual Property Rights

Sharp strives to protect its proprietary technolo-

gies by acquiring patents, trademarks, and other

intellectual property rights in Japan and in other

countries, and by concluding contracts with other

companies. However, there is a risk that rights may

not be granted, or a third party may demand invali-

dation of an application, such that Sharp may be

unable to obtain sufficient legal protection of its

proprietary technologies, or may be unable to re-

ceive sufficient royalty income from the granting of

licenses. In addition, intellectual property that Sharp

holds may not result in a superior competitive ad-

vantage, or Sharp may not be able to make effec-

tive use of such intellectual property, such as when

a third party infringes on the intellectual property

rights of Sharp. There may also be instances where

the period of a license received from a third party

expires, or for some reason or other, is terminated,

or where a third party launches litigation against

Sharp, claiming infringement of intellectual prop-

erty rights. Resolution of such cases may place a

significant financial burden on Sharp. Furthermore,

if such a third-party claim against Sharp is rec-

ognized, Sharp may have to pay a large amount

of compensation, and may incur further damage

by having to cease using the technology in ques-

tion. Also, in the event that a company licensed

to use Sharp’s intellectual property is acquired by

a third party, the third party, previously unlicensed

to use Sharp’s intellectual property, may acquire

such license, with the result that Sharp’s intellec-

tual property may lose its superiority. Alternatively,

the formation of an alliance with said third party

could result in Sharp’s business becoming subject

to new restrictions to which it had not previously

been subject, the resolution of which may require

Sharp to pay additional compensation. Moreover,

the formation of such an alliance could result in

claims for infringement of an existing licensing

agreement with another third party, placing pres-

sure on Sharp to cancel said alliance. Furthermore,

although compensation is given to employees for

innovations that they make in the course of their

work pursuant to a patent reward system governed

by internal regulations, an employee may consider

such payment inadequate and initiate legal action.

If any of the above problems related to intellec-

tual property were to occur, it could impact Sharp’s

business results and financial position.

(10) Long-Term Investments and Agreements

Sharp actively invests in manufacturing equipment

Risk Factors

19

Risk Factors

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Financial Section

Investor Information

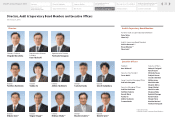

Directors, Audit & Supervisory Board

Members and Executive Officers

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015