Sharp 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

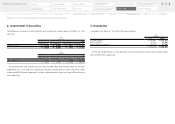

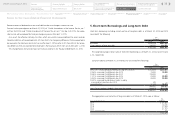

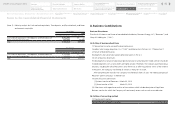

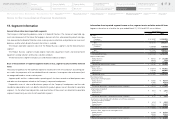

6. Leases

Finance leases

With regards to finance leases that do not transfer ownership and commenced on or before March 31,

2008, lease payments are recognized as expenses.

Information relating to finance leases that do not transfer ownership and commenced on or before

March 31, 2008, as of, and for the years ended March 31, 2014 and 2015 were as follows:

As lessee

(1) Future minimum lease payments Yen

(millions)

2014 2015

Future minimum lease payments:

Due within one year ¥ 331 ¥ 80

Due after one year 103 23

¥ 434 ¥ 103

(2) Lease payments Yen

(millions)

2014 2015

Lease payments ¥ 1,540 ¥ 331

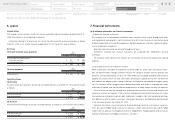

Operating leases

(a) As lessee

Future minimum lease payments for only non-cancelable contracts as of March 31, 2014 and 2015 were

as follows: Yen

(millions)

2014 2015

Due within one year ¥ 3,657 ¥ 4,088

Due after one year 8,361 10,112

¥ 12,018 ¥ 14,200

(b) As lessor

Future minimum lease receipts for only non-cancelable contracts as of March 31, 2014 and 2015 were as follows:

Yen

(millions)

2014 2015

Due within one year ¥ 2,044 ¥ 1,579

Due after one year 2,963 1,831

¥ 5,007 ¥ 3,410

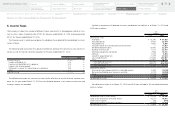

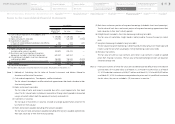

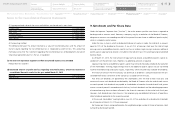

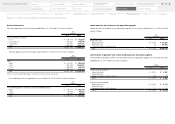

7. Financial Instruments

(a) Qualitative information on financial instruments

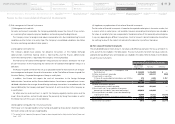

(1) Policies for financial instruments

The Company and its consolidated subsidiaries obtain necessary funds mainly through bank loans

and issuing bonds according to its capital investment plan for its main business of manufacturing and

distributing electronic communication equipment, electronic equipment, electronic application equip-

ment and electronic components.

Short-term operating funds are obtained through bank loans.

Transactions involving such financial instruments are conducted with creditworthy financial

institutions.

The Company utilizes derivative transactions for minimizing risk and not for speculative or dealing

purposes.

(2) Description and risks of financial instruments

Notes and accounts receivable are exposed to customer credit risk. Some notes and accounts receiv-

able are denominated in foreign currencies because the Company conducts business globally and,

therefore, are exposed to foreign currency risk. Notes and accounts payable (excluding other accounts

payable) are payable within one year. Some notes and accounts payable arising from the import of

raw materials are denominated in foreign currencies and therefore are exposed to foreign currency

risk. The Company offsets foreign currency denominated notes and accounts receivable with notes

and accounts payable, and uses forward exchange contracts to hedge foreign currency risk exposure.

Other securities are held for the long term to develop better business alliances and relations with

Company customers and suppliers. Other securities are exposed to market price fluctuation risk. Long-

term borrowings (included in long-term debt) and bonds (included in short-term borrowings and long-

term debt) are mainly for capital investments. The longest repayments and redemption date for bonds

is five and a quarter years from March 31, 2015.

Derivative transactions consist primarily of forward exchange contracts, and currency swap con-

tracts are used to hedge foreign currency risk exposure. Interest swap contracts are used to hedge

interest rate risk exposure. For hedging instruments, hedged items, hedging policies and assessment

methods of effectiveness of hedging instruments, see Note 1.

39

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

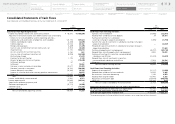

Consolidated Statements of

Cash Flows

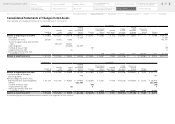

Consolidated Statements of

Changes in Net Assets

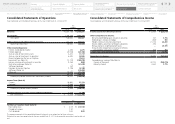

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

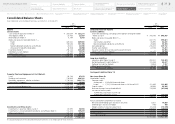

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary