Sharp 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

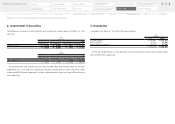

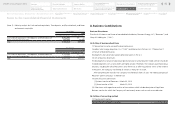

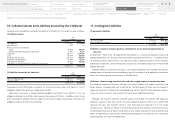

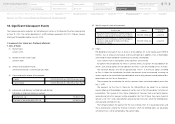

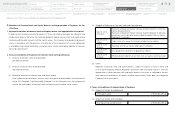

10. Collateral Assets and Liabilities Secured by the Collateral 11. Contingent Liabilities

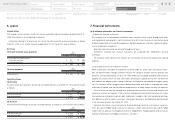

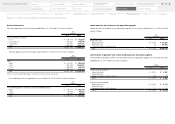

Collateral assets and liabilities secured by the collateral as of March 31, 2014 and 2015 were as follows:

(1) Collateral Assets

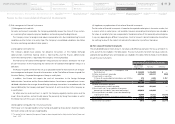

(1) Guarantee Liabilities

Time deposits of ¥19,799 million as of March 31, 2014 and ¥21,335 million as of March 31, 2015 is

pledged as collateral for opening a standby letter of credit.

¥886 million investments in nonconsolidated subsidiaries and affiliates as of March 31, 2014, are

pledged as collateral for ¥18,796 million long-term borrowings of affiliates. In addition, certain shares

of the consolidated subsidiary which are subject to elimination through intra-company transactions are

pledged as collateral of short-term borrowings.

(2) Liabilities Secured by the Collateral

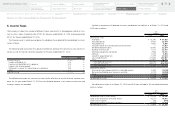

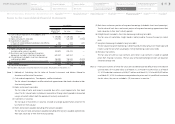

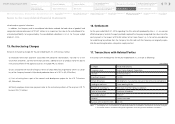

(2) Matters related to inventory purchase commitments on raw materials (polysilicon) of

solar cells

As described in “Notes to the Consolidated Financial Statements, 1. Summary of Significant Accounting

and Reporting Policies, (k) Valuation reserve for inventory purchase commitments,” a valuation reserve

for inventory purchase commitments is set aside with respect to purchase contracts for raw materials

(polysilicon) for solar cells. Some of the purchase contracts for raw materials (polysilicon) at the year-end

prohibit their resale.

Therefore, potential future losses may occur if raw materials (polysilicon) are no longer used. The ag-

gregate amount of purchase contracts prohibiting resale of raw materials after deducting the valuation

reserve for inventory purchase commitments is ¥38,795 million.

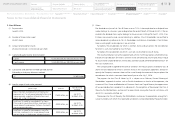

(3) Matters related to long-term electricity and others supply contracts at production basis

The Company entered into long-term contracts with several suppliers with respect to electricity and

others necessary to produce solar cells at Sakai Factory. The total amount of future minimum payments

under such contracts at the end of this consolidated fiscal year was ¥43,915 million (the remaining term

is from 2.5 years to 14 years). Each contract shall not be terminated before expiration.

Although such long-term electricity and other supply contracts give the Company 480 mega-watt

production capacity of solar cells per year, the actual production quantity currently sits at around 160

mega-watt per year. Such long-term contracts cause more expensive production cost in the Energy

Solution Business. However, it is difficult to estimate the amount of loss related to such contracts because

the prevailing market price of electricity and others at Sakai Factory, procurement costs of electricity and

others not depending on such contracts and appropriate production costs based on such market price

and procurement costs cannot be determined.

Yen

(millions)

2014 2015

Time deposits ¥ 21,600 ¥ 23,429

Restricted cash 952 —

Notes and accounts receivable

Trade 78,638 60,674

Nonconsolidated subsidiaries and affiliates 1,400 8,677

Inventories 176,111 214,763

Land 86,704 83,075

Buildings and structures 223,152 162,561

Machinery and equipment 32,693 13,610

Investments in securities 33,591 28,735

Investments in nonconsolidated subsidiaries and affiliates 886 —

¥ 655,727 ¥ 595,524

Yen

(millions)

2014 2015

Loans guaranteed ¥ 19,874 ¥ 17,161

Trade payables guaranteed 150 53

¥ 20,024 ¥ 17,214

Yen

(millions)

2014 2015

Short-term borrowings ¥ 339,475 ¥ 477,648

Long-term debt 159,254 1,044

¥ 498,729 ¥ 478,692

Notes to the Consolidated Financial Statements

44

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary