Sharp 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

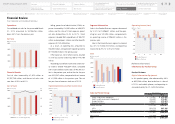

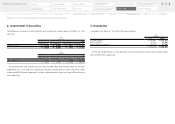

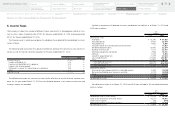

Net Assets

Net assets amounted to ¥44,515 million, a de-

cline of ¥162,658 million. This was due to a de-

crease in retained earnings stemming from the

net loss. The equity ratio was 1.5%.

Cash Flows

Cash and cash equivalents at the end of year

stood at ¥232,211 million, down ¥118,423 mil-

lion from the previous year, as combined cash

outflows from investing and financing activities

exceeded cash inflows from operating activities.

Net cash provided by operating activities

amounted to ¥17,339 million, down ¥181,645

million from the previous year. The main factors

included the posting of loss before income taxes

and minority interests following a posting of in-

come before income taxes and minority interests

in the previous year.

Net cash used in investing activities totaled

¥16,043 million, down ¥68,897 million from

the previous year. The main factors included a

¥20,127 million year-on-year increase in pro-

ceeds from the withdrawal of time deposits, a

¥17,633 million increase in proceeds for sales of

investments in subsidiaries resulting in change in

scope of consolidation, and a ¥12,818 increase

in proceeds from sales of investments in securi-

ties, nonconsolidated subsidiaries and affiliates.

Net cash used in financing activities was

¥136,090 million, compared with net cash pro-

vided by financing activities of ¥32,753 million

in the previous year. The main factors included

a ¥177,160 million decrease in proceeds from

long-term debt.

Notes: 1. Effective for the year ended March 31, 2014, the

Company has changed its segment classification.

Figures for previous years have been adjusted to

reflect the new classification.

2. Sales figures by segment and product group

shown in “Segment Information” include

internal sales and transfers between seg-

ments (Product Business and Device Business).

Operating income (loss) figures are the amounts

before adjustment for intersegment trading.

3. Capital investment figures shown in “Capital

Investment and Depreciation” include the

amount of leased properties.

4. Effective for the year ended March 31, 2015,

the “Solar Cells” product group was renamed as

“Energy Solutions.”

Cash and Cash Equivalents

(billions of yen)

300

200

100

0

400

151411 12 13

Interest-Bearing Debt

(billions of yen)

1,000

800

600

200

400

0

1,200

151411 12 13

Equity Ratio

(%)

40

30

20

10

0

50

151411 12 13

Financial Review

28

Financial Review

Financial Section

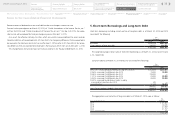

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

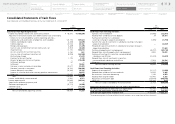

Consolidated

Subsidiaries

Independent Auditor’s

Report

Notes to the Consolidated

Financial Statements

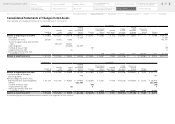

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

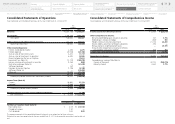

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

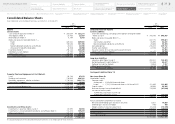

Consolidated Balance Sheets

Five-Year Financial Summary