Sharp 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

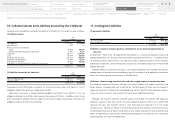

14. Impairment Loss

(Impairment Loss)

With regards to accounting for impairment assets, the Company and its consolidated subsidiaries iden-

tify cash generating units in consideration of business characteristics and business operations. As a result,

idle assets are identified as respective cash generating units.

The Company and its consolidated subsidiaries reduced the book value of production equipment for

Digital Information Appliances to an estimated recoverable amount due to the decreasing profitability

and the unlikelihood of recouping the investment and recognized a decreased amount of ¥3,080 million

as impairment loss for the year ended March 31, 2014.

Details were as follows: ¥1,068 million for molds, equipment and vehicles; ¥1,851 million for long-

term prepaid expenses; ¥161 million for others.

The estimated recoverable amount was evaluated at zero in accordance with use value due to the

unlikelihood of cash flow in the future.

In addition, the Company and its consolidated subsidiaries reduced the value of goodwill and recog-

nized a decreased amount of ¥8,690 million as impairment loss due to the unlikelihood of an estimated

profitability to be generated by certain consolidated subsidiaries for the year ended March 31, 2014.

The estimated recoverable amount was evaluated in accordance with use value and the discount rate

was 14.7%

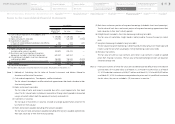

The Company and its consolidated subsidiaries reduced the book value of assets for business use lo-

cated at Digital Information Appliance Division to an estimated recoverable amount due to the decreas-

ing profitability and the unlikelihood of recouping the investment and recognized a decreased amount

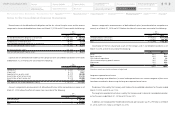

of ¥3,892 million as an impairment loss for the year ended March 31, 2015. Details were as follows:

¥973 million for molds; ¥2,596 million for long-term prepaid expenses; and ¥323 million for others. The

estimated recoverable amount was evaluated at zero in accordance with use value due to the unlikeli-

hood of cash flow in the future.

The Company and its consolidated subsidiaries reduced the book value of assets for business use

located at Energy System Solutions Division to an estimated recoverable amount due to the decreasing

profitability and the unlikelihood of recouping investment and recognized a decreased amount of ¥9,267

million as an impairment loss for the year ended March 31, 2015. Details were as follows: ¥5,344 million

for buildings and structures; ¥1,229 million for machinery, equipment and vehicles; ¥2,547 million for

lease assets; and ¥147 million for others. The estimated recoverable amount for buildings and land was

determined by the net realizable value based on appraisal valuations. The net realizable value for the

other assets was evaluated at zero.

The Company and its consolidated subsidiaries reduced the book value of assets for business use lo-

cated at Display Device Business to an estimated recoverable amount due to the decreasing profitability

and the unlikelihood of recouping the investment and recognized the decreased amount of ¥77,709 mil-

lion as an impairment loss for the year ended March 31, 2015. Details were as follows: ¥41,503 million

for buildings and structures; ¥22,798 million for machinery, equipment and vehicles; ¥12,508 million for

long-term prepaid expenses; and ¥900 million for others. The estimated recoverable amount for build-

ings, machinery and equipment and land was determined by the net realizable value based on appraisal

valuations. The net realizable value for the other assets was evaluated at zero.

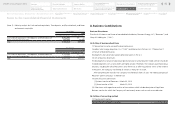

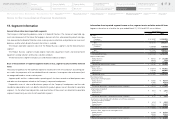

The Company and its consolidated subsidiaries reduced the book value of a part of assets for busi-

ness use located at Electronic Components and Devices Business to an estimated recoverable amount

due to scheduled review and concentration of production system and recognized the decreased amount

of ¥6,293 million as an impairment loss for the year ended March 31, 2015. Details were as follows:

¥3,078 million for buildings and structures; ¥3,066 million for machinery, equipment and vehicles; and

¥149 million for others. The estimated recoverable amount for buildings and land was determined by

the net realizable value based on appraisal valuations. The net realizable value for the other assets was

evaluated at zero.

The Company and its consolidated subsidiaries reduced the book value of assets for business use lo-

cated at a part of consolidated subsidiaries in U.S.A., Mexico, Malaysia, China and others to an estimated

recoverable amount due to the decreasing profitability and the unlikelihood of recouping investment,

and recognized a decreased amount of ¥3,690 million as an impairment loss for the year ended March

31, 2015. Details were as follows: ¥1,851 million for buildings and structures; ¥1,367 million for ma-

chinery, equipment and vehicles; and ¥472 million for others. The estimated recoverable amount was

determined by the net realizable value based on appraisal valuations and others.

The Company and its consolidated subsidiaries reduced the book value of unemployed capital located

at Electronic Components and Devices Business to an estimated recoverable amount due to the unlikeli-

hood of use in the future and recognized the decreased amount of ¥1,337 million as an impairment loss

for the year ended March 31, 2015. Details were as follows: ¥1,286 million for buildings; and ¥51 million

for land. The estimated recoverable amount for buildings and land was determined by the net realizable

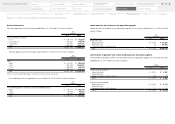

Notes to the Consolidated Financial Statements

50

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary