Sharp 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

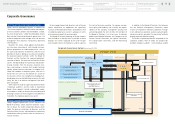

Ongoing Development of the Internal Control System

Corporate Governance

meets regularly with the representative directors, the

directors, the executive officers, the accounting audi-

tors, the head of the Internal Audit Unit and others to

exchange opinions and work to ensure that business is

executed legally, appropriately and efficiently.

In May 2006, the Board of Directors passed a resolu-

tion to adopt a basic policy related to the develop-

ment of systems necessary to ensure the properness of

business (Basic Policy for Internal Control), which was

partially amended in April 2015. This amended policy

forms the basis for Sharp’s ongoing development and

implementation of its internal control system. The In-

ternal Control Committee, which is an advisory body to

the Board of Directors, deliberates on basic policies re-

garding internal controls and internal audits, as well as

the development and implementation status of various

measures related to the internal control system, then

make a decision about what to report on or discuss

with the Board of Directors. The department promot-

ing internal controls on a company-wide basis oversees

the internal controls of the business execution depart-

ments. Meanwhile the Internal Audit Unit makes con-

crete proposals on how to improve business operations

and reinforces internal controls by checking the validity

of business execution as well as the appropriateness

and efficiency of management.

To enhance compliance throughout the group,

Sharp introduced the Sharp Group Charter of Corpo-

rate Behavior, a set of principles to guide corporate be-

havior, and the Sharp Code of Conduct, which clarifies

the conduct expected of all directors, corporate audi-

tors, executive officers and employees of Sharp. Sharp

ensures that these guidelines are thoroughly observed

by posting them on the Web and carrying out position-

specific training programs. Based on the basic rules of

compliance, Sharp is also developing a company-wide

compliance promotion system. Meanwhile, Sharp is

implementing thorough measures to prevent compli-

ance breaches by distributing a Sharp Group Compli-

ance Guidebook to all employees and implementing

training based on the guidebook.

In order to comprehensively and systematically deal

with diverse business risk, Sharp formulated the Busi-

ness Risk Management Guideline to achieve preven-

tion of and swift responses to risk.

Sharp believes that determining whether to accept

large-scale share purchases aimed at a takeover

should be ultimately entrusted to the shareholders.

However, Sharp also believes that it is not appropriate

for any party that conducts an inappropriate purchase,

such as one that clearly harms the corporate value and

common interests of shareholders and/or puts undue

pressure on shareholders to sell shares, to take control

over Sharp, and that it is necessary to take reasonable

countermeasures against such purchases.

In order to prevent purchasing activity that could

potentially cause significant harm to corporate value

and common interests of shareholders—including in

the medium and long terms—the Company has ad-

opted the prior warning type of defense measures

called the Plan Regarding Large-Scale Purchases of

Sharp Corporation Shares (Takeover Defense Plan*)

(“the Plan”).

The Plan provides rules for enabling shareholders to

reach a proper decision, by requiring large-scale pur-

chasers of the Company’s shares who intend to obtain

20% or more of the voting rights of the Company to

provide sufficient information and give an adequate

assessment period.

If a large-scale purchaser does not follow the rules,

or although the large-scale purchaser complies with

these rules, the large-scale purchase is deemed to

be harmful to corporate value and common interests

of shareholders, the Board of Directors of Sharp will

make a decision concerning the implementation of

countermeasures after fully taking into consideration

the advice and recommendations of the Special Com-

mittee consisting of three or more persons who re-

main independent of Sharp’s management. In case the

Special Committee has placed a reserve that confir-

mation of the shareholders’ intent with respect to a

consideration of taking countermeasures shall be ob-

tained, or in case the Board of Directors of Sharp con-

siders it is necessary to take countermeasures, Sharp

shall convene the Shareholders’ Intent Confirmation

Meeting to seek whether countermeasures shall be

taken or not.

The effective term of the Plan is until the conclusion

of the 123rd Ordinary General Meeting of Sharehold-

ers, which will be held by June 2017.

* For more details of the Plan, please visit the website below:

http://sharp-world.com/corporate/ir/topics/pdf/150514-1.pdf

Plan Regarding Large-Scale Purchases of

Sharp Corporation Shares (Takeover Defense Plan)

17

Corporate Governance

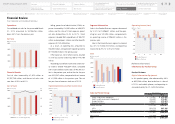

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

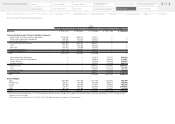

Financial Section

Investor Information

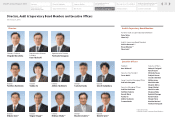

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

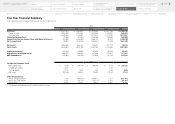

Financial Highlights

SHARP Annual Report 2015